Canada has one of the ten largest markets in the world. With a capitalization of over $2 trillion and over 3300 listed companies, and many of its companies listed in New York, Canadian companies have played an important role in the global economy over the past 150 years. Canadian companies have listed in London since 1692 and in New York since the 1860s. Brokers began trading shares at the Exchange Coffee House in Montreal in 1832 and the Montreal Stock Exchange was founded in 1874. The Toronto Stock Exchange was begun by the Association of Brokers in 1852, was formally founded in 1861 and incorporated in 1878.

Global Financial Data has collected data on companies from South Africa that listed in London during the 1800s and 1900s. Between 1835 and 1985, over 400 South African companies listed in London. Before 1890, there were fewer than 20 South African companies in London, but once gold was discovered in the 1890s, the number of South African companies mushroomed, increasing to 45 in 1890 and over 100 by 1902. South African companies also listed in Paris where they traded on the Coulisse Exchange as well as in Amsterdam, Berlin and other stock exchanges because European investors wanted to profit from the South African gold rush.

Argentina is one of the most interesting countries among emerging markets. Argentina was one of the ten richest countries in the world in the 1920s, but now doesn’t even make the top 50. Argentina was downgraded from emerging market status by MSCI to being a frontier market in 2009 when President Cristina Fernandez imposed capital controls making it difficult for foreigners to invest. Mauricio Macri became the leader of Argentina in 2015 and worked to undo the financial harm that Cristina Fernandez had imposed on the country. Argentina was able to issue a 100-year bond in June 2017, but in 2018 the country went to the IMF for a $56 billion loan. MSCI will upgrade Argentina back to emerging market status in 2019, but its future remains uncertain. The trials and tribulations that Argentina’s leaders have put the economy through are reflected in the returns to investors over the past 150 years.

Argentina was settled by the Spanish, and a local government replaced the Spanish government in 1810. The Buenos Aires stock market was founded in 1854, and has operated for the past 165 years. After the Argentine federation was formed in 1860, Argentina enjoyed growth until 1930, relying upon agricultural exports to make it one of the ten richest countries in the world. The country grew faster than either Canada or Australia, but industry represented a small portion of output. Argentina shipped meat to Europe, taking advantage of the vast pampas where cattle were raised, but failed to develop a large manufacturing base.

In 1930, the military overthrew President Yrigoyen, and in 1946 Juan Domingo Perón gained power in Argentina and promoted the “three flags” of social justice, economic independence and political sovereignty. Before 1930, Argentina was one of the most stable countries in the world, but since 1930, it became one of the most unstable. Between Peronism, military dictatorship, hyperinflation and protectionism, Argentina suffered inconsistent economic policies that prevented the economy from growing quickly. As late as the 1960s, per capita income in Argentina exceeded that of Spain, Japan or Ireland. Today, Argentina’s per capita GDP is about $10,000 which places outside of the top 50 richest countries in the world. Quite a slide from being in the top 10 ninety years ago.

Argentina has defaulted on its debt eight times with recent defaults or restructurings in 2001, 2005, 2010 and 2014. Between 1944 and 1982, Argentina suffered annual inflation of 92% with triple-digit inflation in 15 of those years, and an inflation rate over 5,000% in 1989. The inflation rate today is 54%. The Peso was at parity with the U.S. Dollar between 1992 and 2001, but has collapsed since then. Today there are over 40 Pesos to the U.S. Dollar. Will Argentina ever be able to provide the economic stability it deserves?

