What lessons can we learn from the behavior of the world’s financial markets in the 20th Century that are useful to investors in the 21st Century? In our Guide to Bull and Bear Markets and our Guide to Total Returns, we provided a survey of the returns to financial markets throughout the 20th Century. The ten points below are some of the most important lessons we have gained from studying a century of data on financial markets.

1. Stocks Outperform Bonds and Bills Over the Long-term

In every country that we surveyed, stocks beat both bonds and bills over the long-term. The equity premium, the difference between the return on stocks and bonds, is usually positive. There were some decades in which bonds outperformed stocks, but those decades were the exception, not the rule.

An important source of the superior performance of stocks over bonds was the dividends that were paid on stocks and their reinvestment. Dividends gave a solid underpinning to stock returns, increasing returns by about 4% per annum. Growth in dividends is tied to growth in corporate profits, and that depends upon growth in the economy as a whole. However, the yield on dividends relative to investors’ capital gains has declined over time.

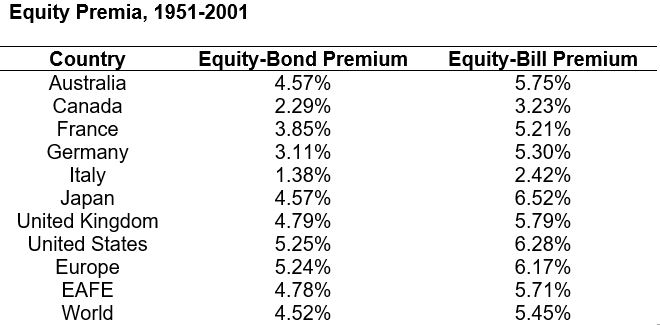

The table below provides data on the equity premium in the countries we covered over the past 50 years. International comparisons use US Bonds and Bills to calculate the equity premia. The table shows that the equity-bond premium has been in the 4-5% range over the past 50 years and the equity-bill premium in the 5-6% range. Italy and Canada had the lowest equity premia, and the United States the highest equity premia.

The primary reason for the equity premium is that equities are riskier than bonds. Shareholders are only paid after all suppliers, employees, and creditors are paid. This makes equity prices are more volatile than bond prices, and shareholders must be compensated for this additional risk. Since bonds are loans, and interest rates depend upon the supply and demand for capital, returns to fixed-income investments are not directly related to the growth in the economy. When economies grow, as they have during the past 50 years, investors received superior returns as compensation for the risks they took. This important fact will remain true in the 21st Century.

The primary reason for the equity premium is that equities are riskier than bonds. Shareholders are only paid after all suppliers, employees, and creditors are paid. This makes equity prices are more volatile than bond prices, and shareholders must be compensated for this additional risk. Since bonds are loans, and interest rates depend upon the supply and demand for capital, returns to fixed-income investments are not directly related to the growth in the economy. When economies grow, as they have during the past 50 years, investors received superior returns as compensation for the risks they took. This important fact will remain true in the 21st Century.

2. Equity Risk Premium or Inflation Risk Discount?

Though it is clear that equities outperform bonds over the long run due to the higher risk that shareholders face, this nothing about how much of an equity risk premium investors should receive. The equity risk premium suffered dramatic swings during the 20th Century. Even though on average, the equity-bond premium was around 4-5%, in some periods, the equity-bond risk premium was 30% or greater, and in some cases, it was a negative 20% or worse.

One reason for this is that different factors drive returns on stocks and bonds. Stocks are primarily driven by expectations of future earnings, and bonds by expectations of future inflation. Equity prices and dividends adjust to inflation rates over time, but secular increases or decreases in inflation affect returns to fixed-income investors. When interest rates rose between 1940 and 1980, bondholders suffered a 40-year bear market. When interest rates fell between 1980 and 2000, bondholders enjoyed a 20-year bull market.

In each country surveyed, stocks beat inflation, but this was not always true of bonds. Countries that suffered high and variable rates of inflation caused fixed-income investors to lose money. Even in countries that had low inflation over the long-term, periods in which inflation rose, such as the 1910s, 1950s, and 1970s, imposed negative returns on bondholders.

High inflation also hurts the real return on stocks. The inflation of the 1940s imposed large losses on shareholders in France, Italy, and Japan, and nearly wiped out investors during the hyperinflation in Germany. Shareholders also suffered during the inflation of the 1970s. In each case, however, bondholders were hurt substantially more than shareholders.

