Until 1934 when the Securities and Exchange Commission outlawed rigging the market, Wall Street was occasionally treated to a battle between shorts and long that ended in a corner on the market. A stock is cornered when shorts have sold more shares in a company than are in the outstanding float, and one shareholder owns the floating stock. Since the shorts must cover their positions by buying back the shares they have borrowed, if one person owns all the shares, he can set the price and the shorts have no choice but to pay the price the owner demands.

Until 1934 when the Securities and Exchange Commission outlawed rigging the market, Wall Street was occasionally treated to a battle between shorts and long that ended in a corner on the market. A stock is cornered when shorts have sold more shares in a company than are in the outstanding float, and one shareholder owns the floating stock. Since the shorts must cover their positions by buying back the shares they have borrowed, if one person owns all the shares, he can set the price and the shorts have no choice but to pay the price the owner demands.

Ryan Races to Produce Roadsters

Thomas Fortune Ryan, Allan A. Ryan’s father, helped his son to get his start on Wall Street. Thomas Ryan opened a brokerage firm in 1873 and bought a seat on the NYSE in 1874. Ryan made his fortune by consolidating public transportation in New York City, amassing personal wealth estimated at $50 million in the process. Ryan built the Metropolitan Traction Company out of street railroads that ran through New York City. Ryan also formed the Union Tobacco Co. in 1898 which consolidated with James Duke to form the American Tobacco Co. Together, Ryan and Duke developed the British-American Tobacco Co. to protect their American tobacco interests. Ryan also owned Royal Typewriter and backed the maker of the Thompson submachine gun. At the time of his death in 1928, Ryan’s fortune was estimated at over $150 million, making him the tenth wealthiest man in the United States. Thomas Ryan tutored his son, Allan Aloysious in the intricacies of finance and in 1905, when he was 25, he turned over his seat on the NYSE to his son. Three years later, Charles M. Schwab, first chairman of U.S. Steel, befriended Allan Ryan after Ryan’s father introduced him to Schwab. His son formed a brokerage firm, Allan A. Ryan & Co. The stock market boomed after America’s entry into World War I in 1917, with the DJIA almost doubling in price by October 1919. Ryan was one of the primary bulls on the exchange and enjoyed profiting from squeezing the shorts. Ryan also invested in the Stutz Motor Car Co. of America, Inc. which he gained a controlling interest in and became president of in 1916. The company was incorporated in New York and took control of the Stutz Motor Car Co. of Indiana. Stutz Motor Car Co. was most famous for making the Bearcat at its factory in Indianapolis, an expensive and high-performing roadster which became synonymous with the roaring twenties. While a Model T cost $500 in the 1920s, a Stutz Bearcat cost $2000. Stutz stock participated in the bull market rally, moving up from 40 at the end of 1918 to 144.875 in October 1919. The DJIA peaked at 118.63 on November 1, 1919, as inflation cut into post-war demand, but Stutz stock remained strong in the face of the post-war bear market. On February 28, 1919, the DJIA hit 91.31, a 23% decline from the top and by definition, a bear market. Nevertheless, the bear market still had strength left in it.The Bear Raid Begins

Ryan interpreted the decline in his stock as a bear raid designed to push the price of Stutz down so the shorts could profit from the decline in the stock. In March 1919 Stutz stock diverged from the rest of the market, making a spectacular rise. The stock had closed February at 110, but by March 23, the stock was at 245, on the March 24 it was at 282 and by the end of March, the stock stood at 391.The Shorts Are Cornered

