Although, few people may realize it, we may be seeing the first generation of kids that will not need to know how to drive a car. With all the changes that are going on in the automobile industry, this is a distinct possibility. Not since the introduction of cars over 100 years ago has the automobile industry gone through so many changes so quickly. Between electric cars and self-driving cars, automobiles as we know them may not even exist 20 years from now.

Although, few people may realize it, we may be seeing the first generation of kids that will not need to know how to drive a car. With all the changes that are going on in the automobile industry, this is a distinct possibility. Not since the introduction of cars over 100 years ago has the automobile industry gone through so many changes so quickly. Between electric cars and self-driving cars, automobiles as we know them may not even exist 20 years from now.

The Birth of the Automobile

What was it like in the beginning? What type of companies were born when automobiles were introduced over 100 years ago? When we looked back at the first automobile companies that issued stock in the United States, we found an unexpected surprise, all of the first automobile companies that issued stock in the 1800s were electric automobile companies! Gasoline-powered cars didn’t appear until the 1900s. Tesla is bringing back an old tradition, not introducing a revolutionary change. The first automobile companies to issue stock raised their money at the end of the 1800s. The General Electric Automobile Co. issued stock in 1898, the Electric Vehicle Co., the New England Electric Vehicle Transportation Co. and the Pennsylvania Electric Vehicle Co. issued stock in 1899. In fact, electric autos outsold steam and gasoline-powered cars in 1899 and in 1900. Although we may not realize it, electric automobiles were the preferred means of transportation in the first decade of automobiles. Not only were electric caThe Rebirth of the Electric Car

With the rising price of oil in the 2000s and the demand for a more environmentally-friendly automobile, every auto company is striving to create an electric car that can replace gasoline-powered vehicles. Today, electric cars and self-driving cars appear to be the wave of the future. Tesla as a company is worth almost as much as General Motors even though it produces a fraction of the number of cars General Motors produces. Tesla is now producing its Model 3 in an attempt to produce an affordable electric vehicle that the average person can afford. Will Tesla succeed, or will Tesla go the way of the earliest electric car companies ending up in bankruptcy? Only time will tell. Global Financial Data has added the most extensive collection of data on sector market caps available anywhere.Global Financial Data divides the stock market into twelve sectors. The 12 sectors include 11 sectors similar to the 11 sectors in the GICS, but adds a twelfth sector for Transportation stocks since these were historically important to the US, UK and other economies. The Communications sector includes not only Telecommunications stocks, but general communications such as Media and Publishing. The Real Estate sector is separated from the Financial Sector throughout its history.