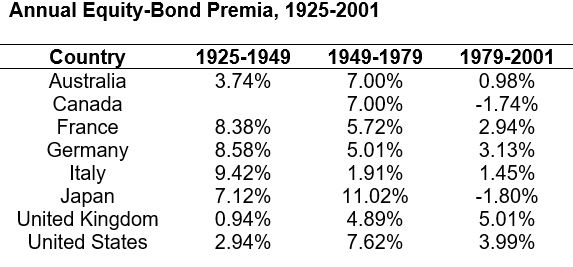

The difference in the yields between stocks and bonds is affected both by higher returns to equities, because shareholders bear greater risk and share in the benefits of economic growth, and by higher inflation rates that lower returns to bondholders. The table below illustrates this point by dividing the past into three periods. The period from 1925 to 1949 was a period of economic and political uncertainty. The period from 1949 to 1979 was a period of rising inflation and interest rates. The period from 1979 to 2001 was a period of declining inflation and interest rates.

There are two important things to notice. First, during the period from 1925 to 1949, the equity premium was lower than in 1949 to 1979 in the three countries (Australia, United Kingdom, United States) that had low inflation rates, but the equity premium was higher in the four countries (France, Germany, Italy and Japan) that suffered high inflation rates and economic dislocation.

Second, with the exception of the UK, every country had a lower equity premium during the period of declining interest rates (1979-2001) than during the period of rising interest rates (1949-1979), and in some cases, the difference in the equity premium was substantial. Inflation, not economic growth, provides the best explanation for this difference. In both Canada and Japan during the past 20 years, bonds have outperformed equities.

This provides important evidence that it is not only shareholder risk, but also inflation that determine the difference in returns between equities and bonds. During the 1700s and 1800s, which were centuries of low or no inflation, the equity-bond premium was generally less than 1%.

This provides important evidence that it is not only shareholder risk, but also inflation that determine the difference in returns between equities and bonds. During the 1700s and 1800s, which were centuries of low or no inflation, the equity-bond premium was generally less than 1%.

Although Depressions and economic dislocations such as war can cause investors to quickly suffer severe losses, inflation can be just as effective, if not more so, in destroying investors’ wealth over the long run. Inflation benefits borrowers and penalizes lenders, and since the government is more often a borrower than a lender, the government benefits from inflation, often at investors’ expense.

If investors expect lower inflation or deflation in the future, they should expect that the equity premium will be lower as well. It is primarily in periods of rising inflation and interest rates that the equity-bond premium exceeds its normal level of 3-4%.

3. The Return on Stocks and Capital Gains Increased During the 20th Century

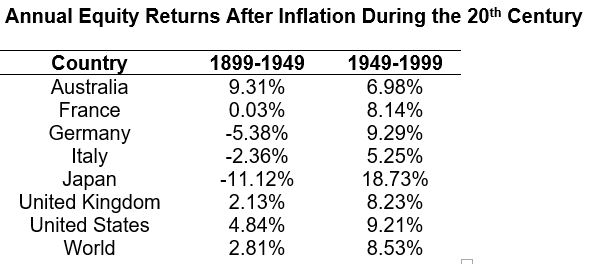

Returns to investors were higher after World War II than before World War II, primarily because of higher capital gains, not because of higher dividend yields. Investors received higher capital gains after World War II, even after adjusting for inflation. The period since World War II has provided the economically stable environment needed to improve corporate profits and allow investors to earn higher returns.

There are two reasons for the presence of high capital gains after 1950. First, high growth rates in Japan and other developing markets allowed extraordinary returns to flow to investors. The stabilization of the international economy in the 1950s and the defeat of inflation in the 1980s and 1990s provided prime conditions for large capital gains. Contrast these three decades with the inflation of the 1910s and the 1940s, and the Depression of the 1930s and investors can see what conditions are conducive to superior returns.

Second, the increase in capital gains has been accompanied by decreased dividends. There are several reasons why dividends have decreased over time. First off, growth and technology corporations that reinvest their capital to produce higher future returns, rather than pay dividends, make up a larger portion of the corporate world. Second, since more people invest for retirement rather than for income, dividends are less important today. Third, taxes often favor capital gains over dividends in the US and in other countries. Fourth, stock options benefit from capital gains and not from dividends. Fifth, and as a result of these factors, corporations devote more of their money to stock buybacks and less to dividends.

Lower dividends increase the risk to investors because lower dividends provide less of a cushion during bear markets. Nevertheless, there is no reason why this trend should reverse in the near future. Capital gains will continue to play a more important role in investor returns than dividends in the near future.