Stock Market Returns

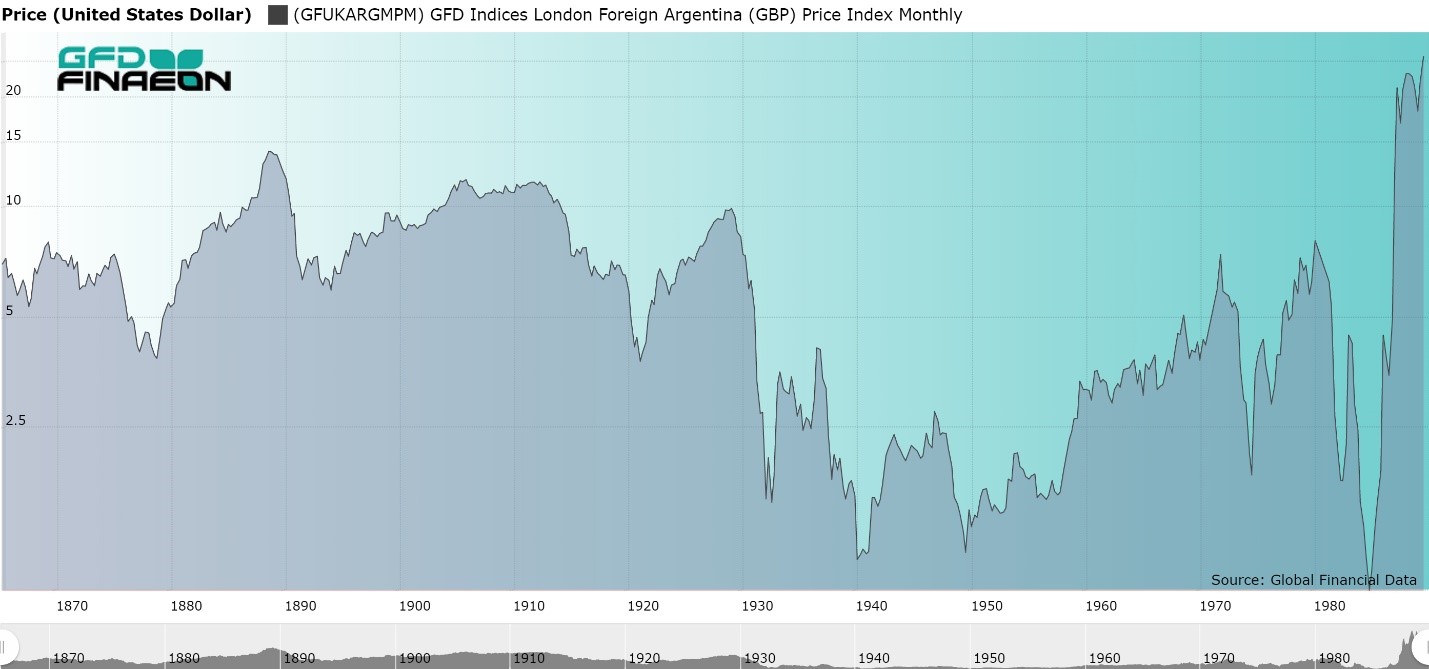

But how has Argentina’s stock market performed compared to the rest of the world? Argentine shares first listed in London in 1863 when the Buenos Aires Great Southern Railway issued shares. We can use data on Argentine shares in London to create an index of shares from 1865 until the 1960s. An Argentine brokerage firm, Swan, Culbertson and Fritz calculated a stock index between 1947 and 1958 with annual data calculated back to 1938 and the Buenos Aires stock exchange has calculated a daily index of shares since 1967. For the remaining years between 1865 and 1947 and between 1958 and 1967, we have used data from London as a proxy for Argentine shares.

Of the 55 companies that listed in London between 1865 and 1985, eight were consumer staples companies (mainly tobacco and food), five were finance, six were materials, five were real estate, nine were utilities and twenty were transports. The Buenos Aires Great Southern Railway had the longest life of any company that listed in London, lasting from 1863 until 1948 when Juan Perón nationalized Argentina’s railroads along with the Buenos Aires and Pacific Railway, the Buenos Aires Western Railway and the Central Argentine Railway. The performance of Argentine shares in London is illustrated in Figure 1. There was little change in the stock market between 1865 and 1929, but after the military overthrew the government in 1930, stocks collapsed.