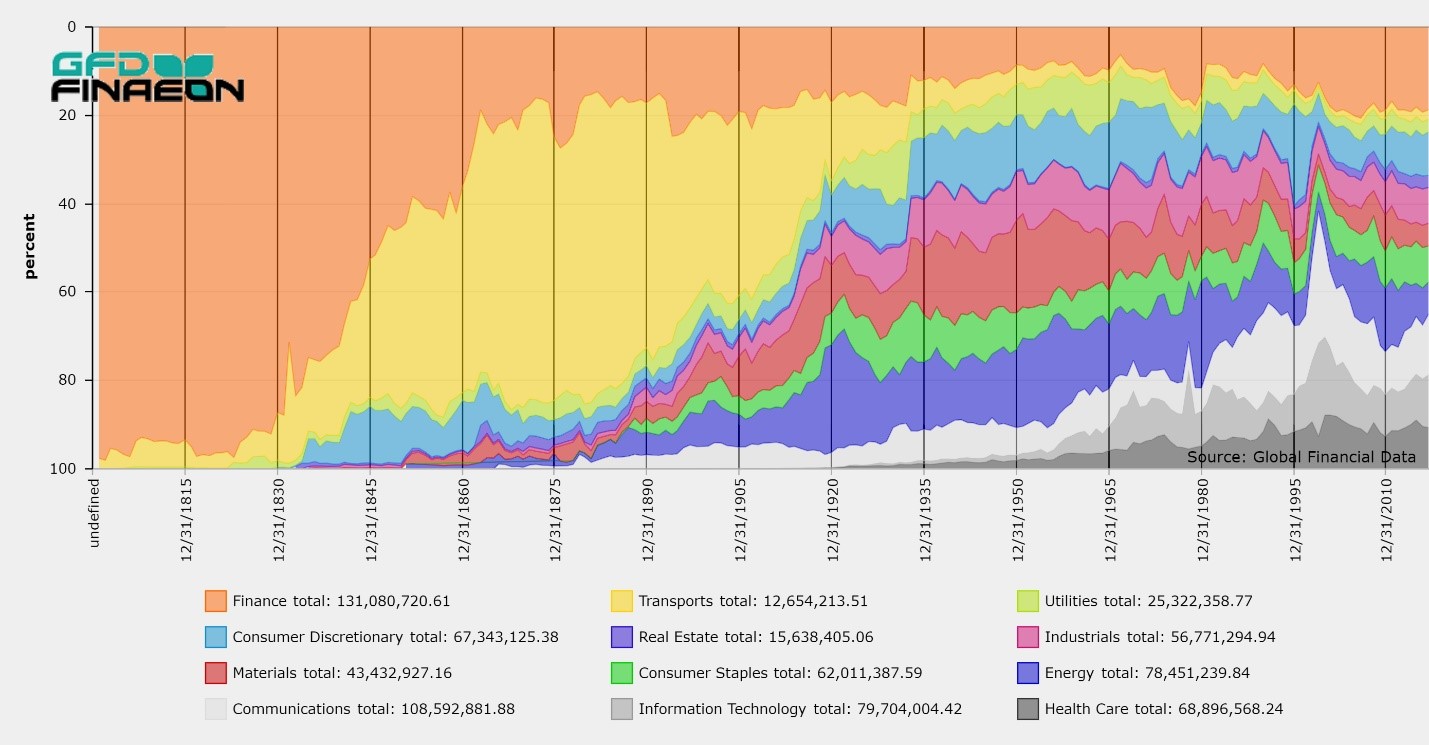

The indices provide both total market cap and market cap as a percentage of the total. Using GFD’s capitalization tool, you can generate pie charts for any individual year, and you can generate a stacked chart over time which show how the composition of the sectors changed over time.

Monthly sector indices have been created for:

Global Financial Data has added the most extensive collection of data on sector market caps available anywhere.Global Financial Data divides the stock market into twelve sectors. The 12 sectors include 11 sectors similar to the 11 sectors in the GICS, but adds a twelfth sector for Transportation stocks since these were historically important to the US, UK and other economies. The Communications sector includes not only Telecommunications stocks, but general communications such as Media and Publishing. The Real Estate sector is separated from the Financial Sector throughout its history.

The indices provide both total market cap and market cap as a percentage of the total. Using GFD’s capitalization tool, you can generate pie charts for any individual year, and you can generate a stacked chart over time which show how the composition of the sectors changed over time.

Monthly sector indices have been created for:

- The S&P Composite back to 1925 (90 stocks to 1957 and 500 thereafter)

- United States companies listed in the United States back to 1801

- All companies listed on United States exchanges back to 1801

- United Kingdom companies listed in London back to 1694

- All companies listed on the London stock Exchange back to 1693

- All companies listed in the US, UK and other countries that are in the GFD Microverse back to 1692

Global Financial Data has added data on individual stocks from the Copenhagen stock market between 1871 and 1937 to the database. This provides a history of Danish stocks that was previously unavailable. In the midst of putting together this data, we discovered a forgotten stock market bubble of shipping stocks during World War I.

This bubble followed the classic pattern of a dramatic rise followed by a crash, but we have never seen this bubble mentioned in any of the sources we have consulted. In many ways, this was a “rational” bubble since dividends paid by the shipping companies rose dramatically during World War I and then collapsed after the war. The details of this bubble are discussed below.

Global Financial Data has added data on individual stocks from the Copenhagen stock market between 1871 and 1937 to the database. This provides a history of Danish stocks that was previously unavailable. In the midst of putting together this data, we discovered a forgotten stock market bubble of shipping stocks during World War I.

This bubble followed the classic pattern of a dramatic rise followed by a crash, but we have never seen this bubble mentioned in any of the sources we have consulted. In many ways, this was a “rational” bubble since dividends paid by the shipping companies rose dramatically during World War I and then collapsed after the war. The details of this bubble are discussed below.