4. The 1950s Were a Turning Point for Investors in the 20th Century

The period from 1914 to 1949 was one of the substantial economic and political problems throughout the world. Two World Wars and the worst economic downturn of the century occurred during this period of time. The period began with World War I, and ended with the beginning of the Cold War after Germany was separated into two halves and the Bretton Woods system was established.

During the early 1920s, hyperinflation in Germany, and inflation in other countries produced some of the worst returns of the century. During the 1930s, economic depression, decreasing international trade, and the beginnings of World War II reduced investor returns. The destruction of World War II, and the inflation that followed after the war made the 1940s even worse for many countries than the 1930s. Investors living in the new Communist countries lost everything they had. The only period when stocks provided positive returns to investors during these 35 years was the late 1920s.

The period from 1950 to 2000 was one of tremendous economic growth for the world, providing equity investors with some of their best returns in history. Whereas the first half of the century had only one good decade (the 1920s), the second half of the century had only one bad decade (the 1970s).

After 1950, fixed-income investors were hurt by the rising inflation and interest rates that resulted from Keynesian economic policies. Most fixed-income investors suffered through a 40-year bear market between 1940 and 1980 when inflation and interest rates rose but enjoyed a 20-year bull market when inflation and interest rates fell between 1980 and 2000.

After 1950, fixed-income investors were hurt by the rising inflation and interest rates that resulted from Keynesian economic policies. Most fixed-income investors suffered through a 40-year bear market between 1940 and 1980 when inflation and interest rates rose but enjoyed a 20-year bull market when inflation and interest rates fell between 1980 and 2000.

The table below shows the difference in equity returns in the first and second halves of the 20th Century. Data for Italy, Japan, and the World only go back to 1925.

The first half of the century shows what can happen to investors when economic and political conditions work against them. The second half of the century shows what can happen when governments provide stable economic and political conditions.

The 1980s and 1990s provided a perfect environment for investors in which inflation and interest rates declined, technological change increased at a rapid pace, markets became freer throughout the world, and capital was allowed to flow more freely throughout the global economy. Although the transition from a regulated, inflation-ridden environment to a low-inflation free market provided a boon to investors that may be difficult to extend into the future, it does show us the economic conditions that are conducive to high investor returns.

This leaves us with an important question. Will investors in the 21st Century continue to benefit from a stable economic and political environment as existed between 1949 and 1979, or will there be a period, like 1914 to 1939, when investors suffer for decades?

5. Past Performance Is No Guarantee of Future Returns

There is a good reason for this clichéd disclaimer. Our survey of returns to stocks, bonds, and bills shows that returns during the recent past are rarely a good predictor of what returns will be in the future. We found that time and time again, periods in which investors had the greatest returns were often followed by periods in which investors had their worst returns and vice versa. What proved to be the right choice in one decade, proved to be the wrong choice in the next decade. This is simply the nature of financial markets, and there is no reason to expect that this fact of life will change in the future. There are two reasons for this pattern.

First, investors look for trends. Investors extrapolate from the recent past to the near future. If stocks provide better returns than bonds, they pour their money into stocks. If bonds provide better returns, they pour their money into bonds. If emerging markets provide better returns, they put their money in emerging markets.

As money flows into those areas, returns increase because of the greater demand, drawing, even more, money in. Eventually, stocks and bonds become overpriced. When the bubble bursts, returns fall, investors suffer losses, and they reduce the allocation of their portfolio to the asset that had looked so promising before.

Second, government policies respond to changes in financial markets. The unstable exchange rates of the 1930s were followed by fixed exchange rates in the 1950s and floating exchange rates in the 1970s. Rising interest rates in the 1970s were followed by declining interest rates in the 1980s. Budget deficits in the 1980s were followed by surpluses in the 1990s.

Each of these changes in government policies had an impact on investor returns, and in each case, it took time for investors to incorporate these new government policies into the prices of financial assets. However, every government policy has unintended consequences. If the government’s policy favors shareholders, it can hurt bondholders and vice versa. This eventually forces changes in government policies that investors must adjust to.

At some crucial point, financial assets become overpriced and government policies change. It is at this point that investors make poor choices. 1929, 1949, 1979 and 1999 were all turning points for financial markets. Investors who lived in the past after those turning points suffered losses. Investors must decide how and why the trend in the market has changed, and adjust their portfolios accordingly.

