Argentina just suffered one of the worst one-day declines in global stock market history. The current President of Argentina, Mauricio Macri, suffered a worse defeat in primary elections than was expected making it almost certain that his opponent Alberto Fernandez and his running mate, the former President of Argentina, Cristina Fernandez de Kirchner, will be elected as the leaders of Argentina and may gain a majority of seats in Argentina’s Congress. Fernandez took in 47% of the vote and Macri only 32%. Under Macri, Argentina borrowed $56 billion from the IMF and $34 billion is due in 2019. Argentina defaulted in both 2001 and in 2014. The fear is that once in power, Fernandez will undo the market-friendly austerity package that Macri imposed on Argentina, leading to a default on foreign bonds, worse inflation, and a collapse in the currency and the economy.

An article on Bloomberg inaccurately said that the decline in the Argentine stock market on August 11 was the second worst one-day decline in global stock markets since 1950. This statement was repeated by both Market Insider and The Economist. When we checked the data that Sarah Ponczek provided, we found no evidence of the other declines that Bloomberg listed in their Top 5. The “winner” was the Colombo All-Share Index which supposedly declined 61.7% in one day in 1989 due to the civil war in Sri Lanka. We found no evidence of this. The worst decline in Sri Lanka’s history was on November 5, 2003 when the market fell 12.98%. In reality, the range of the stock market for all of 1989 in Sri Lanka was 159.1 to 188.88, a range of 18.7%. So a one-day 61.7% decline was simply not possible. We found no large decrease for the Merval Index in 2002. The largest decline in 2002 was on February 11, 2002 when the market fell 10.7%, substantially less than the 45% Bloomberg reported. Similarly, when we investigated the Kazakhstan Stock Exchange index in 2002, we did find a 38% decline, but only because of a bad data print, not because of an actual decline. Where Bloomberg got their bad data from, we do not know.

What we did find, however, was that there was a decline in the Merval index that exceeded Monday’s decline. On January 8, 1990, the Merval Index fell 53.1%. As far as we can tell, this was the greatest one-day decline in global stock market history. The market had been closed between December 28, 1989 and January 8, 1990, so there were ten days of “catch up” adjustment, but the decline was huge. If you look at the Argentina General Index (IBG) which includes all shares listed on the Buenos Aires stock exchange, the market declined “only” 44%. The market bounced back on January 9, 1990 with the Merval index rising 22.9% and the IBG increasing 13.9%.

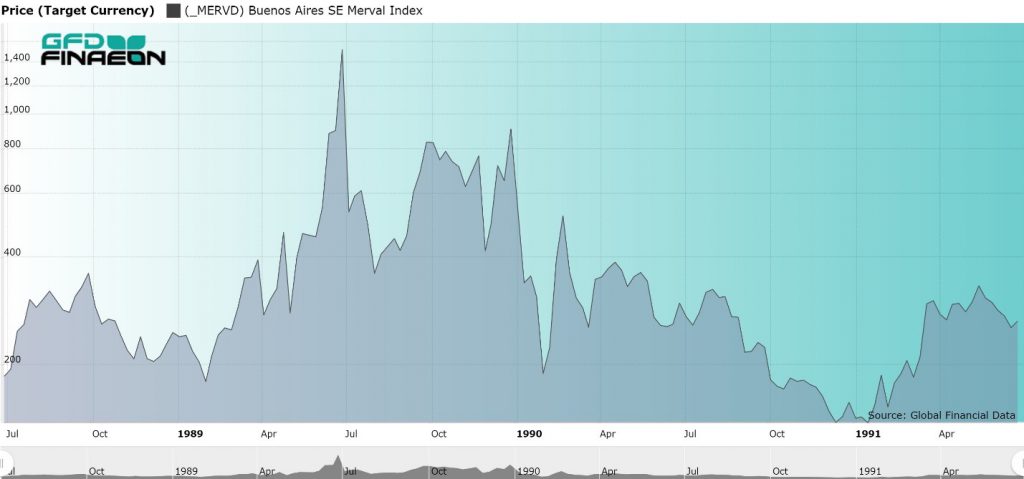

So what was going on to cause the crash in 1990? Hyperinflation. Consumer prices increased 79% in the month of January 1990. Prices doubled in March 1990. Hyperinflation was destroying the economy, but stock prices had to rise in line with inflation. Figure 1 shows the performance of the Argentine index between1988 and 1991 after adjusting for inflation. As you can see, after inflation, Argentine stocks lost 90% of their value between mid-1989 and the end of 1990, an abysmal return.