Since Ryan was the sole lender, he knew who the borrowers were, and he knew they were primarily fellow members of the NYSE, including members of the Exchange’s Board of Governors. The men he worked with on the floor on a daily basis were shorting his company’s stock, trying to ruin him financially. During the week ending March 27, Stutz stock moved up from 220 to 318 on 73,900 shares. Stutz stock closed at 329 on March 29, at 370 on March 30 and at 391 on March 31 when only 930 shares were traded because no stock was available. The shorts had clearly underestimated Ryan’s resolve. Ryan was called before the Exchange’s Business Conduct Committee on March 31 to explain the wild gyrations in Stutz stock. As The New York Times put it, It was clear enough before noon that offerings of the stock had practically disappeared and the Governors acted through a moratorium to protect those speculators who had worked themselves into this untenable position. A single group was found to own more stock and contracts for delivery of stock than the full outstanding Stutz shares. The ruling prevents Stock Exchange members from participating in further dealings in Stutz stock until the ban is lifted. Ryan told the Committee that he would settle with the shorts, some of whom were on the Committee he faced, and allow the shorts to fulfill their contracts at $750 a share. The offer probably made the shorts sick to their stomachs. Ryan knew there were more shares short than there were shares outstanding, and that he owned all the outstanding shares. Ryan could have asked $1000 or $5000 per share. The shorts had put themselves in this position, and they had only themselves to blame. Ryan had cornered Stutz stock, and he wanted the shorts to pay for their bear raid. The shorts in the Northern Pacific corner had paid the price that Harriman had set, so why shouldn’t Ryan set the price for Stutz stock and force the shorts to pay up?The NYSE Tips the Scales

Ryan may have cornered the stock, but the shorts were determined to use their power in the NYSE to destroy Ryan and save their skin. The Committee threatened to strike Stutz from the stock exchange list, and Ryan responded by threatening to demand $1000 a share. Nevertheless, the NYSE decided to suspend all trading in Stutz stock. When a reporter said there was no precedent or rule for the suspension of trading in shares, a NYSE spokesman replied, “The Exchange can do anything.” On April 5 came the most amazing announcement of all when the Law Committee of the NYSE announced, “The Exchange will not treat failure to deliver Stutz Motor stock, due to inability of the contracting party to obtain same, as a failure to comply with his contract.” Essentially, the NYSE sanctioned breach of contract by the shorts, putting them under no legal obligation to cover their shorts. The NYSE told Ryan he was free to challenge their ruling in court. In response, Ryan demanded that the NYSE obtain a settlement price for all the shorts to avoid the trouble of Ryan having to negotiate with each of the shorts. When nations don’t agree, they go to war; when companies don’t agree, they call in the lawyers and go to court. The shorts hired the Dos Passos Brothers, who were the leading experts on stock exchange law. John Randolph Dos Passos had written the standard work on stock exchange law, Treatise on the Law of Stock Brokers and Stock Exchanges in 1882, and had rigorously opposed the Sherman Anti-Trust Act in his book, Commercial Trust, written in 1901. His son, John Roderigo Dos Passos, later wrote his socialist trilogy, U.S.A. in rebellion against his father’s defense of capitalism. Interestingly enough, by the 1950s, Dos Passos had changed his political views dramatically and campaigned for both Barry Goldwater and Richard Nixon. Ryan hired the firm of Stanchfield & Levy, the lesser firm in this David vs. Goliath battle. Realizing it was Ryan vs. the NYSE, Ryan resigned his seat in the NYSE because he felt the Exchange was changing the rules to benefit the shorts. Ryan’s resignation freed him to act independently. He was no longer bound by the NYSE’s restriction on members selling shares since he was no longer a member of the Exchange. Ryan gave a reporter of the New York World the names of the NYSE governors, some of whom were on the committees that had sat in judgment on Ryan, whom he said were caught short in Stutz stock. The obvious conflict of interest led some to demand that the NYSE come under state or federal regulation, something members of the NYSE definitely wanted to avoid. The NYSE backed down from their position that shorts could violate their contracts and left the resolution of the issue up to Ryan and the shorts. On April 20, the protective committee capitulated and said they were ready to accept impartial mediation on a negotiated settlement price between Ryan and the shorts. There were 56 firms that held shares short in Stutz involving 5500 shares. On the other hand, the banks that had loaned Ryan millions to defend Stutz stock also became involved to insure there were sufficient funds for Ryan to repay his loans. Negotiations dragged on for several days and with no resolution, Ryan indicated that he planned to buy in all the stock on April 24, a Saturday, on the Curb Stock Exchange which operated literally on the curb of the New York Stock Exchange on Broad Street. Traders on the Curb didn’t move into their own building until 1921 when the New York Curb Exchange Building was built on Greenwich Street. Brokers made trades on the street in the open air, then signaled to the clerks in the office windows above to carry out their trades. This was where the High Noon shoot-out between Ryan and the shorts was to take place.High Noon on the Curb