6. Inflation Is the Greatest Enemy of Investors

The greatest declines in real stock market returns during the 20th Century occurred during periods of extreme inflation. Both Germany and Japan saw real equity prices decline by over 95% during the inflations that followed World War I and World War II respectively.

The only decade in the 20th Century in which none of the world’s major stock markets provided positive real returns was not the 1930s, but the 1910s when the unexpected inflation caused by World War I exceeded the increase in stock market prices worldwide. Similar inflationary periods, such as the late 1940s or the 1970s generated poor returns to investors throughout the world.

Though a repeat of the Great Depression and the stock market crash of 1929 is the primary fear of most investors, inflation is just as great, if not a greater destroyer of financial assets’ value over time. Economic recession and a bear market can quickly reduce investors’ portfolios, but inflation is a subtler destroyer, gradually eating away at profits that investors have built up.

Not only does the decrease in stock prices reduce the value of reinvested dividends, but dividends are also unlikely to keep up with inflation. As inflation reduces the real dividend yield on stocks, investors’ total return inevitably suffers. Inflation destroys the benefits of a buy-and-hold, dividend-reinvestment strategy because inflation reduces the value of the reinvested dividends.

Not only does inflation destroy the real value of stocks, but it also increases their volatility. Initially, inflation is accompanied by increases in demand that raise the value of stocks; however, when inflation reaches excessive levels, it begins to affect the real economy, and stocks begin to lose their value. Money moves from financial assets, such as stocks, to real assets, such as gold and real estate, which hold their value better in an inflationary environment than financial assets.

The absence of inflation does not guarantee increases in stock prices. Economic growth and increases in corporate profits are what provide good returns to investors. Eliminating inflation is a necessary, but not a sufficient condition for high returns.

In an inflationary environment, long-term government bonds are riskier than short-term government bills because there is more risk of a capital gain or loss when interest rates fluctuate. Since government bills can be redeemed within a few months, they are more likely to be held to maturity than government bonds. Cash investors may receive higher returns as interest rates rise, but in periods of rising inflation, real interest rates can turn negative. Moreover, bondholders may need to sell their bonds before maturity and could suffer a capital loss as a result.

In different ways, inflation reduces the value of all financial assets. There was not a single case in the 20th Century when inflation provided beneficial to investors in the long run.

7. Government Policies Are Extremely Important to Financial Markets

Whether the government’s policies create stable economic and political conditions in which corporations can invest in order to increase productivity and earnings, or whether there is political and economic uncertainty strongly affects returns. Countries such as the United States, Switzerland, Sweden and Australia that were stable for most of the twentieth century, provided good opportunities for consistent total returns to investors who sought a buy-and-hold strategy. Investors in countries where political and economic uncertainty occurred saw dramatic swings in the values of their portfolios. Governments that pursued policies that generated high inflation rates imposed heavy losses on investors.

The government’s policies determine whether buy-and-hold or market timing is the best strategy for investors. If the government provides a stable economic and political environment, buy-and-hold can be an effective long-term investment strategy; however, if uncertainty and chaos are the norm, and if inflation is a general phenomenon, market timing or outright avoidance are the best strategies.

Countries with corporatist policies that favor state-run firms, encourage import substitution, discourage free trade, and limit the growth in the size of firms that might compete with government-approved industries have generally provided poor returns to investors. Countries that favor economic growth, exports, and provide a stable political and economic environment have provided strong returns to investors.

Moreover, changes in government policies can have a dramatic impact on investment returns. The rising inflation that most countries had between 1960 and 1980, and the falling inflation that most countries had between 1980 and 2000 were the primary determinants of returns to fixed-income investors throughout the world.

The worst performing stock markets during the 20th Century were the ones in Latin America and along the Mediterranean (France, Italy and Spain). At different points in time, these economies suffered inflation, political and economic uncertainty, import substitution, corporatist policies toward firms and the other enemies of stock market appreciation. Though government policies may not be able to provide direct increases in share prices, government policies can efficiently destroy investors’ portfolios.

Economic and political chaos, inflation, government ownership of the largest corporations, overbearing government regulation, barriers to trade, and other policies which limit corporate profits all hurt investors.

8. Stocks, Bonds and Bills Do Not Guarantee a Positive Return in the Long Run

Most of the research on long-term returns has been done in the United States since World War II. Data on returns during this period of time can be misleading because the data come from an economy that provided the best economic and political environment for strong returns on stocks in the last half of the twentieth century. The United States has been studied because good data are available on the stock markets; however, this is a biased sample.