And of course, hyperinflation works both ways. The Merval index recorded three 30% plus days in 1989 at the height of its hyperinflation, rising 30% on May 30, 1989, 33.67% on December 27, 1989 and 39.35 on May 31, 1989. That produced a cumulative 81% increase on May 30 and May 31, 1989. That is a good return even when there is hyperinflation!

Argentina just suffered one of the worst one-day declines in global stock market history. The current President of Argentina, Mauricio Macri, suffered a worse defeat in primary elections than was expected making it almost certain that his opponent Alberto Fernandez and his running mate, the former President of Argentina, Cristina Fernandez de Kirchner, will be elected as the leaders of Argentina and may gain a majority of seats in Argentina’s Congress. Fernandez took in 47% of the vote and Macri only 32%. Under Macri, Argentina borrowed $56 billion from the IMF and $34 billion is due in 2019. Argentina defaulted in both 2001 and in 2014. The fear is that once in power, Fernandez will undo the market-friendly austerity package that Macri imposed on Argentina, leading to a default on foreign bonds, worse inflation, and a collapse in the currency and the economy.

An article on Bloomberg inaccurately said that the decline in the Argentine stock market on August 11 was the second worst one-day decline in global stock markets since 1950. This statement was repeated by both Market Insider and The Economist. When we checked the data that Sarah Ponczek provided, we found no evidence of the other declines that Bloomberg listed in their Top 5. The “winner” was the Colombo All-Share Index which supposedly declined 61.7% in one day in 1989 due to the civil war in Sri Lanka. We found no evidence of this. The worst decline in Sri Lanka’s history was on November 5, 2003 when the market fell 12.98%. In reality, the range of the stock market for all of 1989 in Sri Lanka was 159.1 to 188.88, a range of 18.7%. So a one-day 61.7% decline was simply not possible. We found no large decrease for the Merval Index in 2002. The largest decline in 2002 was on February 11, 2002 when the market fell 10.7%, substantially less than the 45% Bloomberg reported. Similarly, when we investigated the Kazakhstan Stock Exchange index in 2002, we did find a 38% decline, but only because of a bad data print, not because of an actual decline. Where Bloomberg got their bad data from, we do not know.

What we did find, however, was that there was a decline in the Merval index that exceeded Monday’s decline. On January 8, 1990, the Merval Index fell 53.1%. As far as we can tell, this was the greatest one-day decline in global stock market history. The market had been closed between December 28, 1989 and January 8, 1990, so there were ten days of “catch up” adjustment, but the decline was huge. If you look at the Argentina General Index (IBG) which includes all shares listed on the Buenos Aires stock exchange, the market declined “only” 44%. The market bounced back on January 9, 1990 with the Merval index rising 22.9% and the IBG increasing 13.9%.

So what was going on to cause the crash in 1990? Hyperinflation. Consumer prices increased 79% in the month of January 1990. Prices doubled in March 1990. Hyperinflation was destroying the economy, but stock prices had to rise in line with inflation. Figure 1 shows the performance of the Argentine index between1988 and 1991 after adjusting for inflation. As you can see, after inflation, Argentine stocks lost 90% of their value between mid-1989 and the end of 1990, an abysmal return.

And of course, hyperinflation works both ways. The Merval index recorded three 30% plus days in 1989 at the height of its hyperinflation, rising 30% on May 30, 1989, 33.67% on December 27, 1989 and 39.35 on May 31, 1989. That produced a cumulative 81% increase on May 30 and May 31, 1989. That is a good return even when there is hyperinflation!

Figure 1. Argentina Merval Index Adjusted for Inflation, 1988 to 1991

Similar stock market volatility occurred during the hyperinflation of 1976. The market declined 29% on March 19, 1976 and 18.2% on June 14, 1976. What is interesting is that all the past declines occurred during periods of hyperinflation. On the other hand, August 12’s decline was purely event-driven, caused by election results that could portend a return to high inflation and a possible default in Argentina. Nevertheless, on August 13, the Argentine market bounced back, rising 10% in one day. However, the Argentine Peso continued to decline falling to 60 on August 14 from 45 on August 11. Investors are expecting the worst from the elections due October 27. Fernandez has maintained his lead and it seems likely that he will become the next leader of Argentina. Macri’s attempt to bring Argentina back into the international financial system has apparently failed. Back in the 1920s, Argentina was one of the ten richest countries in the world as measured by GDP per capita, but since the 1940s, Peronist policies have caused stagnation and inflation that has pushed Argentina’s per capita income down to where it barely makes the top 50 today. Unless Argentina can get its economy moving again, it is likely to fall further. Brazil went through an economic bubble in the 1880s that burst in the 1890s during the first Brazilian military dictatorship. Two finance ministers in Brazil adopted a policy of unrestricted credit for industrial investments in the 1880s. This led to speculation, fraudulent IPOs, inflation and ultimately, a crash that lasted from 1889 to 1893.