Hundreds showed up that Saturday morning just for the spectacle of seeing Ryan place his order to close out his position on the shorts. Colonel John W. Prentiss, who had become the principal spokesman for the shorts, said they should come to terms with Ryan before the Curb opened for its half-day of operations that Saturday. The shorts agreed to act in unison, and slips of paper were passed around where the shorts could write down what they thought would be an appropriate settlement figure. Prentiss then took the average of the numbers that had been written down. A delegation went to the office of Allan A. Ryan & Co. at 111 Broadway, arriving at nine-forty A.M. The delegation offered Ryan $550 per share, which Ryan unhesitatingly accepted, and at two minutes before ten, Colonel Prentiss announced to reporters that the Stutz matter had been settled at $550 per share. Everyone was happy except the spectators on Broad Street who were deprived of viewing the showdown. This appeared to be a great victory for Ryan since he had made almost $1.5 million in the transactions and remained the sole owner of Stutz Motor Co., and was worth, on paper, over $100 million. Unfortunately, for Ryan, this was a Pyrrhic victory. Ryan still owed millions to the banks, and the only way he could raise the money to cover his debts was by selling shares in Stutz Motor Co. With trading in Stutz stock still suspended on the NYSE, Ryan lacked a liquid market to sell large blocks of shares to the public. Unless he could raise sufficient funds to cover his loans, Ryan could become bankrupt.Ryan’s Victory Ends in Bankruptcy

