The Global Financial Database has more equity history for India than for any other country. The British East India Co. was founded on December 31, 1600, preceding the founding of the Dutch East India Co. by one year. Originally, shares were issued for specific ventures to India, but in 1657, joint stock shares were issued and these shares continued to trade in London until the company was dissolved in 1874 and the British government took over ownership of the company. The East India Co. paid a consistent 10.5% dividend from 1793 until the company’s dissolution in 1874. From the late seventeenth century until the early eighteenth century, 95% of Asian imports into Britain come from Mughal India and consisted mainly of cottons and spices produced in India. The decline of Mughal India in the first half of the eighteenth century led to the rise of the British East India Co. which took over India from the Mughal Empire after its victory in the Battle of Plessey in 1757. During the 1800s, the manufacture of textiles moved from India to Britain as the Industrial Revolution enabled Britain to produce the textiles it had formerly imported from India.

During the 1850s, British investment in India boomed, establishing railroads, canals, shipping companies and utilities that were essential not only for the development of the Indian economy, but to enforce Britain’s control over the colony. Merchants in Manchester and London supported building railroads that linked India’s main ports to the interior to bring cotton and other goods to the rest of the world. However, these railroads did not prove profitable, and the British government had to guarantee the 5% dividends the India railroads paid.

In the 1860s, investment in India spread to other sectors. Banks, tea companies, telegraph companies and gold mines were the most popular investments in India. The civil war in the United States led to an increase in demand for cotton causing a bubble in equity markets which burst when the American civil war ended. Although cotton and clothing represented a large portion of India’s production, most of these companies used local capital rather than British funds.

Traders dealt in securities in Calcutta in 1830, trading shares of the East India Co. Twenty-Two stockbrokers met under banyan trees in front of Bombay’s Town Hall in 1855 to trade shares. Premchand Roychand was a native Indian who became a stock broker in 1849 and was a founding member of The Native Share and Stock Brokers Association which later became the Bombay Stock Exchange.

Roychand had earned his fortune when the American Civil War drove the price of cotton up. This led to a speculative bubble in 1864 in which Back Bay Reclamation stock rose from 5,000 rupees to 50,000 rupees. Money made from cotton was redirected into the stock market, and new companies were floated to unsuspecting speculators. The number of companies traded in Bombay grew from 10 in 1855 to 62 in 1862 and over 100 by 1864. The market crashed in May 1865 when the American Civil War ended and Back Bay Reclamation stock fell from 50,000 Rupees to 2,000. Bank of Bombay stock fell from 2,850 rupees to 87. Hundreds of time bargains matured on July 1, 1865 and many speculators were wiped out.

The stock brokers moved to Dalal (Brokers’) Street in 1874. The Bombay Stock Exchange was founded on July 9, 1875 as the Native Share and Stock Brokers Association and was the first stock exchange established in Asia. The Calcutta Stock Exchange incorporated in 1908. Stock exchanges opened up throughout India in the twentieth century. Nineteen former stock exchanges have closed in India since 2000. Today, most trading in Indian stocks takes place on either the Bombay Stock Exchange or the National Stock Exchange, founded in 1992. Both have a market cap of over $2 trillion.

GFD’s index for India uses data on the East India Co. exclusively from 1692 until 1845. A second East India Co. existed between 1698 and 1708, but it merged with the old East India Co. in 1708 because the competition between the two was eliminating their profitability. Data for the East India Railway begins in 1846 and the number of Indian companies that listed in London grew to 20 in the 1860s and peaked at around 50 in 1900. Data for India companies listed in London is used from 1690 to 1922. The number of companies remained around 50 until 1922 when a stock index based upon shares that traded in India was introduced. The domestic India index used data from 100 companies from the Calcutta, Bombay and Madras stock exchanges. By linking together data from The East India Co. from 1690 to 1845, the London Stock Exchange from 1846 to 1922 and from Indian stock exchanges from 1922 to the present, we have been able to provide over three centuries of data on stock companies that operated in India.

Railroads represented a majority of the capitalization in London during the 1800s. You can divide the role of railroads in India into four eras. Up until 1869, British companies constructed and managed the trunk lines that were built with the government providing guarantees on the shares. In the 1870s, the Government of India joined the private companies and began to construct and manage the railways. There were ten private companies incorporated in Britain, which built and managed the trunk lines through India. In the early 1880s, the Government of India began forming public-private partnerships with the Government of India becoming the majority owner of most of the railways in India. In addition to this, after the Afghan War of 1878, the government saw the benefit of building railroads for military use, not just for transporting freight and passengers. The government began to nationalize the railroads in 1924. In 1951, forty-two railways were consolidated into a single Indian Railway completing the nationalization of the nation’s railways.

The first railway was built in India in 1832 and the first passenger railroad opened in 1853 between Bombay and Thane. During the 1800s, about 90 percent of the shares were British-owned and almost all of the capital was raised through equity, not through bonds. The railroad network grew rapidly between 1880 and 1900 and by the early 1900s, India had the fourth largest rail network in the world. By 1900, India had 39, 834 kilometers of railways open, 10,000 more than was open in the United Kingdom, while China had only 1,000 kilometers of railways.

Most railroads received guarantees from the British government so that if their dividends fell below a certain level, usually 5%, the railroad could borrow money from the government to meet the guaranteed return. Because most railways were unable to achieve the 5% rate of return and had to borrow from the government year after year, the government had the right to acquire the railroad after 25 years of subsidies. The government acquired a share of ownership beginning in the 1880s and in the 1920s, most of the railroads were nationalized. The trade-off was that stock in the railways, which represented a majority of the capitalization of the stock market, traded like bonds. Shareholders received a guaranteed return, but railways lacked the incentive to maximize their profits, limiting increases in the price of railway stocks.

By the 1870s, the stock market capitalization of India exceeded its GDP, but as railroads were slowly nationalized, the market cap/GDP ratio continually shrank. The British government did not attempt to develop the Indian economy in the same way that development occurred in the United States, Canada and Australia. The British desire to control the Indian economy and focus on industries that could develop natural resources that could provide exports to Britain and the rest of the world hindered its economic growth. If anything, India deindustrialized in the 1800s as growth in the textile industry in England replaced the demand for textiles from India. Investment went into cotton, tea, and gold mining, all natural resources, but there was little attempt to develop industry in India. British control over the economy bred an anti-colonialism among Gandhi and other supporters of independence that led to socialist policies once India became an independent country after World War II. It wasn’t until the 1980s that India began to promote private business and the stock market began to rise again.

The Global Financial Database has more equity history for India than for any other country. The British East India Co. was founded on December 31, 1600, preceding the founding of the Dutch East India Co. by one year. Originally, shares were issued for specific ventures to India, but in 1657, joint stock shares were issued and these shares continued to trade in London until the company was dissolved in 1874 and the British government took over ownership of the company. The East India Co. paid a consistent 10.5% dividend from 1793 until the company’s dissolution in 1874. From the late seventeenth century until the early eighteenth century, 95% of Asian imports into Britain come from Mughal India and consisted mainly of cottons and spices produced in India. The decline of Mughal India in the first half of the eighteenth century led to the rise of the British East India Co. which took over India from the Mughal Empire after its victory in the Battle of Plessey in 1757. During the 1800s, the manufacture of textiles moved from India to Britain as the Industrial Revolution enabled Britain to produce the textiles it had formerly imported from India.