Data Sources

Global Financial Data went to a number of sources in order to put together 65 years of history on the Danish stock market. Theodor Green published Fonds og Aktier beginning in 1883 and periodically in the years that followed. The books provided price data for Danish stocks as well as shares outstanding and dividend data. In 1893, Danmarks Statistik began providing data on individual stocks and dividends of individual companies in its Statistisk Aarbog, and continued to provide this data until 1937. Danmarks Statistik began calculating its own index of Danish stock prices after World War I, so collecting and organizing this data enables us to put together an index of Danish stock prices going back 45 years before the Danish index was calculated. Global Financial Data has put together a database of almost 100 companies to create Danish indices that previously did not exist. With this data, GFD has calculated a cap-weighted price index and return index as well as the dividend yield on Danish stocks between 1871 and 1937.The Forgotten Bubble

Danish shipping stocks were an important part of the Danish stock market, but overall represented a small portion of the total stock market capitalization. As the chart below shows, transports represented around 10% of the Danish stock market. The two primary sectors on the Copenhagen stock exchange were banks and telecommunications. The banks were represented by Denmark’s four main banks, the Nationalbank, the Privatbank, the Landmandsbank and the Handelbank. The Great Northern Telegraph Co., which listed on the London Stock Exchange, was the largest company in Denmark, representing from 20 to 30 percent of the Danish stock market’s capitalization. It should be remembered that because Denmark is largely a collection of islands and peninsulas, railroads never played a major role in the Danish economy. There were private tramways in the main cities, but they were eventually nationalized by the government. Almost all the transport companies in Denmark were shipping companies and the largest of these was the United Steamship Co. (Forenede Dampskibsselskabs A/S). If you look at the Sector Stacked Graph below, the bubble in transport stocks between 1914 and 1921 sticks out like a sore thumb. Shipping revenues and profits rose dramatically during World War I, leading to higher dividends and higher stock prices. Just to use the United Steamship Co. as an example, the company’s dividend rose from 8% in 1914 to 60% in 1919 then collapsed to 5% by 1922. Other steamship companies provided even more dramatic changes.Denmark in World War I

Denmark was in a difficult position when World War I began. Denmark was a neutral country even before the onset of the war. Denmark had been defeated in 1864 in its war with Prussia. After the war, Denmark lost the territory of Northern Schleswig, which had a majority Danish population, to Prussia and even though Denmark would have liked to regain control over Northern Schleswig, the political reality was that Denmark was too small to challenge Prussia politically or economically. Consequently, neutrality became a part of the Danish mentality. Before World War I, Denmark was highly dependent on imports and exports with ninety percent of exports derived from agriculture in 1913. Denmark built up a large shipping fleet that carried 70% of its shipping between foreign ports. Denmark’s shipping industry was as large as Spain’s, and it was the fourteenth largest merchant marine in the world when World War I began. The Danish merchant marine’s net tonnage doubled in size between 1885 and 1914, and most of this investment was in more efficient steam shipping and motor vessels. The Danish shipping industry was dominated by Det Forenede Dampskib-selskab (United Steamship Company of Copenhagen, now known as DFDS) which represented three-eighths of Danish shipping in 1914. The company was founded on December 11, 1866 when Carl Frederik Tietgen merged the three largest steamship companies into a single company. Since its founding in 1866, the company has consistently paid a dividend over 7% reflecting the profitability of the company and the sector.Conclusion

The Danish Shipping Stock Market bubble of 1914-1920 has long been forgotten, but is a dramatic reminder of how war, politics and the economy affect the stock market. Denmark’s unique geographical and political situation during World War I enabled it to profit from the changes that occurred during the war. The profits were concentrated in the shipping industry and it alone benefitted from the war while the rest of the economy reaped few benefits. The price increases the shipping stocks enjoyed were justified by the dramatic increase in profits and dividends that occurred. In some cases, profits and dividends increased ten-fold during the war and prices responded accordingly. When the war was over and depression followed, share prices collapsed. By any stretch of the imagination, it was a “rational” bubble. The data for the Copenhagen stock exchange, both the data for the individual companies and the GFD Indices that were calculated based upon those indices are available to all subscribers to the stock database. If you would like to access this data and currently do not have access, please feel free to call one of our sales representatives at 877-DATA-999 or 949-542-4200.The Course of the Exchange made the first attempt to break the stock market down into sectors in 1811 when it expanded its coverage of stocks to include shares other than the three sisters, the Bank of England, South Sea stock and East India Company that dominated the English stock market in the 1700s.

Twenty securities were listed in The Course of the Exchange from 1747 to 1811 as a group. On January 1, 1811, coverage expanded to two pages and stocks were divided into different sectors: canals, docks, assurance, water works and miscellaneous companies. On August 30, 1811, Iron Railways were added as a sector, including the Surrey, Cheltenham and Severn and Wye Iron Railroads. By 1845 there were not 3 railroads but 244 railroads.