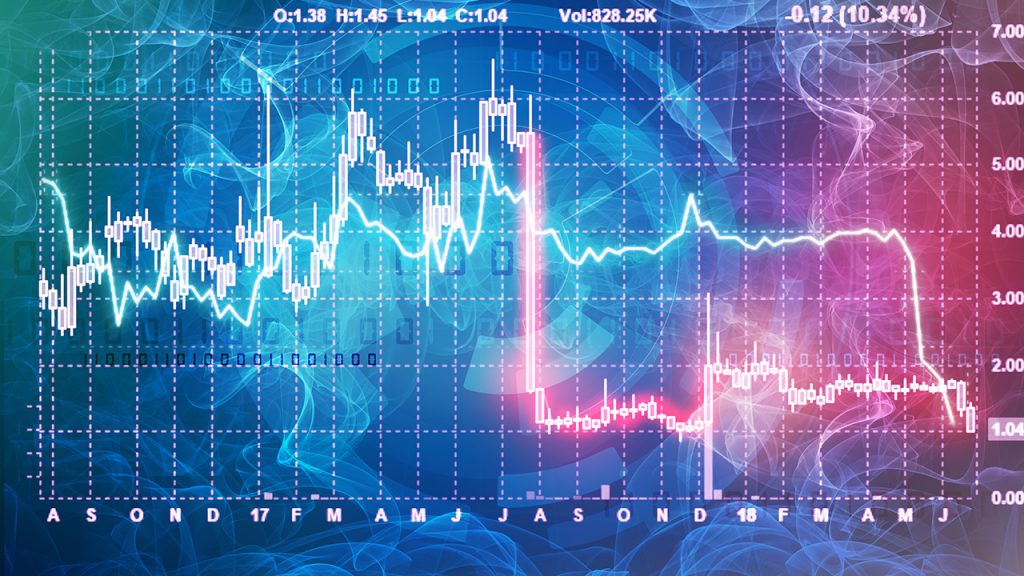

Though defeated, the shorts were still determined to have their pound of flesh. The NYSE refused to accept Ryan’s resignation from the Exchange, and the Board of Governors adopted a resolution saying Ryan’s conduct had been “inconsistent with just and equitable principles of trade;” because he had created “an arbitrary and fictitious price” for Stutz stock. Ryan was called to appear at a closed hearing at the NYSE to defend his actions. Ryan refused to appear before the “star chamber” and he was tried in abstentia. Ryan was found guilty as charged and was voted unanimously to be expulsed from the NYSE. The NYSE sold his seat in July 1920 for $98,000, but by November, the Exchange was still withholding the proceeds from Ryan on a technicality. Ryan’s main problem remained the banks he had borrowed from who were pressing him for their money. The stock market had continued to decline and the prices of the other companies Ryan owned shares in, Stromberg Carburetor, Continental Candy, Chicago Pneumatic Tool, and Hayden Chemical, were falling in price dramatically. By November, Ryan was “cleaned out” and Ryan’s creditors turned to the Guaranty Trust Company, of which Ryan’s father was the largest shareholder, to see if his father would support Ryan. Unfortunately, Ryan and his son had been at odds for several years, and Ryan showed no interest in helping his son. In November the banks formed a committee to take charge of Ryan’s affairs. Ryan fought a losing battle until he was forced to declare bankruptcy on July 21, 1922. It turned out that Ryan owed over $1 million to Harry Payne Whitney, son of his father’s old partner, about $3.5 million to the Chase National Bank and $8.66 million to the Guaranty Trust Co. Ryan’s salvation lay in the shares he owned in Stutz Motor Co., which were to be sold at auction. A lawyer for Guaranty Trust estimated that if Stutz stock sold above $60, Ryan would probably be able to cover his debts and avoid bankruptcy. Stutz stock traded on the Curb, since it was not permitted to trade on the NYSE, and the stock had fallen in price dramatically in the intervening two years. The stock, which had been at $180 at the end of 1920, had fallen to $50 at the end of 1921 and was trading at $15 when Stutz declared bankruptcy.Stutz Motor Co. of America, Inc. Stock Price, 1918-1925

In the auction, Stutz’s holdings were sold at $20 a share to Charles A. Schwab, his erstwhile mentor. Schwab failed to turn Stutz Motor Co. into a profitable enterprise, despite the popularity of the Bearcat automobile. In December 1930, the company had to institute a 1-for-10 reverse split, and in 1932, the company was reduced to making grocery-delivery vans rather than luxury cars and roadsters. The company went bankrupt in 1938.

Berkshire Fine Spinning Associates is Formed

Berkshire Fine Spinning Associates Inc. incorporated under Massachusetts laws in 1929 as a consolidation of Berkshire Cotton Manufacturing Co., Valley Falls Co., Coventry Co., the Greylock Mills, and Fort Dummer Mills. The company changed its name to Berkshire Hathaway in 1955 when it acquired Hathaway Manufacturing Co. Berkshire Fine Spinning Associates Inc. manufactured fine grades of cotton textiles and specialized in fine lawns, batistes, nainsooks, organdies, dimities, handkerchief cloths, broadcloths, oxfords, sateens, rayon and silk mixtures. Plants were located in New Bedford, Massachusetts. Berkshire offered 33,000 shares of common stock in 1929 at $40 per share as well as 4,860 shares of 7% Preferred stock, also at $40 per share. Unfortunately, the shares were offered in the middle of the 1929 bull market, and the share price collapsed soon after. In November 1929, the ask price for Berkshire stock was still at $40, but in November of 1931, shares sank to $0.50. Sales for the company declined and Berkshire ran losses until 1936. As late as 1940, shares traded as low as $3, but profits and the share price picked up with the war. Berkshire did well enough that it was able to reinitiate a regular dividend in 1942 (the dividend had been suspended in March 1930), and in September 1947, the company had a 3-for-1 split. Of course, the split marked the high mark for Berkshire and the stock began a downward trend that lasted until 1962. The graph below shows the performance of Berkshire Hathaway Inc. stock from 1929 until 1967 when Warren Buffett took over the company. As you can see, there was little change in the stock price in the forty years before then. Berkshire lost money between 1930 and 1936, and it lost money in 1957, 1958 and 1961 to 1963. Despite the fact that sales had tripled between the 1930s and the 1960s, there was no comparable increase in profits. In 1963, Berkshire stock was still trading below the price it had been offered at in 1929!Buffet Buys Berkshire