During the 1850s, British investment in India boomed, establishing railroads, canals, shipping companies and utilities that were essential not only for the development of the Indian economy, but to enforce Britain’s control over the colony. Merchants in Manchester and London supported building railroads that linked India’s main ports to the interior to bring cotton and other goods to the rest of the world. However, these railroads did not prove profitable, and the British government had to guarantee the 5% dividends the India railroads paid.

In the 1860s, investment in India spread to other sectors. Banks, tea companies, telegraph companies and gold mines were the most popular investments in India. The civil war in the United States led to an increase in demand for cotton causing a bubble in equity markets which burst when the American civil war ended. Although cotton and clothing represented a large portion of India’s production, most of these companies used local capital rather than British funds.

Traders dealt in securities in Calcutta in 1830, trading shares of the East India Co. Twenty-Two stockbrokers met under banyan trees in front of Bombay’s Town Hall in 1855 to trade shares. Premchand Roychand was a native Indian who became a stock broker in 1849 and was a founding member of The Native Share and Stock Brokers Association which later became the Bombay Stock Exchange.

Roychand had earned his fortune when the American Civil War drove the price of cotton up. This led to a speculative bubble in 1864 in which Back Bay Reclamation stock rose from 5,000 rupees to 50,000 rupees. Money made from cotton was redirected into the stock market, and new companies were floated to unsuspecting speculators. The number of companies traded in Bombay grew from 10 in 1855 to 62 in 1862 and over 100 by 1864. The market crashed in May 1865 when the American Civil War ended and Back Bay Reclamation stock fell from 50,000 Rupees to 2,000. Bank of Bombay stock fell from 2,850 rupees to 87. Hundreds of time bargains matured on July 1, 1865 and many speculators were wiped out.

The stock brokers moved to Dalal (Brokers’) Street in 1874. The Bombay Stock Exchange was founded on July 9, 1875 as the Native Share and Stock Brokers Association and was the first stock exchange established in Asia. The Calcutta Stock Exchange incorporated in 1908. Stock exchanges opened up throughout India in the twentieth century. Nineteen former stock exchanges have closed in India since 2000. Today, most trading in Indian stocks takes place on either the Bombay Stock Exchange or the National Stock Exchange, founded in 1992. Both have a market cap of over $2 trillion.

GFD’s index for India uses data on the East India Co. exclusively from 1692 until 1845. A second East India Co. existed between 1698 and 1708, but it merged with the old East India Co. in 1708 because the competition between the two was eliminating their profitability. Data for the East India Railway begins in 1846 and the number of Indian companies that listed in London grew to 20 in the 1860s and peaked at around 50 in 1900. Data for India companies listed in London is used from 1690 to 1922. The number of companies remained around 50 until 1922 when a stock index based upon shares that traded in India was introduced. The domestic India index used data from 100 companies from the Calcutta, Bombay and Madras stock exchanges. By linking together data from The East India Co. from 1690 to 1845, the London Stock Exchange from 1846 to 1922 and from Indian stock exchanges from 1922 to the present, we have been able to provide over three centuries of data on stock companies that operated in India.

Railroads represented a majority of the capitalization in London during the 1800s. You can divide the role of railroads in India into four eras. Up until 1869, British companies constructed and managed the trunk lines that were built with the government providing guarantees on the shares. In the 1870s, the Government of India joined the private companies and began to construct and manage the railways. There were ten private companies incorporated in Britain, which built and managed the trunk lines through India. In the early 1880s, the Government of India began forming public-private partnerships with the Government of India becoming the majority owner of most of the railways in India. In addition to this, after the Afghan War of 1878, the government saw the benefit of building railroads for military use, not just for transporting freight and passengers. The government began to nationalize the railroads in 1924. In 1951, forty-two railways were consolidated into a single Indian Railway completing the nationalization of the nation’s railways.

The first railway was built in India in 1832 and the first passenger railroad opened in 1853 between Bombay and Thane. During the 1800s, about 90 percent of the shares were British-owned and almost all of the capital was raised through equity, not through bonds. The railroad network grew rapidly between 1880 and 1900 and by the early 1900s, India had the fourth largest rail network in the world. By 1900, India had 39, 834 kilometers of railways open, 10,000 more than was open in the United Kingdom, while China had only 1,000 kilometers of railways.

Most railroads received guarantees from the British government so that if their dividends fell below a certain level, usually 5%, the railroad could borrow money from the government to meet the guaranteed return. Because most railways were unable to achieve the 5% rate of return and had to borrow from the government year after year, the government had the right to acquire the railroad after 25 years of subsidies. The government acquired a share of ownership beginning in the 1880s and in the 1920s, most of the railroads were nationalized. The trade-off was that stock in the railways, which represented a majority of the capitalization of the stock market, traded like bonds. Shareholders received a guaranteed return, but railways lacked the incentive to maximize their profits, limiting increases in the price of railway stocks.

By the 1870s, the stock market capitalization of India exceeded its GDP, but as railroads were slowly nationalized, the market cap/GDP ratio continually shrank. The British government did not attempt to develop the Indian economy in the same way that development occurred in the United States, Canada and Australia. The British desire to control the Indian economy and focus on industries that could develop natural resources that could provide exports to Britain and the rest of the world hindered its economic growth. If anything, India deindustrialized in the 1800s as growth in the textile industry in England replaced the demand for textiles from India. Investment went into cotton, tea, and gold mining, all natural resources, but there was little attempt to develop industry in India. British control over the economy bred an anti-colonialism among Gandhi and other supporters of independence that led to socialist policies once India became an independent country after World War II. It wasn’t until the 1980s that India began to promote private business and the stock market began to rise again.