Not only have long-run returns been different outside of the United States, but the nature of bull-bear market cycles has been different in most of the world’s stock markets. The usual pattern in the United States has been for a bull-bear market cycle lasting about four years in which the market moves up for three years and down for one. Foreign stock markets have had strong bull markets which were often followed by decade-long periods in which stocks gradually drifted downward before a new bull market began.

During the 20th Century, some countries suffered periods of economic and political chaos in which investors lost everything. In countries such as Hungary, Poland and Romania, Communist governments closed stock markets wiping out investors. Other countries have defaulted on government obligations. Anyone who thinks that government defaults are ancient history should remember that Russia defaulted in 1998 and Argentina in 2002.

Inflations in Germany and Japan led to losses of over 95% for investors. Italy provides an example of a country where even through a buy-and-hold, dividend reinvestment, no tax environment, stock prices would have barely kept up with inflation.

Although investors in the United States, the United Kingdom, Australia and Canada received high returns over the periods that were analyzed, investors in Italy received terrible returns. Measured in real terms, one lira invested in stocks in 1925 with all dividends reinvested, grew to an astounding five liras in 2002. There were also periods in France, Japan and Germany in which investors suffered devastating losses due to economic dislocation and inflation. Investors were wiped out during the German hyperinflation.

A stable environment in which corporations are free to pursue profitable opportunities, and in which investors don’t suffer from inflation provide the best returns to investors. Since these conditions generally prevailed in the US, UK, Australia and Canada, each country has provided strong, consistent returns to investors. When these conditions did not exist, investors suffered.

Most secular bear markets produce a real decline in stock values of around 75%; however, if the bear market is accompanied by economic and political chaos, the declines can be even more severe, as in German in the 1920s, or in Japan after World War II.

Whether markets double or quintuple in price, whether they are in an inflationary environment or a deflationary environment, whether the bear market lasts four years or twenty years, the number of times in which markets have declined by around 75% in real terms has been surprising. The U.S. market declined by over 75% in real terms during the 1929-1932 bear market, and the NASDAQ crashed by 75% after it peaked in 2000.

Every one of the G-7 countries suffered at least one period in which equities lost 75% of their market value, and most countries saw similar losses of 75% or more in bonds and bills when inflation reduced real returns to fixed-income investors. Should we believe that this is not going to be repeated in the century that follows?

9. Buy-and-Hold Can Work in a Stable Economic and Political Environment; Otherwise, Market Timing is Recommended

Research on the United States stock market has shown that a buy-and-hold approach to stocks can be a good choice for long-term investors. According to this view, trying to time the market and determine exactly when the market has hit bottom or topped out is a fool’s game.

What has gone unrecognized is the fact that one reason for the superiority of buy-and-hold investing in the US is the relatively stable economic and political environment that prevailed in the United States during the 20th century. With a few exceptions, bear markets in the United States were short and relatively mild compared to bear markets in other countries. Despite some severe setbacks, the long-term trend in American stocks was generally upward throughout the 20th century.

Where there are periodic bouts of economic and political chaos, sudden political changes, international or civil wars, inflation or hyperinflation, governments that threaten businesses and free markets, or provide uncertain economic and political environments for extended periods of time, buy and hold will fail.

Emerging markets provided the best example of where investors should have avoided buy-and-hold in the 20th Century. For decades, Latin American stock markets provided mediocre or inferior returns, and in the case of Peru, whose stock market declined by 99% in real terms between the 1940s and 1980s, the result was outright confiscation. Italy, which suffered problems similar to those in Latin American countries, provided the worst returns of any of the world’s developed stock markets. This is why these are emerging markets and not developed countries.

When do investors have the greatest opportunities for superior returns? When it looks like the world has come to an end and only the greatest fool on the planet would invest in stocks. Germany in 1923 after hyperinflation had created economic chaos, Japan in 1946 after the country was devastated by atomic bombs and inflation, and Chile in 1973 after suffering from hyperinflation and a coup d’etat. All of these were excellent investment opportunities that allowed the lucky few to gain incredible returns.

When Apocalypse has occurred, the contrarian solution is to invest immediately. However, the existence of the Apocalypse is not a sufficient reason to invest. What must also occur is a fundamental change in the country’s political and economic behavior. Since the hyperinflation of the 1920s, Germany has been one of the most inflation-conscious countries in the world. With its political structure destroyed, and the economy in ruins, Japan laid the foundations for an unprecedented economic recovery. Chile had been one of the most inflation-ridden, socialist-oriented, import substitution countries in Latin America until 1973, but after that, the government turned Chile into the most open economy in Latin America.

