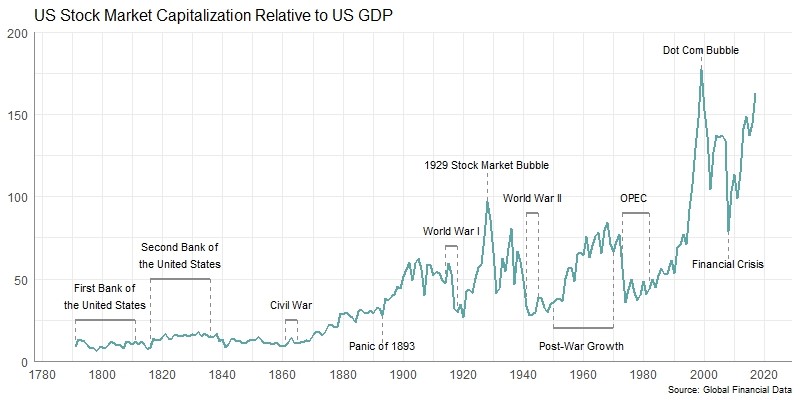

The United States stock market has broken to new highs in January 2020, continuing a bull market that began in March 2009. The S&P 500 has risen 382% since March 2009 and is approaching the record bull market of 1974-1987 in which the S&P 500 rose 442%. This would be only the fourth time that an American bull market rose by more than 400% if this bull market continues. As Figure 1 shows, US stock market Capitalization is close to the same levels as in 1999 when the Internet Bubble burst. By our estimate, when the S&P 500 hits 3650, the stock market’s capitalization will be twice GDP.

Figure 1. US Stock Market Capitalization Relative to GDP, 1792 to 2019

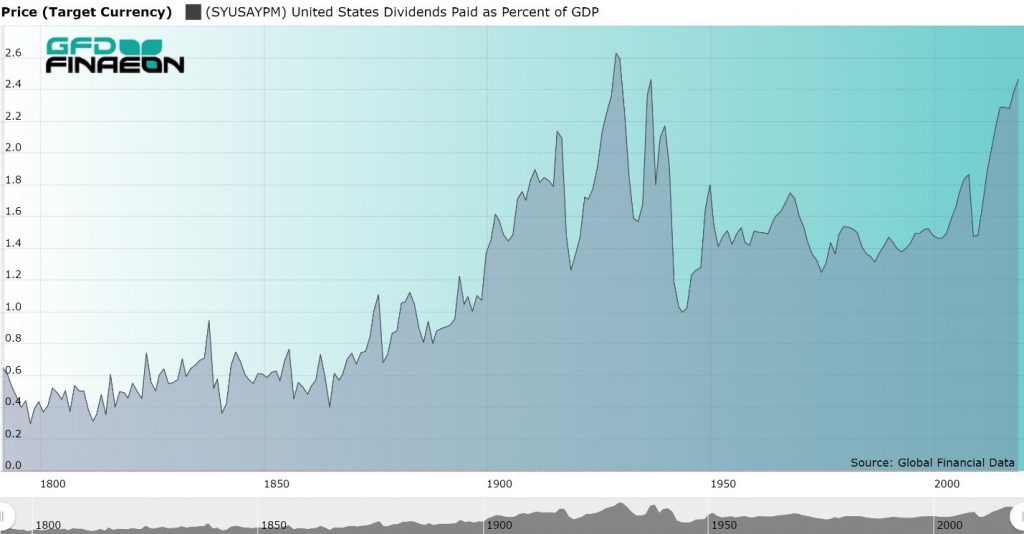

But many people are wondering whether the high price of the stock market is justified by the underlying fundamentals. The economy has been growing for over 10 years, unemployment is at a record low, operating earnings on the S&P 500 are over $1.2 trillion. S&P 1500 companies have paid over $500 billion in dividends and spent over $800 billion on buybacks. As can be seen in Figure 2, GFD’s index of Dividends Paid as a Share of GDP has hit its highest level since the 1929 market crash.

Standard and Poor’s keeps track of the amount of dividends paid on the S&P 500 companies back to 1988. We calculate that the S&P 500 represents about 90% of the dividends paid on all of the companies that are listed in the United States. If we take the amount of dividends paid to S&P 500 companies and add 10% to that amount, we have a good estimate of the total dividends paid by US companies.

In addition to dividends paid to shareholders, corporate buybacks are at record levels as well. While dividend payments reduce the price of stocks, corporate buybacks shrink the supply of outstanding stock and push stock prices higher. In 2018, S&P 500 corporations spent $806 billion on buybacks and $456 billion on dividends. This was equal to 3.86% and 2.39% of GDP respectively. The dividend yield in 2018 was 2.17% and the buyback yield was 3.84% creating a gross return to investors of 6.01%. This puts dividends and buybacks at a record level.

Although the dividend yield has shrunk since the 1980s, as Figure 1 shows, the stock market’s capitalization has grown significantly. This means that even though the dividend yield has declined, dividends paid as a share of GDP has grown. Until the 1950s, the dividend yield on stocks exceeded the yield on government bonds. Between 1957 and 2010, the yield on government bonds exceeded the dividend yield. Now the dividend yield is once again greater than the yield on the 10-year government bond.

We have extended our index of dividends paid as a percentage of GDP back to 1792. We did this by multiplying the US stock market capitalization by the dividend yield and then taking 70% of the total to adjust for companies not paying dividends. This adjustment allowed the data to line up with the actual numbers from the 1990s. The results are provided in Figure 2.

Figure 2. Dividends Paid in the United States as a Percentage of GDP, 1792 to 2019

There was little change in the amount of dividends paid out from 1792 until the end of the civil war. From the 1870s until the 1920s, there was a steady increase in the amount paid in dividends as railroads and industrial companies spread throughout the economy. The index hit peaks in 1916, right before the United States entered World War I, in 1929 when the bull market of the 1920s hit its peak, and in 1937. The index remained fairly constant from 1950 until 2000, but has been rising since then, hitting new peaks in 2019.

In many ways, all of this is good news for investors. It shows that the record levels of the stock market’s capitalization is justified by cash flowing to investors from American corporations. However, it also provides a warning. If American corporations are unable to sustain the payout of record dividends to shareholders, the stock market could fall into a new bear market. If the stock market continues to rise at its current pace, we will be part of the greatest bull market in history.