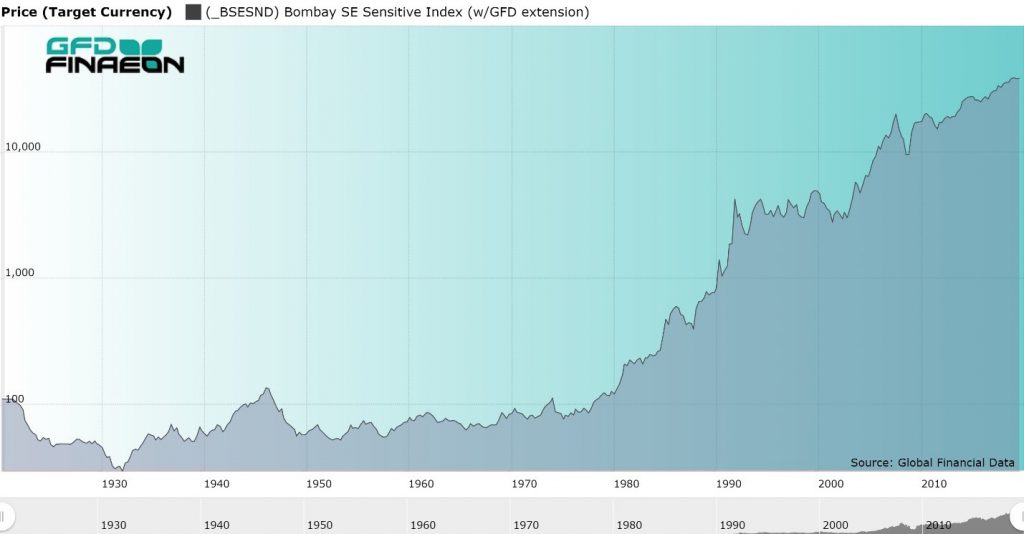

Figure 1. GFD India Price Index, 1657 to 2019

The performance of stocks in India over the past 350 years is illustrated in Figure 1. The most interesting observation here is the lack of movement in the index from the 1700s to 1980. All of the return to shareholders came in the form of dividends. This is the legacy of the guaranteed returns that first went to shareholders of East India Co. stock between 1792 and 1874, and to the railroads up until the 1890s. After the government gained control over the railways in the 1880s, investment went into tea, rubber, cotton, mining and other resources, not into industries that could develop the country. The ratio of the stock market’s capitalization to GDP shrank between 1880 and 1980 and investors had to rely upon dividends to obtain a return. Figure 2 shows the behavior of Indian stocks since the domestic index was first computed in 1920. As can be seen, there was virtually no change in the price of Indian stocks from 1920 until 1980. The Indian economy went through an economic boom between 1910 and 1930 and an economic bust between 1930 and 1950. After India became an independent country, the economy went through a period of economic boom driven by Five-Year plans and socialist policies leading to average growth in the economy of 3.1 percent per year. However, growth slowed between 1970 and 1990 leading to a period of economic liberalization which has prevailed in India since P.V. Narasimha Rao and Manmohan Singh introduced these reforms in 1991. This has given investors the opportunity to finally benefit from growth in the Indian economy. Today, there is investment in information technology as India tries to provide growth to over 1.3 billion people.

Figure 2. Domestic India Stock Price Index, 1920 to 2018

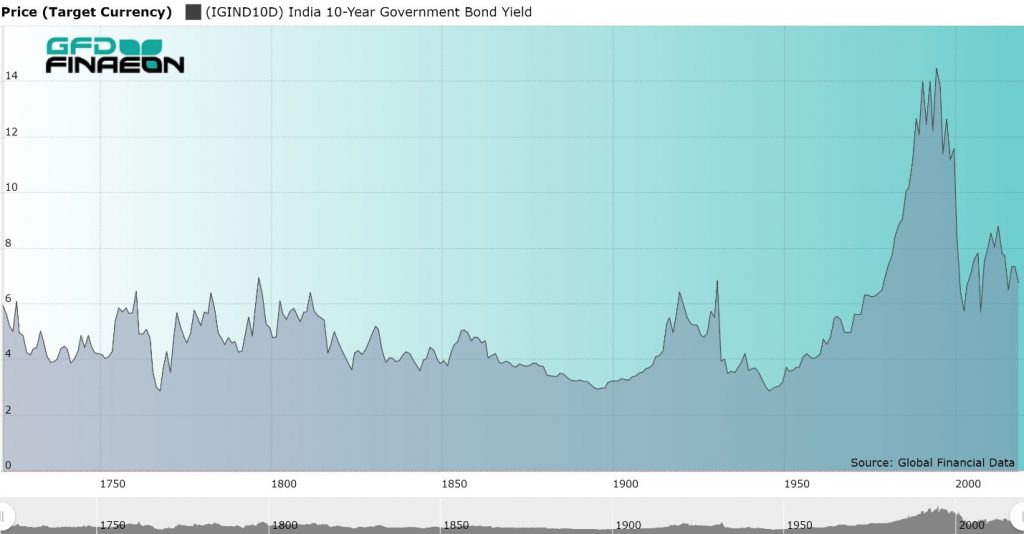

On the other hand, since India was a British colony, there was little risk of default on its outstanding bonds. Figure 3 provides a graph of the yield on Indian government bonds from 1722 until 2019. The series uses the yield on East India Co. stock from 1722 until 1864 when the Government of India issued its first bonds. The dividend was set at 10.5% in 1793 and remained at that level until the dissolution of the company in 1874. India issued a 4% bond in 1864 which was later replaced by bonds yielding 3.5% then 3%. Unlike many other emerging markets, India has never defaulted on its bonds, a fact that is reflected in the yield remaining around 4% until India’s independence. The yield rose to 14% in 1995 because of inflation, but has declined since then.

Figure 3. Yield on East India Co. Stock and India Government Bonds, 1722 to 2019

The actual numbers that measure the return to stocks and bonds in India is provided in Table 1. As can be seen, there was virtually no change in the price of Indian stocks between 1720 and 1980. The combination of a fixed dividend on East India Co. stock, guaranteed returns on Indian railroads, the deindustrialization of India and the focus on small, resource-based industries limited the opportunity for capital gains in India. Investors relied upon dividends as their source of income. During the past 200 years, Indian stocks have only provided a 4.16% annual return, barely 1% greater than bonds.| Period | Name | Stock Price | Stock Return | Bond Return | Premium |