Buffett began buying shares in Berkshire Hathaway at less than $8 in 1962 and by 1966, Buffett and his partners had taken over the company.As soon as Buffett took over Berkshire, he began focusing on insurance and other businesses rather than textiles. Buffett had invested in American Express when Anthony de Angelis’s fraud caused the price of American Express to drop dramatically in 1964. In the 1970s, Buffett expanded his investments to include media companies (The Washington Post and ABC) as well as other companies that fit his investment criteria. The final Berkshire mill was closed down in 1985.Berkshire Booms

The impact of Buffett on Berkshire was incredible. Shares in Berkshire which had gone nowhere for 40 years began increasing at a rapid pace. The stock closed at $18.625 in 1966. Shares first broke the $100 mark in 1977, the $1000 mark in 1983, the $10,000 mark in 1992 and the $100,000 mark 2006. Shares now trade around $200,000. Buffett could have bought any company and the results would have been the same. As soon as Buffett took over Berkshire Hathaway, he began to focus on other businesses and ignore the company’s core manufacturing business. In fact, at one point, Buffett said that buying the textile business had been the worst trade of his life. I guess everyone is allowed one mistake. One question I often receive about the data for the Germany is why the German stock and bond indices had a 90% decline in June 1948. At first, people think there is an error in the data, but German shareholders actually did lose 90% of their capital as a result of the Currency Reform of June 20, 1948 when Reichsmark were converted into Deutschemark.

Despite the loss, the reform benefitted shareholders. who were unable to sell their stocks at the fixed prices the Nazis had imposed during the war. Although the Currency Reform imposed an immediate loss on all shareholders and bondholders, the Reform helped West Germany to emerge from the economic collapse of World War II and begin the Wirtschaftswunder (Economic Miracle) that enabled Germany to enjoy the economic growth that occurred in the decades that followed.

One question I often receive about the data for the Germany is why the German stock and bond indices had a 90% decline in June 1948. At first, people think there is an error in the data, but German shareholders actually did lose 90% of their capital as a result of the Currency Reform of June 20, 1948 when Reichsmark were converted into Deutschemark.

Despite the loss, the reform benefitted shareholders. who were unable to sell their stocks at the fixed prices the Nazis had imposed during the war. Although the Currency Reform imposed an immediate loss on all shareholders and bondholders, the Reform helped West Germany to emerge from the economic collapse of World War II and begin the Wirtschaftswunder (Economic Miracle) that enabled Germany to enjoy the economic growth that occurred in the decades that followed.