Brazil went through an economic bubble in the 1880s that burst in the 1890s during the first Brazilian military dictatorship. Two finance ministers in Brazil adopted a policy of unrestricted credit for industrial investments in the 1880s. This led to speculation, fraudulent IPOs, inflation and ultimately, a crash that lasted from 1889 to 1893.

Saddle Up

The word “encilhamento” means to saddle up or mount a horse and refers to jumping on a get-rich-quick scheme. Brazil had slowly industrialized during the 1800s and founded corporations that developed rail transport, gas lighting, banks and steamships. The “Land Law” of 1850 and the “Barriers Act” of 1860, which limited access to agricultural land by slaves and immigrants, had held back the country’s growth. Under the Encilhamento, big rentiers were better able to invest their money where it provided the highest rate of return. Merchants, businessmen, financiers, politicians and tradesmen could invest their money in either local companies or in Brazilian companies that listed in Paris or London. A new banking act was passed in 1888 which reversed the 1860 Barriers Act, and in the same year, slavery was abolished after a long campaign by Emperor Pedro II. Changes in the Land and Real Estate Law occurred in 1889. Government debt fell, reducing the issuance of government bonds and freeing up capital to flow into equities. With all of these positive changes, stock prices in Rio de Janeiro started to boom. On November 15, 1889, a military coup d’etat established the first Brazilian Republic. It overthrew the constitutional monarchy of the Empire of Brazil and Emperor Pedro II. Unfortunately, this also marked the apex of the bull market and the Brazilian stock market declined over the next four years. Ruis Barbosa was appointed the new Finance Minister under the Republic, and he instituted many of the changes he had promised to pop the bubble. This included introducing a new banking bill and introducing a Central Bank to regulate the money supply.The Baring Crisis