| 1692-1720 | Glorious Revolution | 3.3 | 11.39 | ||

| 1720-1792 | Mercantilism | 0.11 | 5.1 | ||

| 1792-1848 | Transportation | 0.46 | 5.48 | ||

| 1848-1914 | Free Trade | 1.69 | 6.39 | 3.14 | 3.25 |

| 1914-1945 | World Wars | -0.68 | 4.79 | 5.4 | -0.61 |

| 1945-1981 | Keynesianism | -1.03 | 7.1 | 1 | 6.1 |

| 1981-2018 | Globalization | 8.79 | 12.45 | 2.92 | 9.53 |

| 1692-2018 | All History | 1.02 | 6.92 | ||

| 1822-2018 | Bond History | 0.38 | 4.16 | 3.14 | 1.02 |

Table 1, Returns to Stocks and Bonds in USD in India, 1692 to 2018

Conclusion

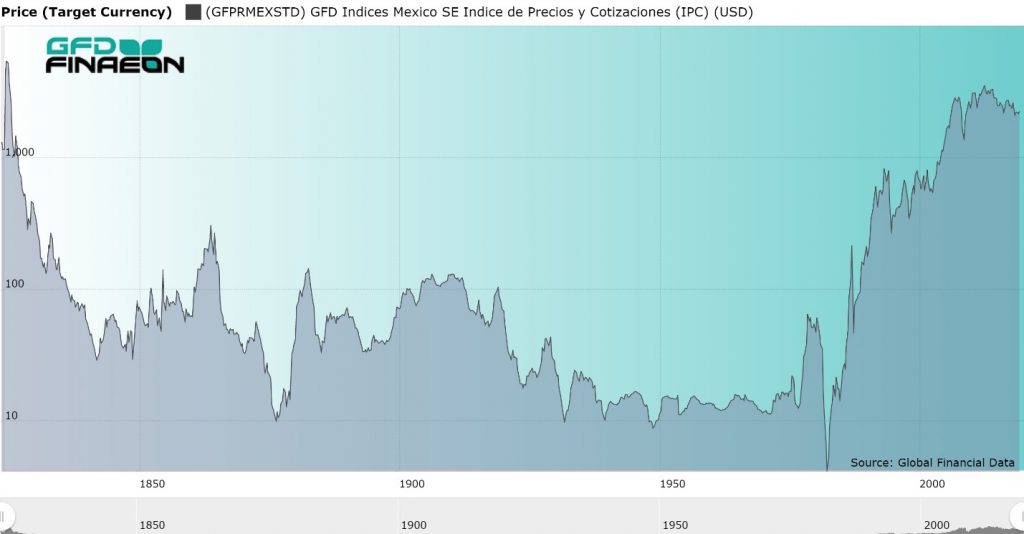

Mughal India was one of the most advanced areas of the global economy in the 1700s, exporting textiles and spices to Europe and the rest of the world. Under the British East India Co. and the British Raj, Britain developed India’s infrastructure, but it did not develop the economy. While the United States, Canada and Australia enjoyed dramatic increases in their GDP and investors received high rates of return, India stagnated. It has only been during the period of Globalization since 1981 that growth has returned to the country. India will soon have the largest population of any country in the world, but it may be several decades before India has the largest economy in the world.Mexico has been struggling to develop its economy since Spain invaded Mexico in 1521 and it gained its independence in 1821. When Mexico was a colony, Spain relied upon exports of silver to profit from its control over the economy. The economy stagnated after Mexico gained its independence, but General Porfirio Diaz (1876-1910) attempted to develop the economy by allowing foreigners to invest in Mexico and build railroads and mines with foreign capital. Most of the investment in the 1910s and 1920s was spent developing Mexico’s oil, but after the nationalization of the oil industry in 1938, foreign capital stopped flowing into Mexico and the country had to rely on domestic capital. The economy grew rapidly after World War II, but collapsed in the 1980s. Since NAFTA was signed in 1994, Mexico has pursued market-oriented policies to expand trade with the rest of the world. The period between 1982 and 2007 was an era of high returns to both stocks and bonds, the highest in the country’s history, but during the past 12 years, returns have stagnated. Global Financial Data has 195 years of data on Mexico stretching from 1824 until 2019. GFD has data on 44 companies that listed in London and 30 companies that listed in New York between 1824 and 1989. Most of the companies that listed in London were mining companies, railroads, banks or oil and gas companies. Oil and gas, telephone and telegraph, utilities and mining companies listed in New York. Some of the companies had a long existence with the Anglo-Mexican Mint Co., Mexican Eagle Oil Co., Mexican Railway Co., and United Mexican Mine Co. all lasting over 50 years before meeting their demise. The poor performance of equities was matched by the poor performance of government bonds. Mexico was in default during most of the 1800s, paid interest from 1887 until World War I, went into default during the Mexican Revolution, then returned to solvency after World War II. Mexico defaulted on its bonds in 1827, made a few interest payments in the 1860s, but didn’t really start paying interest regularly until 1887. Mexico defaulted a second time in 1914 and remained in default until 1963 when the country issued new government bonds in New York. Mexico defaulted a third time in 1982 and remained in default until the “Brady plan” restructured Mexico’s debt in 1989. The Mexican government has been in default on its bonds in more years than it has paid interest. Mexican government bonds are definitely not risk-free. Even with the reinvestment of interest received periodically between 1824 and 1972, investors would have just broken even on Mexican government bonds during those 150 years. On the other hand, between 1994 and 2018, investors in Mexican bonds received an 8.73% annual return, which exceeded the 8.16% returned to equities during those years. British investment in Mexico began in 1824 when the Anglo-Mexican Mining Association, the United Mexican Mine Co. and the Mexican Mining Co. were established. These three companies were followed by The Company of Adventurers in the Mines of Bolaños, the Tlalpujahua Mining Co. and the Real del Monte Silver Mine Co. in 1825 and finally the Anglo-Mexican Mint in 1829. After an initial bubble in Mexican shares in 1825, shares lost over 90% of their value, reaching their nadir in 1876 as is illustrated in Figure 1.

Figure 1. GFD Mexico Stock Price Index, 1824 to 2019 in USD

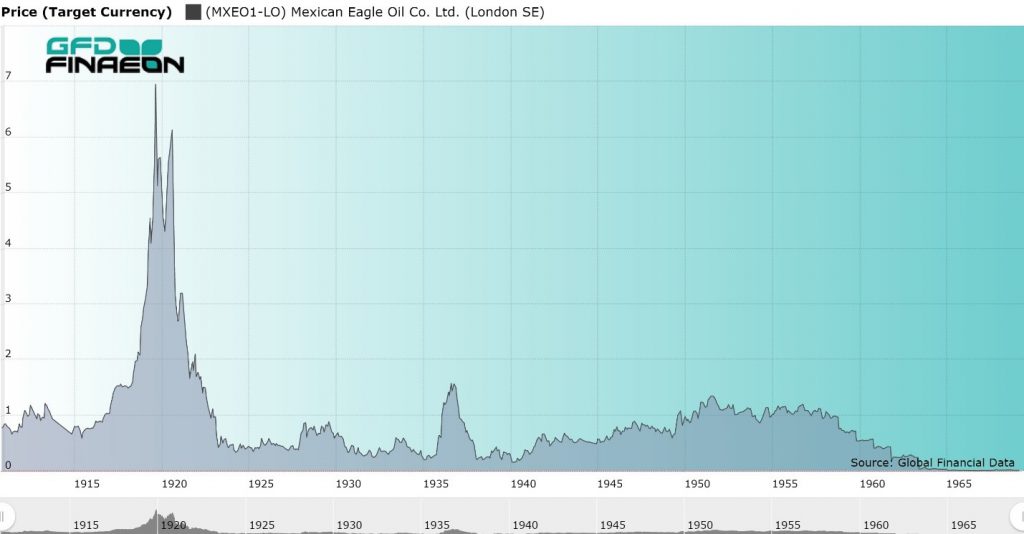

However, in 1876 General Porfirio Diaz became the leader of Mexico and allowed foreigners to invest in Mexico and build railways across the country. The Mexican Railway Co. was established in 1864, the Mexican Telegraph Co. in 1881, the Mexican National Railroad Co. in 1882 and the National Bank of Mexico in 1886. These companies rose in price, providing investors with a ten-fold return between 1876 and 1883. The Bolsa Mexicana de Valores was founded on October 31, 1894. During the 1910s and 1920s, foreign capital flowed from the United States into oil and gas companies. The Compañia Mexicana de Petroleo "El Aguila" S.A. (Mexican Eagle Oil Co. Ltd.) was one of the hottest stocks in both New York and London during the 1910s and 1920s (Figure 2). Speculators loved to trade the “Eagle” as it bounced up and down in the 1920s. However, the Constitution of 1917 gave the Mexican government control over its resources and in 1938, the oil industry was nationalized by the government and Petroleos Mexicano (PEMEX) was born.

