Toys ‘R’ Us has announced that it is closing all of its stores in the United States as parents and kids have found alternatives to the toy retailer. Their closure reminded me what a tough business it is producing and selling toys and of the time that Thomas Alva Edison ventured into the toy business and failed miserably.

Although Edison is recognized for creating or contributing to the creation of the phonograph, electric lights, motion pictures and other essentials of the twentieth century, few realize that he also created the talking doll.

Edison created his phonograph in 1877, filed for a patent on December 24, 1877, set up the Edison Speaking Phonograph Company on January 24, 1878 and received his patent on February 19, 1878. And you thought high tech only moved quickly in the 21st century!

The initial fascination with the phonograph soon wore off, and the Edison Phonograph Co. wasn’t set up until 1887. The Edison Phonograph Toy Manufacturing Co. was also incorporated in 1887 to produce a doll that included a phonograph inside the doll that could play a short nursery rhyme and project the sound through the chest of the doll. If you go to the Wikipedia article on Edison’s Phonograph Doll, you can hear recordings of the nursery rhymes the doll played. To be honest, the recordings sound pretty creepy and it is no wonder that Edison referred to the dolls as his “little monsters.”

A factory was set up in Menlo Park and hundreds of dolls were produced for purchase. The doll was 22 inches tall and could only play one nursery rhyme. Women in the factory recorded the nursery rhyme on beeswax for each doll and the rhymes could not be replaced with new ones. If you got the “Twinkle, Twinkle, Little Star” recording, you had to listen to it for the rest of your life. Moreover, you had to crank a handle each time to play the short recording and the sound was atrocious. It sounded more like something to torture kids with than to put them asleep.

Toys ‘R’ Us has announced that it is closing all of its stores in the United States as parents and kids have found alternatives to the toy retailer. Their closure reminded me what a tough business it is producing and selling toys and of the time that Thomas Alva Edison ventured into the toy business and failed miserably.

Although Edison is recognized for creating or contributing to the creation of the phonograph, electric lights, motion pictures and other essentials of the twentieth century, few realize that he also created the talking doll.

Edison created his phonograph in 1877, filed for a patent on December 24, 1877, set up the Edison Speaking Phonograph Company on January 24, 1878 and received his patent on February 19, 1878. And you thought high tech only moved quickly in the 21st century!

The initial fascination with the phonograph soon wore off, and the Edison Phonograph Co. wasn’t set up until 1887. The Edison Phonograph Toy Manufacturing Co. was also incorporated in 1887 to produce a doll that included a phonograph inside the doll that could play a short nursery rhyme and project the sound through the chest of the doll. If you go to the Wikipedia article on Edison’s Phonograph Doll, you can hear recordings of the nursery rhymes the doll played. To be honest, the recordings sound pretty creepy and it is no wonder that Edison referred to the dolls as his “little monsters.”

A factory was set up in Menlo Park and hundreds of dolls were produced for purchase. The doll was 22 inches tall and could only play one nursery rhyme. Women in the factory recorded the nursery rhyme on beeswax for each doll and the rhymes could not be replaced with new ones. If you got the “Twinkle, Twinkle, Little Star” recording, you had to listen to it for the rest of your life. Moreover, you had to crank a handle each time to play the short recording and the sound was atrocious. It sounded more like something to torture kids with than to put them asleep.