Nazi Economics

During the 1940s, the German government organized its economy with one goal in mind: to win the war. As in the United States, the government made sure that all goods essential to the war were acquired by the government at a reduced cost. The prices of consumer goods were controlled in order to limit inflation, but the inevitable result was a black market in scarce consumer goods.Not only were price controls imposed upon goods, but price floors were introduced for stocks and bonds, preventing securities from declining in value. A bombed out factory isn’t worth as much as a fully functioning factory, and industry was run to aid the war effort, not to make profits. If markets had been left to themselves, stock prices would have declined as the tide of the war turned against the Nazis. Since prices didn’t reflect the values of the shares, stock markets froze and trading dwindled until it was almost non-existent. Price floors had been introduced during World War I in London, New York, Berlin and other countries for good reason. Although stocks traded at full price, market makers only had to put up a fraction of the cost of stocks, waiting until settlement days to balance their accounts. A steep decline in prices would have bankrupted many of the stock market’s traders, so the price floors were introduced to prevent panic selling. As a result of the price floors, trading in many securities stopped since no one was willing to buy shares for less than they were worth. Consequently, between January 1943 and June 1948 there was virtually no change in the German stock market index. The Nazi government remained in default on its own bonds until 1953, introduced multiple exchange rates, and imposed capital controls to stem the flow of money out of Nazi Germany.The War Ends and the Economy Collapses

After the war ended in Germany, the economic situation got even worse. The money supply had expanded five-fold between 1939 and 1945, but prices of many goods were fixed. Although ration coupons were used to allocate some goods, the amounts rationed were insufficient to meet daily needs, and consumers were forced to turn to black markets.

After the war ended, the occupying powers replaced the Reichsmark and Rentenmark with a Military Mark. Although the western Allies tried to limit the issue of Military Marks to control inflation, the Soviets were more than willing to print extra marks to pay for the rising costs of occupation. For political, rather than for economic reasons, the Western Allies gave copies of the plates for the Military Mark to the Soviets who began printing excessive amounts of the notes generating inflation. Having suffered from economic collapse and inflation after World War I, Germany was facing a second collapse that might have been worse than the hyperinflationary death spiral of the 1920s.

Replacing Nazi Economics with the Free Market

With the growing tension between the western Allies and the Soviet Union, the need to revive the German economy superseded the need to pacify Germany. The reform of the German currency and economy was overseen by Ludwig Erhard who wanted to replace the government-controlled Nazi economy with one based upon the market. Erhard had refused to support the idea of a centralized economy under Hitler, and his anti-Nazi credentials helped him to secure the support of the Allies over other German economists who wanted to maintain the government controls and rationing which clearly were impoverishing the nation. Erhard advocated the ending of price controls and a currency reform which would replace the Military Mark with a new currency with a limited money supply called the Deutschemark.By eliminating the Military Mark and replacing it with a smaller supply of Deutschemark while simultaneously eliminating all price controls, Erhard hoped to end both inflation and the shortages that plagued the economy. The Deutschemark were secretly printed in the United States and put in boxes that were innocuously labelled “doorknobs” so they wouldn’t arouse suspicion. Meanwhile, factories were instructed to withhold the distribution of their goods until the currency reform was introduced so the flood of goods into stores would help the economy to revive as quickly as possible. On June 20, 1948, the currency reform was introduced. Germans, who had gone to bureaucratic offices to pick up their ration coupons, instead received 40 Deutschemark in the new currency and an additional 20 Deutschemark soon after. Germans were allowed to exchange a limited amount of their Military Marks into Deutschemarks, but most of their money was lost. Now goods would be rationed by Deutschemark, not by ration coupons.

Stocks and bonds were converted from Reichsmark into Deutschemark at the rate of 1 to 10. A bond or stock that had been worth 100 Reichsmark was now worth 10 Deutschemark. In effect, the government imposed a 90% loss on all securities. This is why GFD’s German stock and bond indices show a 90% drop in 1948.

Though investors suffered losses, consumers were ecstatic. The effect of the currency reform was immediate. Within a week, store shelves were full, black markets were eliminated, and economic stability returned to Germany. The politics, however, were not so simple.