Figure 2. Mexican Eagle Oil Co. Ltd. Stock Price, 1911 to 1972

Although this gave Mexico possession of its oil industry, further investment of foreign capital in Mexico came to a halt. Mexico had to rely upon domestic investment and the stock market began a steady decline for the next 50 years. This occurred despite steady growth in Mexico between 1940 and 1970. The Nacional Financiera introduced an index of Mexican stocks in 1930. The index included 11 stocks in 1958 and expanded to 30 stocks in 1966 when daily calculations began. The Indice de Precios y Cotizaciones (IPC) was introduced in 1978 and includes 35 stocks. It is currently calculated by S&P. The Mexican stock market crashed during the Peso Crisis of 1982, losing two-thirds of its value in Pesos, and over 90% of its value in U.S. Dollars. Over the next twenty years, the market bounced back, rising over 98% per annum between 1982 and 1994 when NAFTA was signed. Stocks stagnated between 1995 and 1999, rose to 2006, but have stagnated since then. The return to equities in Mexico, as measured in US Dollars, is provided in Table 1. As can be seen, over the long term, investors have not been richly rewarded. Between 1824 and 1981, investors on average lost 4% per annum. All of the return to stocks has occurred since 1982 when the stock market bottomed out during the Peso Crisis. Unfortunately, only data on the price behavior of stocks is available for Mexico. Complete data on the return to stocks and bonds is not available because the dividend record for stocks is incomplete and the record on bond yields and returns is unavailable in the 1970s and 1980s. Nevertheless, we can provide data on stock prices over the past 195 years.

| Years | Era | Stock Price |

| 1848-1914 | Free Trade | 0.52 |

| 1914-1945 | World Wars | -4.44 |

| 1945-1981 | Keynesianism | 2.1 |

| 1981-2018 | Globalization | 11.65 |

| 1824-1981 | Pre-Globalization | -4.04 |

| 1824-2018 | Full History | -0.36 |

Table 1. Annual Returns to Mexican Stocks, 1824 to 2018

Mexican stocks and bonds provided horrible returns to shareholders between 1824 and 1981. Investors in both Mexican equities and Mexican government bonds lost money, even after the reinvestment of dividends and interest. Only since the collapse of the Peso in 1982 have investors been able to obtain positive returns. However, equity investors have broken even since 2007 as have investors in government bonds. Investors had 25 years of marvelous returns between 1982 and 2007, but returns have stagnated over the past dozen years. Distrust of the Mexican establishment led to the election of Andres Manuel Lopez Obrador in 2018. How his policies will impact the stock market in the future remains to be seen. Although the fabulous returns of the 25 years of Mexico’s investment miracle are unlikely to return, one can hope that Mexico does not return to the stagnation it suffered in the 60 years before 1982.

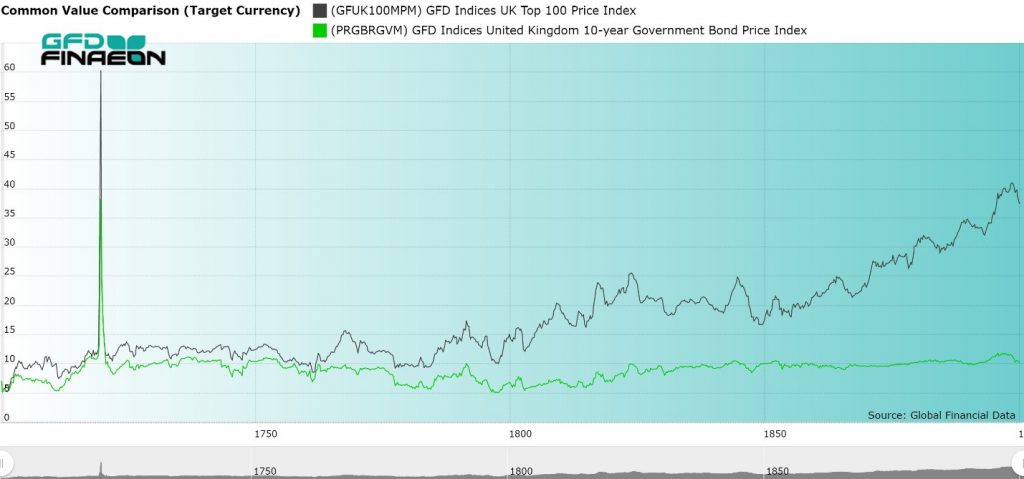

Financial markets have evolved over time. The relationship between stocks and bonds differed in each of the eras that Global Financial Data has created to differentiate the behavior of financial markets in the past: the Dutch East India Co. (1601-1692), the Glorious Revolution (1692-1720), Mercantilism (1720-1792) the Transportation Revolution (1792-1848), Free Trade (1848-1914), World War (1914-1945), Keynesianism (1945-1981) and Globalization (1981-). Bonds have primarily been used as a source of income with inflation and the risk of default affecting the price and yield on bonds. With stocks, on the other hand, higher earnings and dividends and thus capital gains have become the main driver of stock prices since higher earnings mean higher cash flows in the future to shareholders. The relative performance of stocks and bonds in the United Kingdom since 1700 is illustrated in Figure 1, which shows how this relationship has changed over time. As can be seen, there was a strong correlation between stocks and bonds during the Mercantilism of the 1700s. During the 1800s, the price of bonds generally rose, but slightly and showed little change over time. Equities, on the other hand, rose in price, first gradually during the Transportation Revolution, then strongly during the era of Free Trade between 1850 and 1914. As Figure 3 illustrates, there was almost an inverse correlation between stocks and bonds between 1914 and 1981. After World War II, the price of bonds fell as inflation rose, but equities rose in price both when there was little inflation before World War II and during the rising inflation that occurred after 1945. Since 1981, the correlation between stocks and bonds has been positive with the price of both stocks and bonds rising, bonds through falling inflation and quantitative easing, and stocks through higher profits. Let’s see how the relationship between stocks and bonds has evolved over time.

Financial markets have evolved over time. The relationship between stocks and bonds differed in each of the eras that Global Financial Data has created to differentiate the behavior of financial markets in the past: the Dutch East India Co. (1601-1692), the Glorious Revolution (1692-1720), Mercantilism (1720-1792) the Transportation Revolution (1792-1848), Free Trade (1848-1914), World War (1914-1945), Keynesianism (1945-1981) and Globalization (1981-). Bonds have primarily been used as a source of income with inflation and the risk of default affecting the price and yield on bonds. With stocks, on the other hand, higher earnings and dividends and thus capital gains have become the main driver of stock prices since higher earnings mean higher cash flows in the future to shareholders. The relative performance of stocks and bonds in the United Kingdom since 1700 is illustrated in Figure 1, which shows how this relationship has changed over time. As can be seen, there was a strong correlation between stocks and bonds during the Mercantilism of the 1700s. During the 1800s, the price of bonds generally rose, but slightly and showed little change over time. Equities, on the other hand, rose in price, first gradually during the Transportation Revolution, then strongly during the era of Free Trade between 1850 and 1914. As Figure 3 illustrates, there was almost an inverse correlation between stocks and bonds between 1914 and 1981. After World War II, the price of bonds fell as inflation rose, but equities rose in price both when there was little inflation before World War II and during the rising inflation that occurred after 1945. Since 1981, the correlation between stocks and bonds has been positive with the price of both stocks and bonds rising, bonds through falling inflation and quantitative easing, and stocks through higher profits. Let’s see how the relationship between stocks and bonds has evolved over time.