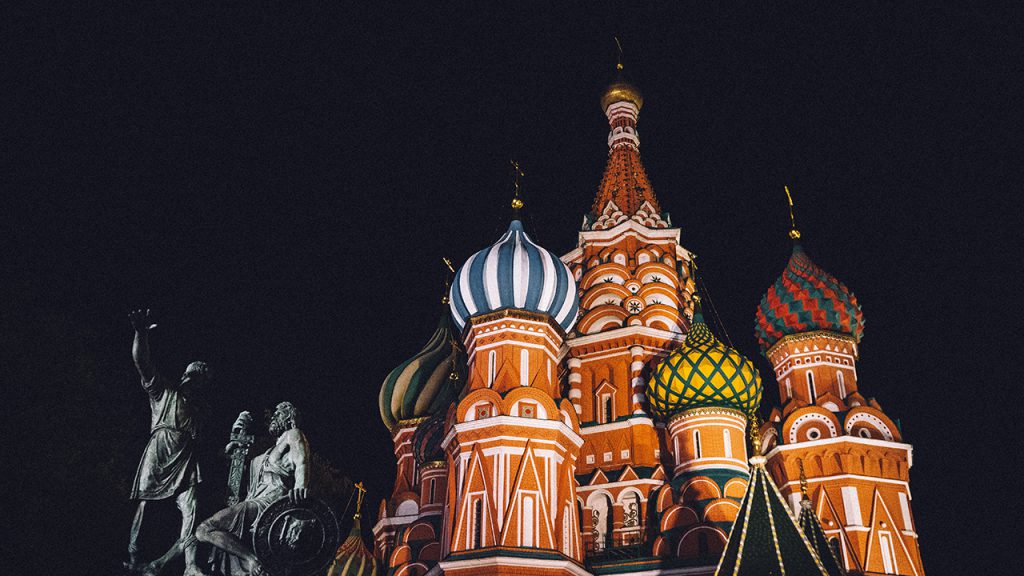

Global Financial Data has put together indices of the St. Petersburg Stock Exchange before World War I and the collapse of Russia into Communism. The data was made available to us from Yale’s International Center for Finance. The files were marked in transliterated Cyrillic, so we converted the names back into Cyrillic and then translated the names of the companies into English. We then classified the stocks according to their sector so we could see how one sector did relative to the others. Although the data from Yale was rich in price data, it was lacking in shares outstanding and dividends. The source material that Yale collected only had information on capitalization in the first issue. None of the other issues provided any information on either capitalization or shares outstanding. Except for a few issues around 1900, no data on dividends was available either, and having dividend data for four or five years was hardly sufficient to create a useful total return series.

Global Financial Data has put together indices of the St. Petersburg Stock Exchange before World War I and the collapse of Russia into Communism. The data was made available to us from Yale’s International Center for Finance. The files were marked in transliterated Cyrillic, so we converted the names back into Cyrillic and then translated the names of the companies into English. We then classified the stocks according to their sector so we could see how one sector did relative to the others. Although the data from Yale was rich in price data, it was lacking in shares outstanding and dividends. The source material that Yale collected only had information on capitalization in the first issue. None of the other issues provided any information on either capitalization or shares outstanding. Except for a few issues around 1900, no data on dividends was available either, and having dividend data for four or five years was hardly sufficient to create a useful total return series.

Common Stock and Scrip

Every stock market has its own peculiarities and one of the interesting facts about the St. Petersburg Stock Exchange is that over time, banks, railroads and other firms raised more capital by issuing new shares as in any other country; however, the newly issued shares traded alongside the original shares. All of the issues would trade simultaneously on the St. Petersburg Stock Exchange, even though the price of each was virtually the same. The St. Petersburg-Tula Land Bank had 15 issues trading simultaneously, the Don Land Bank 14 and the Bessarabsko-Tavrichesky Land bank 19. In all, there were over 150 issues of scrip that traded alongside the mother shares for each company. Once these issues were designated as scrip, rather than common shares, this left about 425 different companies that traded on the St. Petersburg Stock Exchange between 1865 and 1917, some for a few months, some for the entire 52 years. The St. Petersburg Stock Exchange shut down in August 1914 when World War I began, briefly reopened in 1917, then shut down for the next 75 years when the Russian Revolution began. The goal of organizing this data was to produce indices which could be used to analyze the Russian stock market. The source material from Yale principally relied upon St. Petersburg, but quotes from the Moscow, Kiev and Warsaw exchanges were provided as well. Of course, before World War I, the Russian Empire included not only Russia, but the Baltic states, Poland, and Ukraine. The principal industries were banks and railroads with oil companies, utilities, mining, insurance and iron and steel companies providing most of the capitalization. Russia tried to follow Germany’s lead by infusing capital into the banks and railroads to enable the country to industrialize. The railroads relied heavily on bonds as well as common stocks to raise capital for a network of railroads to crisscross the empire. Russia also relied extensively on infusions of capital from Germany, France and Britain to fund the country’s transformation. Of course, when the Communists took power, all the shares became worthless, though foreign-listed companies continued to trade in Paris and Berlin until the 1920s.