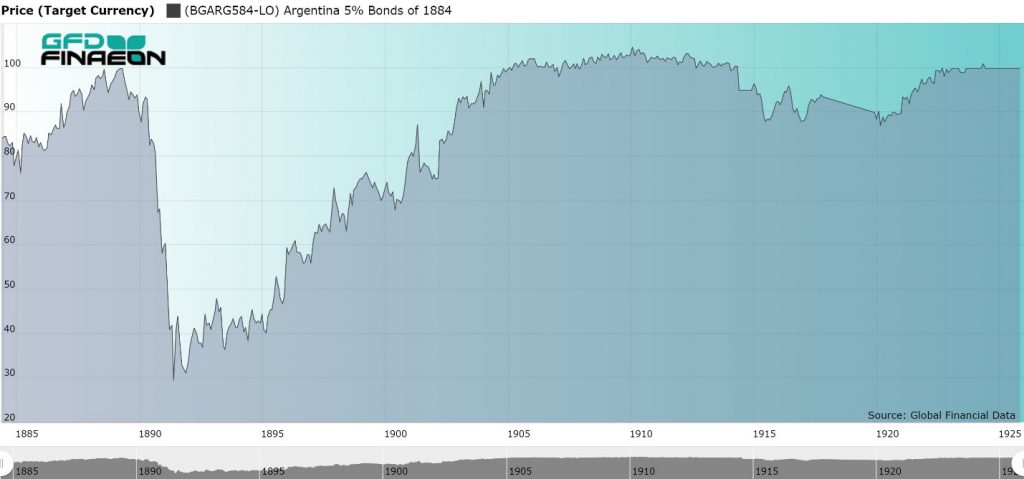

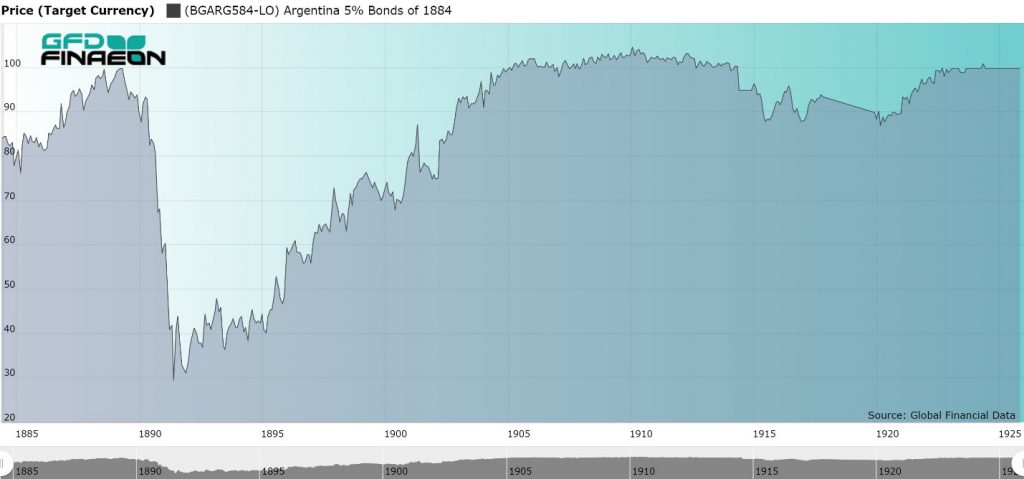

During the 1880s, there were huge capital flows from London into South America with the current account deficit of Argentina averaging 20% of GDP between 1884 and 1889. During those years, the Argentine money supply grew at the rate of 18% per year, inflation averaged 17% and the paper peso depreciated at the rate of 19% per annum. By the end of the decade, Argentina was the fifth largest sovereign borrower in the world; 40% of foreign borrowing was going toward debt service and 60% of imports were for consumption goods. Argentina defaulted on £48 million in debt in 1890. The military tried to overthrow the Argentine government on August 6, 1890, but failed. After the crisis hit, real GDP in Argentina fell by 11% in 1890 and 1891. The collapse this caused in the price of Argentine sovereign bonds that resulted is illustrated in Figure 1. Figure 1. Argentina 5% Bond of 1884, 1884 to 1925

Figure 1. Argentina 5% Bond of 1884, 1884 to 1925

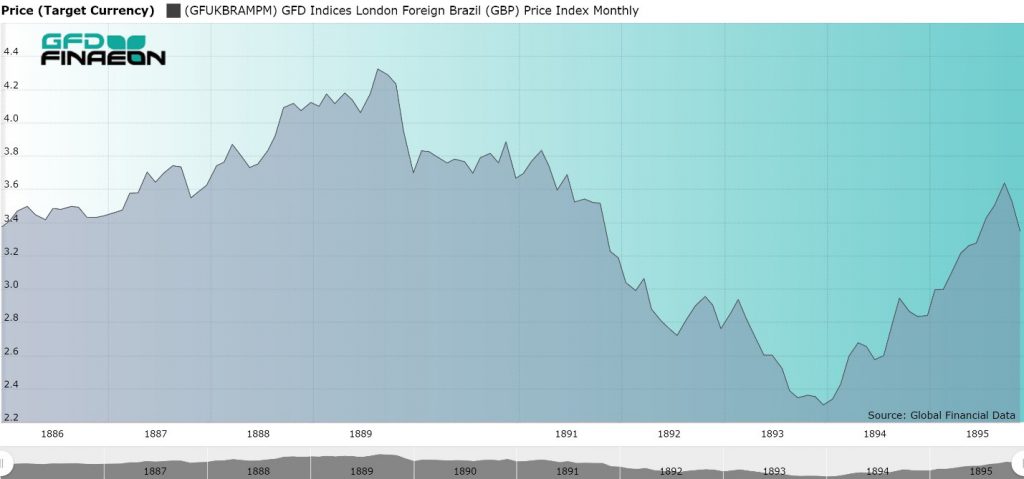

Figure 2. Brazil 4.50% Bond of 1883

As the Baring Crisis spread throughout South America, the bubble that had built up in Brazil burst. This led to a steady decline in equity prices in the years that followed. Brazilian share price steadily declined from 1889 to 1893 as is illustrated in Figure 3.

Figure 3. Brazil Stock Price Index, 1885 to 1895

The Baring Crisis led to a world-wide depression which, although it was not as severe as some of the other depressions of the 1800s, affected Europe, the United States and South America. Argentina, Brazil and Uruguay were all affected by Argentina’s default and the Baring Crisis that followed. The crisis spread to South Africa and Australia, and in the United States. The global economy suffered throughout the 1890s. No country was left unaffected. Brazil may have suffered from the Great Depression of the 1890s, but so did every other country in the world. The Panic of 1857 was one of the first global panics in financial history. The failure of the Ohio Life Insurance and Trust Co. of Cincinnati, Ohio precipitated a world-wide panic that would last for the next two years.

The Panic of 1857 traces its origins back to the Crimean War which was fought between 1853 and 1856 between Russia and the Ottoman Empire, France, Britain and Sardinia over the rights of Christians in the Holy Land. During the war, many European agricultural workers were involved in the war, making Europe more reliant on agricultural imports and increasing Europe’s dependence on American crops. The American economy had boomed since the discovery of gold in California in 1849 and railroads expanded into the Midwest. American banks took advantage of this prosperity to increase their loans to farmers.