Figure 1. Stocks and Bonds in the United Kingdom, 1700 to 1900

Mercantilism (1720-1792)

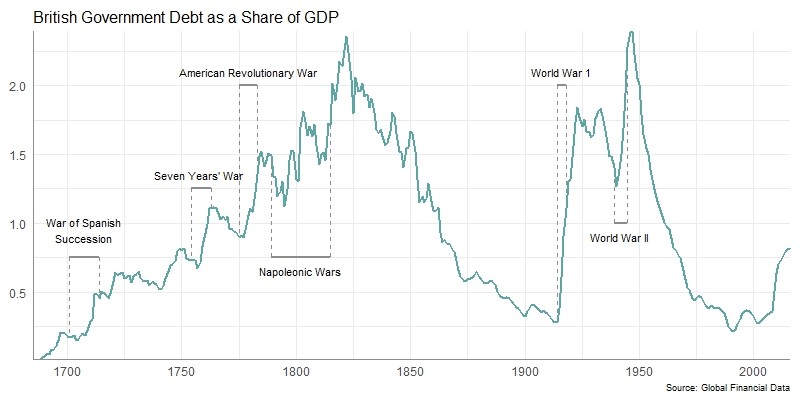

Global Financial Data lacks information on the behavior of bonds in the 1600s and data on bonds in England only begins in the 1720s. During the period of Mercantilism (1720 to 1792), income was king. Just as today, bonds trade in parallel with each other, going up and down in price, with only small differences in the yields according to the risk of default, the same was true in the 1700s. During the eighteenth century, there were about two dozen securities that traded in Paris, London and Amsterdam. Most of the securities were bonds, but a few were international trading companies, such as the East India Company, which were backed by the central government of each country. In a way, virtually all of the liquid securities that were traded were government-backed securities which paid dividends or interest. Although the interest on bonds did not change, the dividends paid on individual securities did, though rarely. When the dividend changed, the price of the security responded so the yield stayed around 5%. If you look at Figure 1, you can see that stocks (black line) and bonds (green line) exhibited the same movements up and down, but stocks outperformed bonds over the course of the eighteenth century because of the greater risk to shareholders. In the United Kingdom, stocks returned 4.79% per annum while bonds returned 4.39% leaving an equity premium of 0.40%. During the 1700s, the amount of outstanding debt grew dramatically relative to equity. In 1692, the market capitalizations of stocks and bonds in the United Kingdom were each around £1 million, but by 1820, the British stock market had grown in size to £50 million and British government debt to £800 million. After the collapse of the South Sea and Mississippi Bubbles, investors preferred government bonds to equities. The 1700s were more a market for bonds than for stocks, but this would change in the 1800s.

Figure 2. British Government Debt as a Share of GDP, 1692 to 2018

The Transportation Revolution (1792-1848)

The world went through a transportation revolution between 1792 and 1848, surviving the Napoleonic Wars that ravaged Europe between 1792 and 1815. There were four separate bubbles that occurred during those 56 years as investors found new stocks to speculate in. The stock market was revolutionized by the Canal Bubble of 1793 when dozens of canal stocks were issued leading to the first stock market bubble since the South Sea Bubble of 1720. Dozens of canals were approved to be built in the Midlands of Britain and some canals quadrupled in price as speculators rushed into the canals before their stock price collapsed back to par. 1792 was also the year when shares of the Bank of the United States started trading in Philadelphia, leading to a bubble in its shares, as speculators tried to corner its shares. The bubble ended quickly, but two new canal bubbles occurred between 1806 and 1810 and in the 1820s. In the mid-1820s money poured into South American stocks and bonds as investors tried to take advantage of resources in the newly independent countries. The Railway Mania of the 1840s led to a doubling in the value of transportation stocks in the United Kingdom before they collapsed after the bubble burst. Before 1800, each company only issued one security to shareholders, but in the 1840s, a single company could issue a dozen different classes of shares including partial shares, preferred shares, ordinary shares, deferred shares, bonds, and auxiliary shares. Each class was created to appeal to a particular group of individual investors. However, the railway mania crashed in 1848 as revolution swept through continental Europe. French and German stock markets both lost over 50% of their value during the crash of 1848. While stocks and bonds largely moved in parallel with each other before 1792, this did not occur during the Napoleonic War when companies in France and the Netherlands were closed and every country except the United Kingdom defaulted on their government bonds, either skipping interest payments or replacing old bonds with new bonds. Bondholders in France and the Netherlands lost two-thirds of their capital when sovereign debt was refinanced. In the United States, bondholders received three types of bonds in exchange for bonds issued during the Revolutionary War. South American governments issued bonds around 1820 only to default on them a few years later. Government bonds were certainly not risk free. The period between 1792 and 1848 was one of constant financial and economic innovation as investors had to deal with war between 1792 and 1815 and the financial revolution of canals and railroads after that. During those years, the United States endured a 50-year bear market and investors in London had to deal with speculative bubbles that drove stock prices up then down. Table 1 provides data on the returns to stocks, bonds, bills and inflation between 1792 and 1815 for the United States, the United Kingdom and the world. Stocks outperformed bonds in the United Kingdom, but not in the United States.

| Stocks | Bonds | Bills | Equity Premium | |

| UK | 5.63 | 4.54 | 4.58 | 1.04 |

| USA | 4.87 | 5.61 | 4.82 | -0.7 |

| World | 5.45 | 5.52 | 4.82 | -0.07 |

Table 1. Returns to Stocks, Bonds and Bills in USD, 1792 to 1848

Free Trade (1848-1914)

After the revolutions of 1848 failed, the world opened up to Free Trade. There were no major wars between 1848 and 1914, and government debt decreased as a share of GDP while the capitalization of the world’s stock markets grew dramatically as each country built railroads, canals, telegraphs, utilities and other infrastructure to integrate the global economy. Equities provided the opportunity for growth while bonds provided steady, reliable income. After 1815, the 1800s was a century of peace so the risk of default due to war by countries such as the United Kingdom, France or the Netherlands was almost nil. The yield on bonds fell to the 3% range in London and stayed there for most of the century. Bonds issued by emerging markets such as Greece, Portugal, Spain or South America, however, did run a risk of default, and emerging market government bonds were riskier than the blue-chip stocks that traded in London. Some governments missed interest payments for decades and had to refinance their debts imposing losses on investors. Equity prices made little progress between 1800 and 1850. Between 1850 and 1914, however, there were no bear markets in equities in the United Kingdom. Instead, stocks moved up in price as Figure 1 shows. Because British Consols had virtually no risk, they hardly changed in price. The coupon on Consols fell from 3% to 2.75% to 2.5% between 1881 and 1907. Consequently, stocks and bonds became separate types of securities and different asset classes. Bonds were purchased for income, and equities for capital gains. American railroads issued billions of dollars in stocks and bonds in New York, Amsterdam and London to pay for the railroads that crisscrossed America. Because the 1800s were a century of peace, the amount of outstanding British debt hardly changed and stayed at roughly £800 million throughout the century. As Figure 2 shows, the ratio of government debt to GDP fell in the United Kingdom as it did in the United States. Equities, however, grew in size dramatically. Stocks provided more of an opportunity for growth and their capitalization in the United Kingdom grew from £50 million to £700 million between 1815 and 1914. Meanwhile, the value of U.S. stocks grew from $20 million in 1792 to $20 billion in 1914, a phenomenal 1000-fold increase in stock market capitalization. The size of the US stock market increased another 1000-fold between 1914 and 2019 growing from $20 billion to $20 trillion. Will the US stock market increase another 1000-fold over the next 100 years? Table 2 provides data on the returns to stocks, bonds and bills between 1848 and 1914. As can be seen, returns to stocks and bonds varied dramatically between countries, with France and the United States providing the highest returns to stocks while the United Kingdom provided the smallest returns. Bonds actually outperformed stocks in the United Kingdom while the equity premium was around 3% in both the United States and in France.