Mines, Bridges and Literary Institutions were added in 1817. Gas, Light & Coke Companies received a separate classification in 1819, and by 1825, The Course of the Exchange had 11 sectors: Canals, Docks, Assurance, Bridges, Water Works, Literary Institutions, Mines, Gas Light & Coke Companies, Roads, Iron Railways and Miscellaneous as the main components of the British stock market. Oddly enough, there were 11 sectors in 1825 as there are 11 sectors in the GICS system today.

As the stock market evolved, so did the sector classification. Railroads represented over 80% of the stock market by the middle of the 1800s. When stock market indices were introduced in the 1800s, there were two types of indices, railroads and industrials. Over time other sectors were introduced and in 1999, MSCI and S&P created the Global Industry Classification System (GICS) which broke the stock market down into 10 sectors. Since then Real Estate has increased the number of sectors to 11 and Telecommunications has become Communications. Who knows what the GICS will look like 10 years from now.

United States sectors 1800 to 2018

They say a picture is worth a thousand words, and that is certainly true of the picture below. In fact, maybe it is worth 3000 words. The graph shows the evolution of the 12 GFD sectors that make up the American economy over the past 200 years. In the 1800s, finance companies and transports largely dominated the stock market, but starting in the 1880s, other sectors began to grow in size, squeezing out finance and transports until today transports represent such a small portion of the total capitalization of the stock market that GICS doesn’t even recognize it as a sector.

Global Financial Data recognizes 12 sectors rather than 11. Because of the historical importance of transports, GFD treats transports as a separate sector, not as part of the industrial sector. From canals to railroads to airlines, transports have been and always will be an important sector of the stock market. The graph below illustrates the capitalization of each sector based upon stocks included in the U.S. Stocks Database.

Finance

In 1791, finance was the only sector listed on the stock exchange as banks and then insurance companies were provided funding by investors. For the first 50 years of the stock market’s existence, finance was the stock market. Until 1836 when the second Bank of the United States lost its charter, the Bank of the United States as a company was a giant among a sea of minnows.

Banks and insurance companies continued to grow after the Bank of the United States lost its charter in 1836, but at a slower pace than other sectors, especially Transports, and Finance shrank to 20% of the stock market by the Civil War. Finance maintained its 20% share until the Great Depression when the collapse of the banking sector and the severe government restrictions on banks after the 1930s reduced the Finance sector to about 10% of the total capitalization by the 1960s.

Starting in the 1980s, the government allowed banks to cross state lines, expand their business, and consolidate the industry into a small number of large firms rather than thousands of small banks. Unitary banking in which a bank was allowed to have only one physical location in the country was abolished. The finance sector grew until it reached over 20% of the total capitalization of the stock market in 2008 when the financial crisis hit and shrank it back in size. Nevertheless, banks and insurance companies have maintained their 20% share of the stock market since 2008 and probably will do so for some time to come.

Transports

In the 1800s, transports were the most important sector of the stock market. Today, transports are a footnote and have lost their status as a sector. Nevertheless, because historically transports represented a majority of the stock market, GFD has given them sector status.

In the beginning, there were turnpikes and canals. Only a handful of the turnpikes had a capitalization over $1 million, and unlike the United Kingdom, canals were unable to connect the nation’s rivers to provide a national transportation system.

The real beginning of the growth of transports was in 1828 when the Baltimore and Ohio Railroad came into existence. The United States was covered with land and the railroads could go where no canals could reach. Consequently, from the Civil War until 1900, railroads represented over half of the capitalization of the United States stock market. Since most banks and insurance companies were traded over-the-counter, railroads represented over 80% of trades on the New York Stock Exchange. Railroads not only transformed the American economy, they transformed the stock market. American railroad shares were traded in London, Paris, Amsterdam and other bourses as Europeans invested in the American “emerging market.” Never again would any industry dominate the stock market the way railroads did in the 1800s.

Once the transcontinental railroads were built, there was little to add to the network of railroads that crisscrossed the country, and when the automobile was born, railroads’ share of the stock market could only shrink. Most local tramways were taken over by local governments, but the national railroads remained in private hands.

In European countries, the railroads were nationalized. Belgium’s railroads were built by the state, Germany’s railroads were nationalized in the 1870s and Britain’s in 1947. Although passenger service has been nationalized through Amtrak, railroads remain an important portion of transportation in the United States, as do airlines and trucks, but transports will never regain their status as a dominant sector in the American economy.

