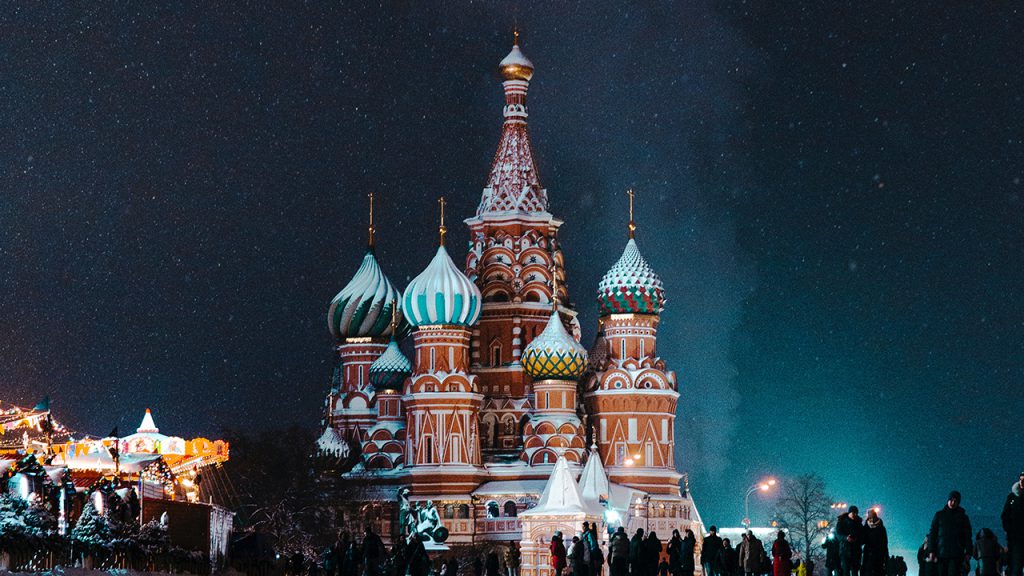

GFD has added data on over 220 companies and over 600 securities listed on the St. Petersburg Stock Exchange between 1865 and 1917 when the Russian Revolution forced the stock exchange to close until the fall of the Soviet Union.

Contrary to popular belief, both Imperial Russia and the St. Petersburg stock exchange were booming before the Russian Revolution occurred. The St. Petersburg Stock Exchange Index outperformed shares on the New York Stock Exchange between the end of the American Civil War in 1865 and the onset of World War I in 1914. Although Russia had one of the largest economies in the world before World War I, it was also a developing country where there were plenty of opportunities for investment in banks, railroads, oil, and other booming sectors.

GFD has added data on over 220 companies and over 600 securities listed on the St. Petersburg Stock Exchange between 1865 and 1917 when the Russian Revolution forced the stock exchange to close until the fall of the Soviet Union.

Contrary to popular belief, both Imperial Russia and the St. Petersburg stock exchange were booming before the Russian Revolution occurred. The St. Petersburg Stock Exchange Index outperformed shares on the New York Stock Exchange between the end of the American Civil War in 1865 and the onset of World War I in 1914. Although Russia had one of the largest economies in the world before World War I, it was also a developing country where there were plenty of opportunities for investment in banks, railroads, oil, and other booming sectors.

The stock data are monthly, and are priced in Russian Rubles. The equity data were obtained from the International Center for Finance at Yale. GFD provides both the original names of the companies in Russian and the names of the companies translated into English (Russian External Trade Bank (Русский банк вн ешней торговли) or Keller Vodka Company (Водочный завод “Келлер и К”)). Shares have been classified by sector and industry to aid analysis of the data.

One interesting aspect of the St. Petersburg stock exchange is that individual securities traded on the exchange rather than company shares. Railroads raised money by issuing new issues of common stock which traded simultaneously with other shares. A railroad or bank might have a dozen issues from the same corporation trading simultaneously, all with equal rights and similar prices. Data on these separate issues is included.

Global Financial Data has added monthly data on 88 companies listed on the Copenhagen Stock Exchange between 1893 and 1937. Using the data for these companies, GFD has also calculated 50 proprietary indices for Danish stocks during this period of time.

The data on the individual companies includes both monthly price data and dividends on the top 50 companies listed on the Copenhagen Stock Exchange between 1893 and 1937. Users can download price data for each company as well as a total returns showing the effect of reinvesting dividends. Shares have been classified by sector and industry to aid analysis. Data can be converted into other currencies and adjusted for inflation.

Global Financial Data has added monthly data on 88 companies listed on the Copenhagen Stock Exchange between 1893 and 1937. Using the data for these companies, GFD has also calculated 50 proprietary indices for Danish stocks during this period of time.

The data on the individual companies includes both monthly price data and dividends on the top 50 companies listed on the Copenhagen Stock Exchange between 1893 and 1937. Users can download price data for each company as well as a total returns showing the effect of reinvesting dividends. Shares have been classified by sector and industry to aid analysis. Data can be converted into other currencies and adjusted for inflation.

Global Financial Data is launching its own proprietary indices to help its customers analyze the trends in global stock markets that have occurred over the past 300 years.

Global Financial Data has the most extensive historical database of data on individual securities available anywhere. Data on individual securities from the United States begins in 1786 and includes information on over 75,000 securities. Data from the United Kingdom begins in 1690 and includes information on over 19,000 securities.

Global Financial Data is launching its own proprietary indices to help its customers analyze the trends in global stock markets that have occurred over the past 300 years.

Global Financial Data has the most extensive historical database of data on individual securities available anywhere. Data on individual securities from the United States begins in 1786 and includes information on over 75,000 securities. Data from the United Kingdom begins in 1690 and includes information on over 19,000 securities.

Global Financial Data has added new data for GDP, including measures for Global GDP, regional GDP and data on several countries not previously covered. GFD has also added data on the Purchasing Managers’ Index for 50 countries.

GFD users now have access to a global measure of GDP, both in real and nominal terms, which they can use as a benchmark against the GDP other countries and regions. The nominal World GDP file (GDPWLD) goes back to 1960 and the Real World GDP file (GDPCWLD) goes back to 1950. Both files have 20 years of quarterly data.

Global Financial Data has added new data for GDP, including measures for Global GDP, regional GDP and data on several countries not previously covered. GFD has also added data on the Purchasing Managers’ Index for 50 countries.

GFD users now have access to a global measure of GDP, both in real and nominal terms, which they can use as a benchmark against the GDP other countries and regions. The nominal World GDP file (GDPWLD) goes back to 1960 and the Real World GDP file (GDPCWLD) goes back to 1950. Both files have 20 years of quarterly data.