| Stocks | Bonds | Bills | Equity Premium | |

| Belgium | 5.66 | 4.36 | 2.1 | 1.25 |

| France | 8.07 | 4.73 | 3.21 | 3.19 |

| Germany | 4.49 | 4 | 3.3 | 0.47 |

| UK | 2.6 | 2.69 | 3.2 | -0.09 |

| USA | 8.44 | 4.75 | 3.73 | 3.52 |

| World | 6.5 | 3.4 | 3.73 | 3 |

Table 2. Returns to Stocks, Bonds and Bills in USD, 1848 to 1914

World War (1914-1945)

Between 1914 and 1945, the world endured a thirty-year war in which Germany fought against France, Britain and the United States. The government heavily regulated the economy during World War I and World War II and the mismanagement of the economy by the Federal Reserve contributed to the depth of the Great Depression in the United States in the 1930s. Bond yields rose from 1914 until 1920 as the war generated inflation that drove interest rates higher. After 1920, interest rates declined, first through a lack of economic activity during the 1930s and through government regulation during World War II. Many governments defaulted on their bonds and waited until after World War II was over to come to terms with their creditors and issue new bonds to replace the old. The world had enjoyed a relatively open global economy of free trade until 1914, but when World War I began, stocks markets closed throughout the world. Governments went off the gold standard and introduced capital controls to limit the free flow of capital between countries. Attempts in the 1920s and 1930s to bring back the gold standard, free trade and the stability that marked the global economy before 1914 failed. By the 1930s, countries were seeking autarkic policies that relied upon government support and domestic production. International trade collapsed as war enveloped the world. The Federal Reserve was founded in 1913 and in 1914, World War I began leading to a large increase in the number of outstanding bonds as governments absorbed outstanding capital to pay for World War I and II. Between 1914 and 1945, there was great variety in the returns to stocks and bonds in different countries. Hyperinflation in the 1920s and defaults in the 1930s and 1940s wiped out many investors. While government bonds returned between four and five percent in most countries between the beginning of World War I and the end of World War II, equity returns varied tremendously. These returns are illustrated in Table 3. As the table shows, there is no correlation between the returns in different countries, reflecting the fact that capital could not easily flow between countries as it did before 1914. Countries that were not directly affected by the war, such as Australia, Canada and the United States provided high returns to shareholders while Germany provided a negative return. Countries that suffered from high inflation provided negative returns to bondholders in Belgium, Finland, France and Germany. Consequently, there was a wide variance in the equity premium, ranging from negative returns in Sweden and the United Kingdom to double digits in Germany as a result of hyperinflation reducing the return to fixed income investors.

| Stocks | Bonds | Bills | Equity Premium | |

| Australia | 8.5 | 4.07 | 1.5 | 4.26 |

| Belgium | 2.21 | -2.07 | -1.27 | 4.37 |

| Canada | 7.19 | 4.26 | 2.17 | 2.81 |

| Denmark | 3.05 | 4.9 | 4.19 | -1.76 |

| Finland | 5.12 | -2.85 | -4.53 | 5.12 |

| France | 3.55 | -13.59 | -4.29 | 6.59 |

| Germany | -0.02 | -1.05 | -53.19 | 15.7 |

| Japan | 2.32 | 4.38 | -2.45 | 3.41 |

| Netherlands | 5.18 | 3.38 | 2.5 | 0.77 |

| Sweden | 3.7 | 4.59 | 2.87 | -0.85 |

| Switzerland | 5.84 | 5.33 | 3.66 | 0.48 |

| UK | 3.51 | 3.93 | 2.07 | -0.4 |

| USA | 8.48 | 4.1 | 1.87 | 4.21 |

| World | 6.71 | 4.01 | 1.87 | 2.6 |

Table 3. Returns to Stocks, Bonds and Bills in USD, 1914 to 1945

Keynesianism (1945-1981)

After World War II concluded, the world wanted to avoid a return to the Great Depression of the 1930s. This led to attempts to micromanage the macroeconomy through Keynesian policies of government regulation, foreign exchange controls and the nationalization of key industries. At first these policies worked and the world was able to avoid a return to the Great Depression, but the cost was rising inflation and rising interest rates. Between 1950 and 1981, interest rates steadily rose in the United States and other countries, peaking in the US at 15.84% in 1981. Although the Federal Reserve was created to control inflation and thus interest rates, it failed in the 1970s as both inflation and interest rates rose to their highest levels in peacetime. Stocks were undervalued at the end of World War II since many investors feared that the economy would once again sink into depression, but instead, the creation of a system of global trade through the GATT allowed the economy to grow dramatically. European economies recovered from World War II, enjoying the fastest rates of growth in history, allowing stocks to rise in price, far exceeding the returns to bonds.

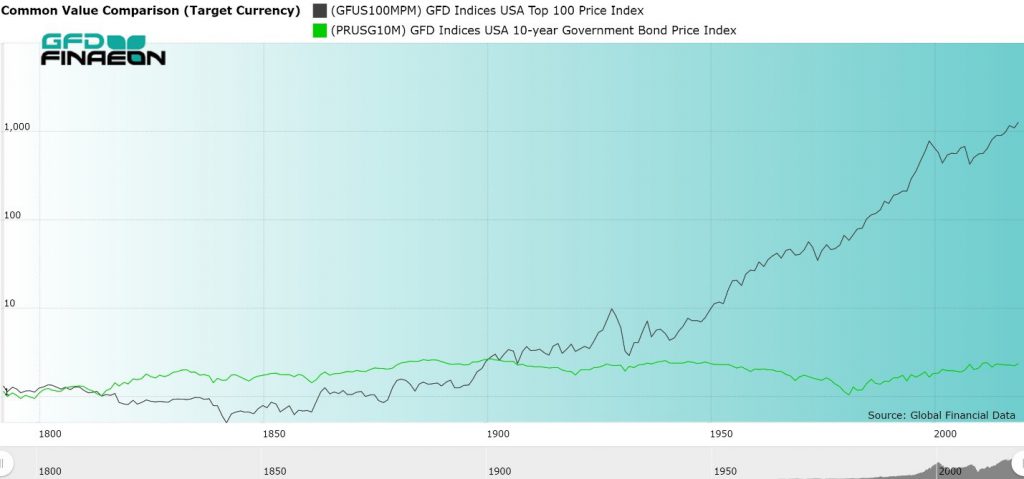

Figure 3. United States Stock and Bond Price Indices, 1792 to 2018

Stock prices rose in price between 1945 and 1981, though mainly in line with inflation. Between April 1901 and April 1982, there was virtually no change in the S&P 500 stock price index after adjusting for inflation. Between 1981 and 2018, on the other hand, the S&P 500 increased ten-fold after adjusting for inflation. Between 1792 and 1900, stocks and bonds provided similar returns with stocks declining in price between 1792 and 1848, then rising in price for the rest of the century. Bonds, on the other hand, steadily rose in price during the 1800s as bond yields declined. The real difference in performance came after World War II when stocks continually rose in price while bond yields rose causing bond prices to decline. As Table 4 illustrates, this situation created a high equity premium as stock returns rose and bond returns faltered. In 12 of the 15 markets GFD covers between 1945 and 1981, inflation exceeded the return to bonds making investors worse off after inflation. In France, Germany and Italy, inflation exceeded the return to bonds by over 6%. Holders of cash received negative returns after inflation in 11 of the 15 markets GFD covers. On the other hand, the world stock index provided a return of 10.26% with double-digit returns in five other countries. This created double-digit equity premia in Germany, Italy and Japan with the world equity premium equal to 8.52% and the equity premium in the United States equal to 7.38%. These results were driven by two concurring events: the recovery from World War II and the Great Depression and thirty years of rising interest rates. This was a perfect storm for the equity premium. Unfortunately, since investors lacked the history of four centuries of stock market performance that we now have, investors took this excessive excess premium as the norm. Since 1981, equities have continued to provide excess returns, but the decline in bond yields since 1981 has generated high returns to bonds, squeezing the equity premium.