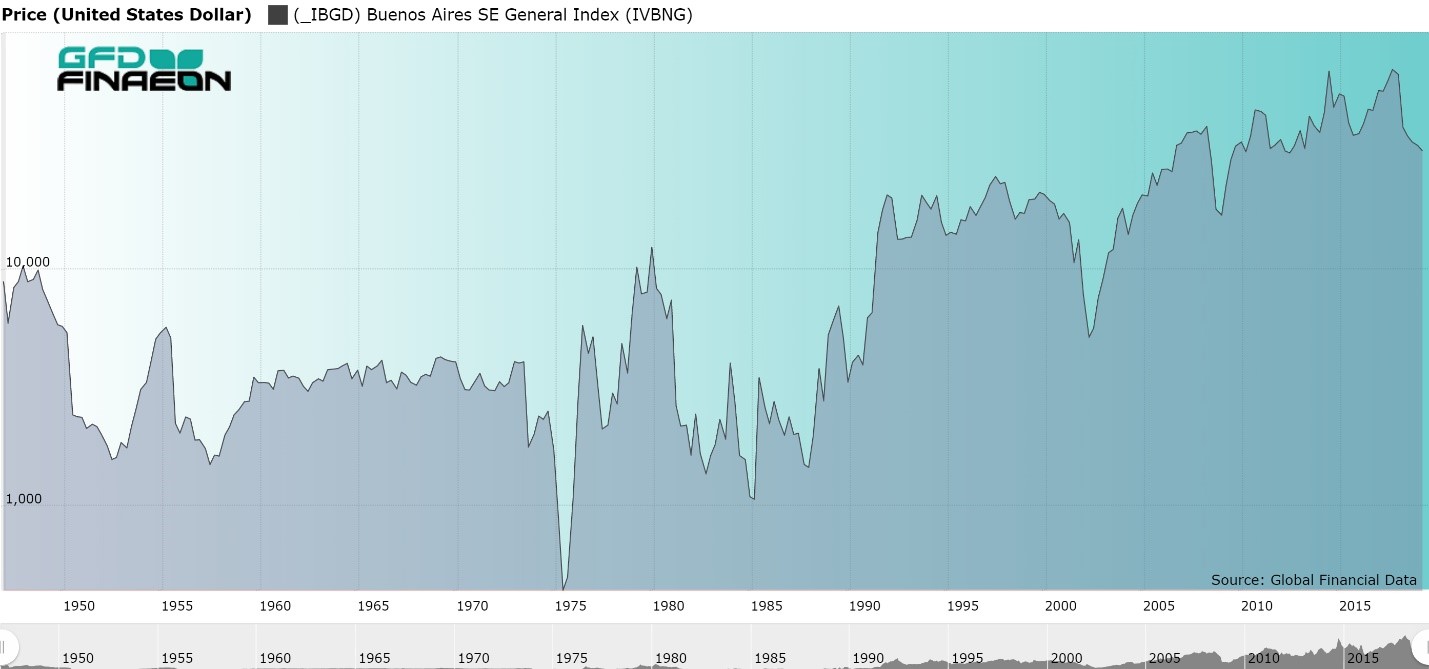

Because the exchange rate is so volatile, the size of the stock market and returns as measured in US Dollars can vary widely. The stock market capitalization was over $700 million in 1929, but still only $800 million in 1977. Argentina’s stock market capitalization fell from $105 billion at the end of 2017 to $46 billion at the end of 2018. This was less than it had been in 1994 ($47 billion). With a market cap of $46 billion, Argentina’s stock market represents less than 10% of GDP. There is obviously room for growth if politicans can stabilize the economy.

Carlos Menem was elected president in May 1989, and ended up privatizing almost every company the state owned. On January 1, 1992, a currency board was introduced, linking the Argentine Peso directly to the U.S. Dollar. Anticipating the growth Menem’s reforms would generate for the economy, the stock market rose over 99% per annum between 1987 and 1991. The next few years were ones of growth in the economy; however, in 2002 Argentina was unable to maintain its link to the U.S. Dollar, and the economy faced a decade of instability.