Creating Indices

Our first step was to create a Russian index that included all the companies that traded in St. Petersburg, an All-Share index, but we also wanted to create an index of Russian “blue chip” stocks. We did this by finding the 50 stocks with the largest number of months traded and created an index of the 50 top companies. Because we had no data on shares outstanding, the index had to be equal-weighted meaning that a small cotton factory had the same weight as the largest railroad or bank in the country. To try and address this issue, we collected capitalization data from two stock exchanges where Russian shares also traded, in Paris and in Berlin. We were able to collect data on 68 companies that listed in St. Petersburg and abroad. Of course, the primary companies that listed abroad were the larger blue-chip companies. When we summed up the capitalization of these companies in 1913, it came to $982 million (1910 million Rubles). Our 1900 figure of $486 million is about one-third of the estimate made by Leslie Hannah. The three main sectors in 1913 were railroads (40%), finance (38%) and energy (14%).

Figure 1. Market Cap of Russian Industries in 1913 in US Dollars

The final question that remained was what the total return was to investors, including dividends that were paid out. We were able to obtain dividend data for most of the companies back to 1885. Before 1885, we turned to the Berlin Stock Exchange yearbook which had data on Russian companies that listed in Berlin. Since dividend data was only available on a limited number of companies before 1885, the total return indices before 1885 are not reliable. After 1885, sufficient data is available. The dividend yield for the Russian market is between 4% and 5% which is comparable to the yield in other countries. Some of the railroads paid no dividend so this helped to pull down the average dividend yield.

Russian Stock Price Indices

Below is a graph that compares the two indices that we calculated for Russia between 1865 and 1914. We calculated indices for both the 68 stocks for whom we were able to find share outstanding data (GFRUSMPM) and the equal-weighted 50 Blue Chip stock index (GFRUS50EPM). Although the actual returns vary over time, the two indices follow the same behavior and provide very similar returns.

Both Indices surged between 1865 and 1870, stabilized between 1870 and 1875, had a sustained bull market from 1875 until 1895, then followed a steady decline between 1895 and 1907. Russia went through a financial crisis between 1899 and 1902 and this is shown in the decline in the index during those years. The war between Japan and Russia occurred February 1904 and September 1905 and the Russian Revolution, in response to Russia’s defeat, occurred between January of 1905 and June of 1907. After the Tsar responded to some of the demands made during the Revolution, establishing a state duma and enacting a new Russian constitution in 1906, the economy stabilized and began to recover. The indices recovered and rose dramatically between 1908 and 1914 reaching new highs by the time that World War I began.

Russian Stock Return Indices

The return indices for the Cap-Weighted and the 50 Blue Chip indices are provided in Figure 3. The equal-weighted index outperforms the Cap-weighted index, as would be expected. Small cap stocks are generally more volatile than large-cap stocks and tend to provide higher returns. Nevertheless, the two indices follow a similar pattern over time, rising between 1885 and 1895, making no progress between 1895 and 1908, then rising again between 1908 and 1914.

We have calculated returns for Russia between 1865 and 1914. We used the cap-weighted index for our calculations and divided the data into the period between 1865 and 1914 and the period between 1885 and 1914 when dividend data were available. Between 1864 and 1914, the price of Russian stocks rose by 3.06% per annum, the stock return index rose by 6.73% providing a dividend yield of 3.56%. Russian government bonds returned 3.54% per annum.

Between 1884 and 1914, Russian stocks rose 1.05% in price, reflecting the difficulties created by the Russian Financial Crisis of 1899-1902, the Russo-Japanese War and the Russian Revolution of 1905. However, since the dividend data are more complete, the return index provided a 6.44% return per annum and a dividend yield of 5.33%. Russian government bonds returned 1.78% per annum between 1884 and 1914. Data on returns to stocks and bonds by decade, using the cap-weighted index are provided in Table 1.

|

Years |

Stock Price |

Stock Return |

Dividend |

Bond Return |

|

1869-1879 |

4.55 |

5.85 |

1.24 |

5.58 |

|

1879-1889 |

-0.29 |

2.4 |

2.7 |

8.45 |

|

1889-1899 |

3.07 |

7.98 |

4.76 |

5.83 |

|

1899-1909 |

-1.34 |

3.53 |

4.94 |

3.09 |

|

1909-1914 |

4.64 |

13.73 |

8.68 |

2.47 |

|

1864-1914 |

3.06 |

6.73 |

3.56 |

5.58 |

|

1884-1914 |

1.05 |

6.44 |

5.34 |

5.14 |

Table 1. Returns to Stocks and Bonds in Russia, 1864 to 1914

The St. Petersburg stock exchange closed in July 1914 and didn’t reopen until 1917. The exchange was open in January and February 1917, but closed when the Russian Revolution began. The stock exchange never reopened. Although Russian stocks traded in Paris for over a decade after the Russian Revolution, Russian shareholders lost everything.