| Stocks | Bonds | Bills | Equity Premium | |

| Australia | 11.41 | 3.22 | 3.18 | 8.19 |

| Belgium | 6.22 | 5.23 | 6.65 | 0.99 |

| Canada | 10.29 | 3.56 | 4.52 | 6.73 |

| Denmark | 8.61 | 5.97 | 6.54 | 2.64 |

| Finland | 7.97 | 1.02 | 4.3 | 6.95 |

| France | 4.1 | -1.91 | -0.95 | 6.01 |

| Germany | 10.4 | -2.74 | -4.55 | 13.14 |

| Italy | 5.55 | -2.91 | -0.58 | 15.01 |

| Japan | 12.1 | 0.5 | -1.28 | 11.6 |

| Netherlands | 8.66 | 3.27 | 3.88 | 7.25 |

| Spain | 4.17 | -1.46 | 0.46 | 5.63 |

| Sweden | 10.52 | 3.47 | 4.97 | 7.05 |

| Switzerland | 8.78 | 6.29 | 5.24 | 2.49 |

| UK | 4.38 | 1.2 | 3.63 | 3.18 |

| USA | 10.11 | 2.73 | 4.28 | 7.38 |

| World | 10.26 | 1.74 | 4.28 | 8.52 |

Table 4. Returns to Stocks, Bonds and Bills in USD, 1945 to 1981

Globalization (1981-)

High inflation, high interest rates, the OPEC oil crisis, stagflation and other problems led to large losses to investors in the 1970s. The Keynesian policies of macroeconomic management had clearly failed. When Paul Volcker was appointed chairman of the Federal Reserve in 1979, he reversed the policies of his predecessor to squeeze inflation out of the economy. As a result, inflation and interest rates have been declining for the past 38 years. Bondholders have profited immensely from the Fed’s policies since 1981. During the past 45 years, market exchange rates have replaced fixed exchange rates, capital has been free to flow to wherever investors can get the highest returns, Communism has fallen, China has opened up to the rest of the world, billions of people have moved out of poverty, governments have privatized firms they previously nationalized, technology has improved dramatically, thousands of new firms have introduced products that didn’t exist before, and the capitalization of the global stock market has grown dramatically. The result has been a win-win for investors as they have benefited from the globalization of world markets and the steady decline in bond yields which have generated capital gains for fixed-income investors. But this has come at a cost. Stock markets have been more volatile with the Crash of 1987 producing the largest single-day decline in history, and two vicious bear markets in 2000-2002 and 2007-2009 which each wiped out over half of the value of stock markets worldwide. During the past ten years, stock markets have bounced back and the S&P 500 and the World Index both now trade above where they were at in 2009. Table 5 shows how the high returns to fixed-income investors reduced the equity premium. Returns to stocks between 1981 and 2018 generally exceeded returns between 1945 and 1981. This was accompanied by lower inflation, but more importantly, dramatically higher returns to government bonds. In the United States, bond returns were 5% greater between 1981-2018 than 1945-1981 and 6% in the world as a whole. This reduced the global equity premium from 8.52% to 3.06%, and in four countries bonds generated a higher return than stocks. The equity premium fell in almost every country in the world.

| Stocks | Bonds | Bills | Equity Premium | |

| Australia | 11.41 | 8.98 | 5.81 | 0.44 |

| Belgium | 6.22 | 8.82 | 4.79 | 1.9 |

| Canada | 10.29 | 8.61 | 4.66 | -0.55 |

| Denmark | 8.61 | 10.36 | 6.69 | 2.11 |

| Finland | 7.97 | 8.73 | 5.13 | 5.03 |

| France | 4.1 | 9.06 | 4.85 | 1.96 |

| Germany | 10.4 | 7.73 | 5.19 | 3.8 |

| Italy | 5.55 | 9.09 | 5.5 | -3.21 |

| Japan | 12.1 | 6.74 | 3.76 | -0.86 |

| Netherlands | 8.66 | 8.1 | 4.4 | 2.25 |

| Spain | 4.17 | 8.7 | 4.99 | 1.65 |

| Sweden | 10.52 | 6.8 | 5.73 | 5.39 |

| Switzerland | 8.78 | 6.05 | 4.05 | 4.82 |

| UK | 4.38 | 8 | 4.54 | -1.08 |

| USA | 10.11 | 8.04 | 3.89 | 3.25 |

| World | 10.26 | 6.87 | 3.89 | 3.06 |

Table 5. Returns to Stocks, Bonds and Bills in USD, 1981 to 2018

Conclusion

Stocks and bonds have behaved differently in each of the historical eras of the past. During the period of Mercantilism (1720-1792), there was little difference in the behavior of stocks and bonds because both were backed by the central governments of each country. Equities emerged as a separate asset class during the Transportation Revolution (1792-1848) with bubbles in canals (1790s and 1810s), South American stocks (1820s), and railroads (1840s) driving the prices of stocks up before they crashed back down when the bubble burst. During the period of Free Trade (1848-1914), there were no global bear markets. There were periodic panics in 1857, 1870, 1893 and 1907, but equity markets recovered and continued to move upward until World War I began. Meanwhile, bond yields fell below 3% in the United Kingdom and other countries as capital was free to flow between countries. The period of the World Wars (1914-1945) saw capital restricted from flowing between countries as nations hoarded capital to pay for the two world wars. Since capital was not free to flow from one country to another, some countries suffered hyperinflation, and returns varied dramatically from one country to another. The principal problem was the default of many countries on their bonds. After World War II, during the period of Keynesian attempts to regulate the economy, the combination of recovering from World War II and rising interest rates generated high returns to equities, but low returns to government bonds. This widened the spread on returns to equities and bonds driving the equity risk premium to historically unprecedented levels. Since 1981, however, the reduction in government regulation of the economy, lower interest rates and the globalization of the international economy have provided immense benefits to investors. Both equities and bonds have provided high returns to investors who have benefitted no matter whether they chose to invest in stocks or in bonds. Today, however, investors face the threat of trade wars and currency wars which could reverse the period of growth and globalization that has prevailed during the past 40 years. Bond yields are at their lowest level in history, with most bond yields in Europe and Japan negative in nominal terms and negative in real terms in the rest of the developed world. If the equity premium remains within the 1%-3% range that it has registered over the past four centuries, this does not bode well for investors. It seems unlikely that either equities or bonds will provide high returns over the next decade. We can only hope that these fears of low returns are not realized and that politics doesn’t return the rising interest rates and government regulation that stymied investors between 1914 and 1981.