Utilities

Utilities have played an important, though consistently small role in the American economy. Although local tramways were often treated as a utility, we treat tramways as a transportation company. Telecommunication companies such as AT&T and Western Union were part of the Dow Jones Utilities in the 1930s, but these firms are in the communication sector in GFD.

Utilities represented a sliver of the American economy until the 1920s. Thousands of local utilities were strung across the country, but in the 1920s, utilities were absorbed by holding companies to create large corporations that drove the stock market boom of the 1920s. Tramways were absorbed into the utilities that provided power, transportation and telephones to local communities.

When the stock market crashed in the 1930s, many of the utility companies were overleveraged and they collapsed. The government began to regulate the utilities and they shrank in size to a managed portion of the American economy. Because the utilities are regulated, it is unlikely they will gain much market share in the future.

Consumer Discretionary

The early growth of the consumer discretionary sector came from the establishment of mills that produced textiles in New England. The mills took advantage of the power the rivers provided to drive the spindles that produced clothing for the rest of the country.

It was only after 1900 that the consumer discretionary sector began to grow again as automobiles began to take over personal transportation and large retail stores such as Sears replaced the local shops that people had grown up with. The consumer was largely born in the 1920s and has remained a consistent 10-15% of the American Stock market since the 1920s.

It should also be remembered that a good portion of consumer discretionary stocks have been transferred to the Communications sector. Because the internet has transformed communications to make them something that can be streamed rather than purchased on vinyl or seen in a theater, communications has become a sector unto itself. For this reason, consumer discretionary is unlikely to grow over time.

Real Estate

Real Estate has never been an important sector in the American stock market. Most of its growth has occurred in the past 20 years as real estate investment trusts have become an efficient way of managing properties.

Nevertheless, as a sector, GFD has data for real estate back to the 1830s. Many investors treat real estate as a separate investment asset class from stocks, bonds and bills and with the bubble in real estate that occurred in the 2000s, there is an interest in real estate as an asset class that didn’t exist in the twentieth century.

The problem with tracking real estate as an asset class is that property is so diversified and individualistic that few reliable indictors of returns to real estate exist. However, there have been real estate investment companies listed on the stock market since the 1830s and they can provide valuable insights to the return on property over the past 180 years. Real estate as a stock market sector can provide insights that indices put together from sales of property are unable to capture.

Industrials

Industrial companies produce goods for other businesses, not for individuals. When the Dow Jones Industrial Average was born in 1896, industrials included everything other than finance, transports and utilities. The New York Times had two indices, Railroads and Industrials. Dow Jones had three, adding utilities in the 1920s. Over time, “industrials” have been broken up into sectors that didn’t exist 100 years ago. Consumer stocks, materials and energy, health care and information technology are treated as separate sectors and industrial stocks are mainly companies that produce goods for other businesses. Industrials include machinery, electrical equipment, aerospace and commercial services.

The industrial sector grew until the 1920s as companies began to produce large machinery for the growing American economy. Over the past 100 years, industrial stocks have maintained their share of the market’s capitalization.

In reality, industrials have continued to grow over the past 100 years. IBM was considered an industrial company in the past but is now part of the Information Technology sector which in many years in the twenty-first century is the largest sector on the stock market.

Materials

The materials sector provides the inputs that other sectors use to generate their outputs. During most of the twentieth century, materials was one of the largest sectors in the economy as iron and steel, chemicals and mining provided the raw inputs that the country’s industries used to transform these raw materials into the automobiles and other goods that consumers wanted.

In the twenty-first century, materials have shrunk as intellectual property and services have grown in size and this will probably be the trend for the rest of the century. As the economy moves to rely more upon information technology and autonomous cars, materials will continue to provide the backbone of the American economy.

Consumer Staples

It is interesting to contrast consumer staples with consumer discretionary stocks. Consumer staples had almost no impact on the stock market until the 1890s because many people were farmers producing their own consumer staples, and the sector had not been taken over by large-scale firms providing consumer goods to millions of individuals employed in other industries.

Today, almost all food and beverages are produced by large conglomerates and represent a fairly fixed proportion of total output. The role of consumer staples is unlikely to change in the twenty-first century for a good reason, they are staples and as people grow richer, staples represent a shrinking share of total expenditures. This trend is unlikely to change.