Because of the growing importance of equities in the pensions of individuals throughout the developed world and in emerging markets, once individuals realize how stable economic and political environments impact financial asset returns, political demands for an economic environment that is amenable to growing stock markets.

Because individuals have a stake in their stock market’s performance, they will place even greater demands on governments to follow policies that allow corporations to provide the earnings growth necessary to generate strong stock market returns. Otherwise, unless investors are good market timers, the only choice investors have is to avoid these countries completely.

10. Emerging Markets Provide the Greatest Opportunities for Gains—and for Losses.

The most dramatic bull markets in the 20th Century occurred in emerging markets. The most dramatic bear markets of the 20th Century occurred in emerging markets. Chile’s stock market increased sixty-fold, in real terms, between 1973 and 1980. The Mexican stock market increased almost thirty-fold between 1982 and 1987 in real terms. Other Latin American markets saw ten-fold real increases at one time or another during the past twenty years. On the other hand, Peru had the worst performance of any of the world’s stock markets between the 1940s and the 1980s, losing 99% of its value in real terms.

Although emerging markets can show dramatic increases, they can also reverse quickly and violently, losing 50% or 75% of their value within a period of a year or two. Developed markets are more likely to show a slow, steady decline, but emerging markets collapse quickly and violently.

In the 1970s, when Asian markets were emerging, they also displayed these volatile tendencies. The Hang Seng index rose 880% between 1971 and February of 1973, only to collapse 91% by the end of 1974. Poland, Russia and other stock markets went through similar bubbles and crashes when they emerged from Communist rule in the 1990s. Market timing is everything in these markets.

Emerging markets are subject to such extreme volatility because they have uncertain economic and political environments causing expectations to drive their stock markets more than fundamentals. Government policies toward the economy often go awry, leading to hyperinflation, nationalization, political coups, dramatic political swings from the right to the left, defaults on debt, the loss of currency reserves, and other problems.

When a new government arrives and seriously reverses these problems, stocks respond quickly, but the enthusiasm can lead to a financial bubble that pops, providing evidence that the improvement was short-term rather than long-term.

When emerging markets get hot, the reward can be overwhelming, but once they falter, losses can pile up quickly.

Conclusion

What about the century to come?

No one at the beginning of the 1900s would have predicted the roller coaster ride that investors went through in the 20th Century. Almost every assumption that investors at the beginning of the 20th century held to be true proved false. In some countries, investors lost everything they had during the last century. In others, inflation slowly destroyed their portfolios. Countries, where businesses enjoyed stable economic environments that enabled them and their investors to profit, were the exception, not the rule.

The period from 1914 to 1949 was terrible for investors. The period from 1949 to 1999 were the best 50 years for investors in human history. Which of these two periods will characterize the 21st Century?

It is impossible to know whether World War III, new bouts of inflation, terrorism or other factors that create economic and political chaos will condemn investors to lower returns in the future. Was the last half of the 20th Century the framework for what will happen in the 21st Century, or was it an interlude between periods of war, inflation, protectionism, and international uncertainty?

We do not know. What we do know is that the 20th Century has provided us with every possibility that investors can face from decades with dramatically high returns to decades that wiped out investors. We know what works and what doesn’t work.

In the century to come, people will live longer. They will be retired longer, and this will create a greater need to save for retirement. Investing in financial assets only works if there are stable economic, political and financial conditions that enable investors to earn consistent returns from their investments. Hyperinflation, government defaults, war, economic and political instability, government barriers to free trade all wipe out investment portfolios. Germans in 1923 and in 1948 had to start from scratch. Investors in the future don’t want to be put in that situation.

No investors in the century to come want to see their portfolios wiped out, but neither did investors want that in the century that passed. When investors get wiped out, it is a consequence of government policies that were meant to solve one set of problems, but merely created more problems. The difference is that in the 21st Century, more people than ever will rely upon financial assets to smooth out consumption over their lifetime. Large losses stemming from political, economic and financial problems will have an even greater impact on the average person in the 21st Century than in the 20th Century.

Every decade in the 20th Century presented new challenges to investors. What worked for investors in one decade rarely worked in the next decade. The lesson to be learned here is that investors must be eternally vigilant in the century to come. They should never take investing for granted. The economy, technology, and government policies are constantly evolving, and so will financial markets and the returns they generate. We may not be able to predict the future, but we can study the past to better understand how to respond when changes occur.

Welcome to the 21st Century.