Germany Separates into West Germany and East Germany

The Ostmark was introduced in East Germany and continued to circulate in East Germany for the next forty years. Although the official exchange rate between the Ostmark and Deutschemark was set at one-to-one, the Ostmark always traded at a discount. I remember when I visited East Berlin in 1986, the black market rate was 5 Ostmark to the Deutschemark, but visitors to East Berlin had to exchange 25 Deutschemarks for 25 Ostmarks (which looked like monopoly money) as the price of entering East Berlin to see the walls of Babylon at the Pergamum Museum. The Ostmarks had to be spent in East Berlin, and since I was thirsty, I bought a glass of Vita Cola, the East German version of Coca-Cola, a drink which made cod liver oil taste delicious by comparison. Vita Cola kept the formula for their soft drink secret, but more likely to protect the rest of the world rather than to hide trade secrets.

One of the most dramatic events in the financial history of Victorian England was the collapse of Overend, Gurney and Co. Its failure had a more severe impact on the London financial market than the collapse of Bear Stearns had on U.S. markets over 140 years later. During the financial crisis of 1866, over 200 firms went bankrupt, including a number of banks. The failure of Overend, Gurney and Co. also led to one of the first trials for financial fraud in history when all six directors were brought before the courts of London to answer for their alleged crimes.

One of the most dramatic events in the financial history of Victorian England was the collapse of Overend, Gurney and Co. Its failure had a more severe impact on the London financial market than the collapse of Bear Stearns had on U.S. markets over 140 years later. During the financial crisis of 1866, over 200 firms went bankrupt, including a number of banks. The failure of Overend, Gurney and Co. also led to one of the first trials for financial fraud in history when all six directors were brought before the courts of London to answer for their alleged crimes.

Quaker Origins

When Limited Liability Adds Insult to Injury

Overend, Gurney & Co. stock started trading on August 21, 1865, and hit a high of 22.5 on November 16, 1865. As the price rose, investors who had missed out on the initial offering bought shares, keeping the price around 20; however, they were unaware of the rot that lay beneath the façade of the bank. By the end of February, 1866, shares still traded above 20, but began to drift down, falling below 15 by late April. In April, the investment in the Millwall Iron Works on the Isle of Dogs began unravelling, producing £500,000 in unexpected losses for the bank. The financial markets in London were reaching the heights of a small bubble, and the Bank of England responded by raising the lending rate from 6 per cent to 7 per cent on May 3, to 8 percent on May 5 and to 9 per cent on May 11 and 10 percent on May 12. As money tightened, Overend tried to raise capital by collecting on debts owed to it by the Mid Wales Railway and others, but when the bank was unable to get this money, it became evident that the bank would soon become insolvent. Overend’s only alternative was to go to the Bank of England, which as lender of last resort, could have bailed out Overend, Gurney and Co. However, the Bank of England declined, not because allowing Overend to fail would reduce the amount of competition the Bank of England had, but because Overend was in such poor shape that no amount of money could have saved it. On May 10, 1865, the bank announced that it was suspending payment on deposits. The price of the stock had closed at 10 on May 10, fell to 3.5 on May 11 and to 0.5 on May 12. Until then, few had suspected that the greatest name in wholesale banking could have collapsed so suddenly. If Overend, Gurney & Co. was unsafe, could any bank be safe? A financial panic ensued and during the next few months, over 200 companies, including many banks, failed as well.

For the shareholders, the worst was yet to come. The bank had issued shares at a par of £50, only requiring £15 of paid in capital before going public. Since the bank still had many outstanding liabilities, the shareholders were liable for these, though only to the extent of the par value of the shares. Still, this meant that not only had shareholders lost all they had invested in Overend, Gurney & Co., but now they would be required to pay an additional £35 to a bankrupt company to help cover outstanding liabilities.

Although some shareholders made legal challenges to this demand, the courts said a contract was a contract and shareholders had to pay the additional £35 (equivalent to about $7500 in today’s money) even though they would never get anything back. Can you imagine how shareholders in Bear Stearns would have reacted if, after losing everything, they had been required to send in an additional $7500 for each share they owned even though the company was already bankrupt?