The instability in the Argentine stock market over the past 70 years is illustrated in Figure 2. The peso lost half of its value in 2018 and today (March 2019), MSCI’s stock market index, as measured in USD, is virtually the same level it was at in May 1992. Energy represents 40% of the stock market index and financials 17% with Tenaris SA, which manufactures steel pipes for energy companies representing 20% of the stock market’s capitalization and YPF representing 13.5%.

Bonds have suffered from Argentina’s instability as well. Between 1824 and 1953, Argentine bonds provided an annual return of 5.36%, but were made worthless by the inflation that destroyed the economy in the 1960s, 1970s, and 1980s. Since 1993, the EMBI index of government bonds returned 3.98% which is more than stocks which returned only 3.55% per annum between 1993 and 2018.

| Years | Price | Return | Inflation | Dividend | Real Return |

|---|---|---|---|---|---|

| 1865-1929 | 0.84 | 5.76 | 0.89 | 4.88 | 4.83 |

| 1929-1987 | 2.86 | 5.18 | 3.34 | 2.26 | 1.78 |

| 1987-1991 | 99.87 | 104.23 | 4.55 | 4.37 | 95.68 |

| 1991-2018 | 0.94 | 3.19 | 2.25 | 2.23 | 0.92 |

| 1929-2018 | 5.37 | 7.74 | 3.06 | 2.24 | 4.54 |

| 1865-2018 | 3.45 | 6.91 | 2.15 | 3.34 | 4.66 |

Table 1 allows us to compare returns in Argentina over long and short periods of time, converting all returns into U.S. Dollars. Over the past 153 years, Argentine stocks returned 4.66% per annum, after inflation. Returns were pretty much the same between Argentina’s period of stability (1865-1929) and instability (1929-2018).

The greatest contrast is between the returns during the four years of reform under Carlos Menem between 1987 and 1991 when investors received a real annual return of over 99% and returns since 1991. Investors received only 1.78% between 1929 and 1987 and the return to investors since 1991 has been only 0.92% per annum. Contrast this with annual returns after inflation of 6.66% in the United States since 1991.

What went wrong?

There was great anticipation that converting from the hyperinflationary Peso to the stable Dollar under President Menem would turn the economy around, but since 1991, investors have not shared the benefits of the growth they anticipated. Instead, the economy collapsed when Argentina was unable to maintain its link to the U.S. Dollar after 2001. The country has gone through a series of defaults and because Fernandez introduced capital controls, Argentina was downgraded from being an emerging market to being a frontier market. Macri has fought to return Argentina to a market-based economy that can attract more investment, but so far, this has not happened.

Argentina embodies the problems investors may face when they invest in emerging markets. There can be a few years of rapid growth when investors anticipate change, but also lost decades of slow growth when that change does not occur. Why would investors give up the relative stability of investing in the United States for the instability of investing in Argentina? Argentina is not committed to the market in the same way a developed country is. Argentina will face new elections in October 2019 and current polls show that Cristina Fernandez could defeat Macri and upend the changes he has introduced. As we all know from finance, the value of a company depends upon the present value of future cash flows, and future cash flows in Argentina are by no means guaranteed. Argentina has a record of political and economic instability which no one can ignore.

Argentina was able to sell a 100-year bond in June 2017, but a year later went to the IMF for a $56 billion loan. Argentina’s current inflation rate is 54%, and the peso has lost half of its value during the past year. Argentina embodies all of the risks that investors in emerging markets face. The willingness of investors to commit money to Argentina under Presidents Menem and Macri shows that investors are willing to invest when they see an opportunity. Unfortunately, Argentina also shows what can happen when a country does not follow through on its promises.

Most people know the basic story of the French Revolution. France’s aid to the United States indebted the nation leading to new taxes that fed a revolt against the king and the aristocracy. The Estates General was convened in May 1789, and on July 14, 1789, the Bastille was stormed marking the beginning of the French Revolution. The Declaration of the Rights of Man was passed and feudalism was abolished in August 1789. France became a republic in September 1792 and in January 1793, King Louis XVI was executed. A dictatorship gained power in 1793 under Robespierre and the Committee of Public Safety which introduced the Reign of Terror. In 1795, the Directory assumed control over France, suspended elections and repudiated debts. The Directory remained in power until 1799 when Napoleon Bonaparte overthrew the Directory in a coup and became the leader of France.