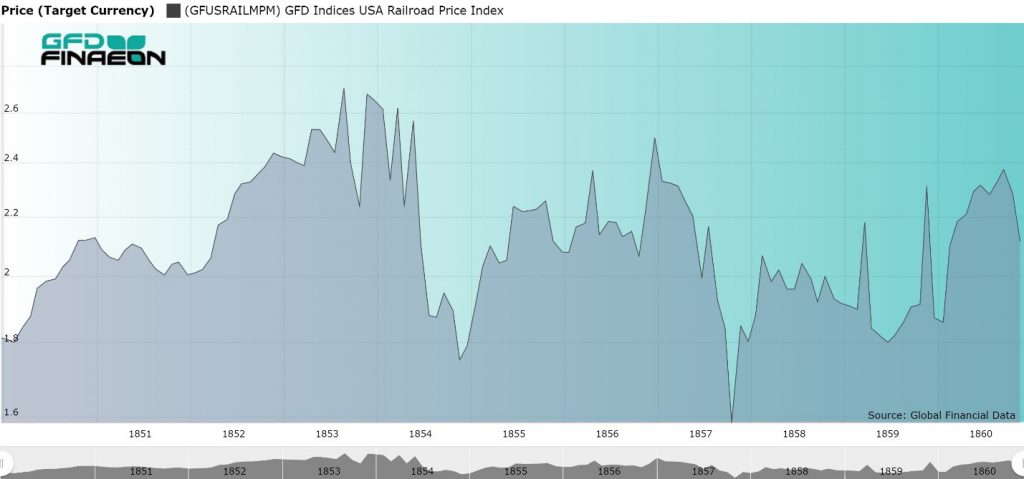

The US stock market peaked in August 1853 and continued its decline until October 1857 by which time the stock market had fallen by 33%. After the Crimean War ended in March 1856, European agricultural production picked up and American exports declined. In January 1857, railroad stocks peaked and declined for the rest of the year as is illustrated in Figure 1. Railroads lost over one-third of their value between January and August 1857. The Delaware, Lackawanna and Western and the Fond du Lac Railroads were forced into bankruptcy.

The Panic of 1857 was one of the first global panics in financial history. The failure of the Ohio Life Insurance and Trust Co. of Cincinnati, Ohio precipitated a world-wide panic that would last for the next two years.

The Panic of 1857 traces its origins back to the Crimean War which was fought between 1853 and 1856 between Russia and the Ottoman Empire, France, Britain and Sardinia over the rights of Christians in the Holy Land. During the war, many European agricultural workers were involved in the war, making Europe more reliant on agricultural imports and increasing Europe’s dependence on American crops. The American economy had boomed since the discovery of gold in California in 1849 and railroads expanded into the Midwest. American banks took advantage of this prosperity to increase their loans to farmers.

The US stock market peaked in August 1853 and continued its decline until October 1857 by which time the stock market had fallen by 33%. After the Crimean War ended in March 1856, European agricultural production picked up and American exports declined. In January 1857, railroad stocks peaked and declined for the rest of the year as is illustrated in Figure 1. Railroads lost over one-third of their value between January and August 1857. The Delaware, Lackawanna and Western and the Fond du Lac Railroads were forced into bankruptcy.

Figure 1. GFD Indices Railroad Price Index, 1850 to 1860

On August 11, 1857 N.H. Wolfe and Co., the oldest flour and grain company in New York failed. The Ohio Life Insurance and Trust Co. had invested heavily in agricultural loans and many of these loans went bad. On August 24, a cashier at the Ohio Life Insurance and Trust Co. was revealed to have embezzled almost all the assets of the firm to sustain his stock market operations. The bank’s New York office suspended payments on August 24, and the company failed. When this occurred, the bank’s failure threatened to precipitate the collapse of other Ohio banks or even cause a bank run. The collapse of the Ohio Life Insurance and Trust Co. is illustrated in Figure 2 with the company’s stock price declining to zero in 1857. Bank failures followed in Liverpool. London, Paris, Hamburg, Oslo and Stockholm. The Bank Act was suspended in Britain on November 12, and Hamburg provided a loan to save Austria on December 10. The firm of Winterhoff and Piper, which was engaged in American trade, was suspended in Hamburg.

Figure 2. Ohio Life Insurance and Trust Co. Stock Price, 1835 to 1857.

The market bottomed out in October 1857. It took two years for the stock market to recover from the Panic of 1857 and begin its move upward. The market rose for the next seven years. It wasn’t until the Panic of 1873 that the market would see a similar financial panic ricochet through the world’s financial markets.