Russian Sectors

If you study the different sectors, you’ll see that the Bank Index (Black line) never recovered to the 1895 peak, even by 1914. The Railroad (green line) and energy sectors (blue line), however, moved up significantly. Between 1865 and 1905, Russian Railroads made no progress, but between 1905 and 1912, the railroads more than tripled in price. The best performance came from the oil and gas industry which made significant gains in the 1890s and the 1910s. Since the cap-weighted index included more railroad and energy shares than the St. Petersburg stock market in general, this provides the best explanation for the outperformance of the cap-weighted indices over the equal-weighted indices.

Russia and the United States

Finally, a comparison was made between the total return to shareholders in the United States and in Russia between 1870 and 1914. Previous comparisons showed that the Russian index had outperformed the American index, but this only compared the prices of the stocks and excluded the dividends that were paid. Russian stocks advanced more in price than American stocks between 1864 and 1914, but American companies paid larger dividends. Price and dividends offset each other and during that 45-year period, the two stock markets provided approximately equal returns. The American and Russian stock markets are compared below.Conclusion

The result is as complete of a picture of the Russian Stock Exchange before World War I as currently exists. To our knowledge, no one else has generated either a cap-weighted or a total return index for Russia before World War I. We hope we can get more data on shares outstanding and on dividends in the near future. Of course, by 1918, all of the Russian shares were worthless, but in the meantime, these numbers will have to stand as the best that are available for Russia before the Revolution.

Much is being made about the fact that the bull market is marking its ninth anniversary today. The bear market of the Great Recession hit its bottom on March 9, 2009 and has steadily moved up since then, especially in the United States. The bump we hit in February 2018 is now ancient history. Naturally, most market analysts refer to this as an old bull market since it has been moving steadily upward for the past nine years. But how old is it?

Yes, the United States stock market hasn’t had a 20% correction, or even a 15% correction since 2009, but that is not true of the rest of the world. If you look at both the MSCI Europe Asia and Far East (EAFE) index which includes all developed countries except the United States, and the MSCI Emerging Market Index, these two global indices finished a bear market on February 11, 2016, declining from the peaks of July 2014. A second low was hit in July 2016 and it has been off to the races since then.

Much is being made about the fact that the bull market is marking its ninth anniversary today. The bear market of the Great Recession hit its bottom on March 9, 2009 and has steadily moved up since then, especially in the United States. The bump we hit in February 2018 is now ancient history. Naturally, most market analysts refer to this as an old bull market since it has been moving steadily upward for the past nine years. But how old is it?

Yes, the United States stock market hasn’t had a 20% correction, or even a 15% correction since 2009, but that is not true of the rest of the world. If you look at both the MSCI Europe Asia and Far East (EAFE) index which includes all developed countries except the United States, and the MSCI Emerging Market Index, these two global indices finished a bear market on February 11, 2016, declining from the peaks of July 2014. A second low was hit in July 2016 and it has been off to the races since then.

Global Financial Data has reorganized its sector and industry classification system to make Communications a separate sector. The introduction of the internet 25 years ago has transformed the world and will continue to change the global economy in ways we still cannot predict. Many services which formerly were provided through brick and mortar stores are now provided online. Businesses which formerly were included in Consumer Discretionary, such as Media and Broadcasting or the Internet in Information Technology have more in common with each other than was formerly realized.

A company such as Amazon not only has a huge retail business, but also hosts huge amounts of data on the cloud and provides streaming services for video and music. Netflix not only rents and streams video, but produces its own movies and series, as does Amazon. These changes have caused a re-evaluation of the classification system of industries and sectors by all of the index providers.

Global Financial Data has reorganized its sector and industry classification system to make Communications a separate sector. The introduction of the internet 25 years ago has transformed the world and will continue to change the global economy in ways we still cannot predict. Many services which formerly were provided through brick and mortar stores are now provided online. Businesses which formerly were included in Consumer Discretionary, such as Media and Broadcasting or the Internet in Information Technology have more in common with each other than was formerly realized.

A company such as Amazon not only has a huge retail business, but also hosts huge amounts of data on the cloud and provides streaming services for video and music. Netflix not only rents and streams video, but produces its own movies and series, as does Amazon. These changes have caused a re-evaluation of the classification system of industries and sectors by all of the index providers.