But what about investors? How were they affected by the French Revolution? The king lost his head, but investors lost their money.

Before the Revolution

Few people realize how active the Paris stock market was during the 1700s. The Paris stock exchange was founded on September 24, 1724, though shares in the French East India Co. (Compagnie des Indes) had traded in Paris for years. GFD has data on over 70 securities that traded on the Paris bourse in the 1700s. This includes 15 common stocks in 7 different companies, one corporate bond, 50 different government bonds and 6 issues of scrip, all faithfully recorded from issues of the Gazette de France. And this ignores the fact that Parisian investors were also able to invest in stocks and bonds in London and in Amsterdam during the 1700s.

It is interesting to note that French East India Co. stock suffered more volatility during the 1700s than shares in either London or Amsterdam. Compagnie des Indes shares rose over 4000% during the bubble in 1718 and 1719, only to lose 99% of their value during the crash that followed. There were five bull markets in which shares rose by over 90% in Paris in the 1700s and three bear markets in which shares fell by over 50%. The Paris stock exchange was not for the feint of heart. The rise and fall of Compagnie des Indes shares are illustrated in Figure 1.

The Paris stock exchange was formally closed on June 27, 1793 and all joint-stock companies were banned on August 24, 1793. But once the joint-stock companies were shut down, who would dispose of the assets of the companies? French East India Co. officials bribed government officials so the company, rather than the government, could oversee its liquidation, but once these bribes were uncovered, several of the company officials involved were arrested and later executed. The liquidation of the company produced only three ships which were liquidated in July 1795, and as a result, shareholders in the Compagnie des Indes lost virtually everything.

Bondholders met a similar fate. France defaulted on its pre-revolutionary debt in 1796, giving shareholders 1/3 the value of their old bonds in new 5% consolidated bonds which didn’t pay any interest until 1802. A similar loss occurred to Dutch shareholders, who also lost 2/3 of the value of their bonds. English bondholders suffered no default.

After the Revolution

Investors were decimated by the French Revolution. Bondholders lost 2/3 of the value of their bonds, and the French Revolution officially abolished joint-stock companies in 1793. Investors received very little compensation for their shares. Officials caught up in the bribery scandal in 1793 lost their lives. The Assignats, which were issued during the revolution, became almost worthless during the inflation that ravaged France. After inflation, 100 Francs in Assignats in 1789 were worth less than 5 centimes by 1796. More people were put to death for counterfeiting the eventually worthless Assignats than for any other crime committed during the French Revolution.

Just as the ancien regime collapsed during the French Revolution, so did the country’s finances. Investors were unable to sell their shares and bonds and fled to England where, at least, they wouldn’t lose their lives. As the Napoleonic Wars dragged on, other countries defaulted on their debts. The Swedes, Dutch, Portuguese, Spanish and Russians all suspended interest payments at some point during the Napoleonic Wars. Only English finances survived the Napoleonic wars intact.

After Napoleon gained power during a coup on November 9, 1799, he worked to rehabilitate France’s finances. Napoleon replaced the Livre Tournois with the French Franc. The 5% Consolidated Bonds were issued to replace outstanding French debt. Initially, the price of the bonds sank to 9.25 at the end of 1798, but once the government started paying interest, the price of the bonds recovered and the yield on the bonds fell as is illustrated in Figure 2. Napoleon established the Banque de France in 1801 to provide France with a central bank similar to the one that England had. The company’s shares became the largest joint-stock company on the bourse and traded in Paris until the bank was nationalized in 1946.

The re-establishment of France’s finances was a success. Between 1800 and 1914, Paris was the center of finance in continental Europe providing shareholders and bondholders during the 100 years before 1914 with one of the highest returns of any European country.

Investors and the French Revolution