Energy

Energy has been one of the most volatile sectors in the American stock market, dominating it when energy supplies are short and the price of energy shoots up, shrinking when energy prices collapse due to oversupply.

Until the 1860s, coal was the primary source of energy for the country. The Delaware and Hudson canal was built to transport coal from Pennsylvania to New York City and the rest of the country. But the real growth in the energy sector came with the discovery of oil in Pennsylvania and the hundreds of companies that emerged. Of these companies, Standard Oil became the largest of the group and by 1890, Standard Oil was the largest company in the world. Despite being broken up in 1913 and evolving to become ExxonMobil, Standard Oil remains one of the largest companies in the world.

Throughout the twentieth century, energy was one of the largest sectors in the economy, eclipsing railroads and finance by the 1920s. The only time period when energy lost its prominence in the stock market was in the 1990s when the price of oil collapsed in real terms to its pre-OPEC price, but as the Chinese economy grew and the price of oil increased to over $100 a barrel, ExxonMobil once again became the largest company in the world.

With the collapse of the price of oil after the Great Recession, the growth of fracking and the prospect of cleaner energy in the future, energy’s share of the American stock market has shrunk, but there is little reason to believe it won’t be the most volatile sector of the twenty-first century.

Communications

As a sector, communications is a recent addition. Until recently, media were part of the consumer discretionary sector, but with the ability to stream virtually any media in to your house, communications and entertainment have merged into a single sector.

to your house, communications and entertainment have merged into a single sector.

Communications as a separate sector in the American stock market was born in the 1860s when cables were laid across the oceans, telegraphs stretched across the country and railroads enabled express services to reach every part of the country. Telephones replaced the express services by the 1920s.

The communications sector has grown over the past 150 years because the price of communications has fallen dramatically. Increased demand has offset the fall in price. I can remember as a child waiting until 5pm or 11pm to make a phone call and take advantage of the lower phone rates that prevailed for long-distance phone calls in the off hours. Now it makes no difference what time you call or whether you make a local call or a long-distance call.

AT&T was the largest company in the United States between the 1920s and 1960s, and even though AT&T no longer holds that title, other companies provide communications that we didn’t even dream of 100 years ago. And who knows what will be available by the end of this century?

GFD has recalculated its indices to include all communications companies, not just telecommunications, in this sector from the 1860s to the 2010s. As can be seen, communications’ share of the stock market has grown continuously over the past 150 years, transforming itself as communication costs have declined. This trend will continue for decades to come.

Information Technology

Two sectors were born in the twentieth century, information technology and health care, and both of them have steadily grown in size. Of course, information technology was originally part of the industrial sector, but as computers have gradually taken over the economy, they have become their own sector because information technology has largely driven the growth in the stock market over the past few decades.

What really drove the growth of information technology was transistors and semiconductors which enabled information to be transmitted, calculated and stored in ways humans could not do by themselves. The S&P 500 and the whole stock market would not exist as it does today were it not for information technology. Stock trades take nanoseconds, not hours or days.

As new technologies are inevitably born in the decades to come, information technology will grow until the physical limits of information technology are reached. When that will occur remains to be seen.

Health Care

The final sector of the twelve is health care which will continues to grow in size because everybody dies. The only question is when. The older people get, the more expensive it is to keep them from dying and with health care now approaching 20% of GDP and the government funding the prolongation of life for an aging population, health care will slowly squeeze out the other sectors.

In the 1920s, there were drug companies, then there were health care suppliers, then hospitals, and now biotechnology. Pharmaceutical companies produce drugs that cost over $100,000 per year to delay the inevitable. Government and everyone else wants to control health care costs, but the Iron Law of Health Care is the closer you are to death, the more it costs to keep you from dying, but in the end, everyone dies. So health care as a sector will inevitably grow.

Conclusion

What will this stacked chart look like over the rest of the century? Which sectors will grow and which will shrink? What new sectors will come into existence, broken off from other sectors to reflect the dynamic changes in the economy?

When The Course of the Exchange introduced the concept of stock market sectors in 1811, they little realized how much sectors would change, but the number of sectors has barely changed, only the classification system has.

There is no reason why the twenty-first century shouldn’t endure as much change as the twentieth century did and no one can even predict what sectors will dominate the stock market by the end of the century. Who would have guessed that the largest sector of the nineteenth century, transports, would lose its classification as a sector by the twenty-first century?

The global economy will evolve over time and the sector map will change in ways no one can predict. Stay tuned.