I visited Cuba a few weeks before Castro passed away, and my visit to Cuba not only provided me with the opportunity to see a country frozen in time with American cars from the 1950s acting as taxis and a vision of what a country without any multinationals would look like, but it also enabled me to understand exactly how a socialist economy worked, or as is often the case, didn’t work.

I visited Cuba a few weeks before Castro passed away, and my visit to Cuba not only provided me with the opportunity to see a country frozen in time with American cars from the 1950s acting as taxis and a vision of what a country without any multinationals would look like, but it also enabled me to understand exactly how a socialist economy worked, or as is often the case, didn’t work.

Cubanomics at the Airport

Black Market Goods at the Airport

Your first thought is that like any bureaucrat in any country this official has no sense of humor and therefore does not like anyone to smile, but when you realize that this bureaucrat makes about $30 per month, as do most people who work for the Cuban government, while every day thousands of dollars in black market American goods go through the airport wrapped in blue shrink wrap, you have a deeper understanding of why the bureaucrat is not smiling. The goods brought into Cuba outnumber the luggage brought in since this is often the main way that Cubans are able to obtain American goods that are otherwise unavailable in Cuba. Some of the goods are brought in by Cubans returning from the United States, some are brought in by Americans visiting their Cuban relatives, and others are brought in by the equivalent of “consumer good mules” who run goods between the United States and Cuba. The Cuban government controls official imports into Cuba and you never know when particular consumer goods are going to be imported, or if they will be imported. A store in Havana may get in a shipment of Adidas shoes one week, but not get in any more for months. And even if Adidas shoes do come in, they are often sold out before Cubans can get the pair they want. So what is a Cuban to do? Simple, go to the Cuban version of Craigslist which provides black market access to goods otherwise unavailable in Cuba. You go to a friend who has a list of American goods that can be imported through the black market on a flash drive. Then you review the list on the flash drive and find the item you want. You then contact the person who handles that item and order what you need. They contact someone in the United States who goes to Costco or some other store in the United States and purchases the item, sends it down with a mule on a flight to Cuba, gives the item to the black marketer who then delivers it to you. This is the Alice-in-Wonderland world of Cuban economics. If you can’t buy a particular item in a Cuban store, or order it from Amazon, you can pay someone to bring the good to you from the United States. Cubans have to pay more for this roundabout way of purchasing goods, but at least they can get them. The black market fills in where there is no market, and where government regulations and American law forbids Cubans from buying what could be easily obtained at thousands of stores or on line in a few minutes in the United States.Two Currencies and No Credit Cards

After you have gotten your visa at the airport, turned in your health card, gotten your baggage and cleared customs, you can change money in the airport. Unlike other countries, Cuba has two currencies, one for the socialist economy, the Cuban Peso, and one for the market economy, the Peso Convertible, or cuc (pronounced “kook”). Historically, the Cuban Peso was equal to one United States Dollar and provided a unified currency for Cuba. In 1985, Cuba introduced Foreign Exchange Certificates to tourists spending money in Cuba, rather than allow US Dollars to freely circulate. In 1994, the Foreign Exchange Certificates were replaced with the Convertible Peso, which is equal in value to one US Dollar, although the government does penalize tourists exchanging US Dollars with a 10% penalty which is not applicable to exchanging other currencies. The one medium of exchange that everyone uses in the rest of the world, the credit card, is completely worthless in Cuba. No stores or restaurants or hotels accept them because the embargo places Cuba outside of the integrated financial world of modern credit. It is also extremely difficult for Cubans to borrow money from banks. Consequently, the country is on an entirely cash economy. Even if a Cuban wants to make a large purchase in the tens of thousands of dollars, it has to be done in cash. For almost all transactions that any tourist would carry out in Cuba, purchases are in Convertible Pesos, but transactions for Cubans and for domestic goods in local stores are in Cuban Pesos. Converting from one to the other is relatively simple. There are 25 Cuban Pesos to 1 Convertible Peso so something that costs 10 Convertible Pesos costs 250 Cuban Pesos. Each currency has its own banknotes and coins that are distinguishable from each other. US Dollars were allowed to be used in Cuba from 1994 to 2004, but in 2004 the US Dollar was replaced by the Cuban Convertible Peso which is still used in lieu of US Dollars. Many goods are only available in Cuba by using Convertible Pesos, so Cubans have to keep both currencies in order to get what they need.Surviving on Thirty Dollars a Month

To understand why there are two currencies, you have to go back to Cuba’s Special Period in the 1990s. When the Soviet Union collapsed, Russia stopped sending the billions of dollars in subsidies that the USSR had been providing to Cuba for decades. With the withdrawal of this money, the Cuban economy nearly collapsed. In the course of a few years, Cuban GDP shrank by one-third, Cubans were without electricity for the majority of the day due to blackouts, there was insufficient gasoline for cars, and malnutrition occurred because Cuba did not have enough food to feed its people. Until the withdrawal of the Soviet subsidies, Cuba was able to maintain the façade of having a working economy, but the Special Period turned the economy upside down and laid the foundations of the Alice-in-Wonderland economy that now exists in Cuba. The economy went through an inflationary bout in the 1990s and wages fell to their real level. Prices went up, but wages did not. Someone who had made 1000 Cuban Pesos in the 1980s when the USSR subsidized Cuba continued to make 1000 Cuban Pesos in the late 1990s, but with 25 Cuban Peso equal to 1 US Dollar, their salary shrank from $1000 to the equivalent of $40. The Cuban government had difficulty feeding its people, and rather than moving to a market economy like almost every other country in the world had done, Cuba chose to allow a very limited opening to the market in which citizens could establish small businesses, but not use the accumulation of capital to grow their business. People were allowed to work in the private sector, to open small businesses, to have US Dollars, to provide services outside of the public sector, but only as the equivalent of a sole proprietorship. Cuban businesses were limited to certain sectors and were not allowed to hire large numbers of people. Nevertheless, the private sector grew. Twenty years later, any entrepreneur with any business skills had left the public sector for the private sector. The rest were left to stagnate in the government sector earning an average of $30 a month. The eternal refrain that everyone asks is, how can someone who makes the average wage of around $30 a month or receives the average pension of around $15 a month survive? You do have to understand that in addition to their salary, Cubans get free health care, free education, are provided with housing if necessary, and receive a food ration. The Libreta de Abastecimiento provides Cubans with about 6 pounds of rice, 20 ounces of beans, 6 pounds of sugar, a dozen eggs and 15 pounds of potatoes and bananas per month (plus 1 liter of milk per day for children under 7). When available, some meat is distributed as well. After that, you are on your own.Alternatives to Surviving on Thirty Dollars a Month

Of course, the simple answer is that you can’t really survive on the government’s minimal distribution of money and food. You have to find some way of supplementing the government’s minimal allocation. So, what are the choices? One solution is to leave the country and get a good paying job elsewhere. The problem is that in order to leave the country, Cubans have to have a Visa, and if a foreign government suspects that a Cuban is planning on working during their visit, then they won’t provide a Visa unless the Cuban is already offered a job by a company within that country. My impression is that most young people in Cuba are apolitical and only want a good job regardless of whether the job is in Cuba or another country. I think that if they had the chance, the majority of young people would leave the country for a higher paying job. Unfortunately, only the lucky ones, those with connections, or those with special skills are able to leave. This fact was exemplified by our tour group’s visit to a dance troupe which performed for us. The troupe had about 40 members in it, and when we asked if most people stay with the group or pursue other dance opportunities, we discovered that the dance troupe had a high turnover and had to hire a new member almost every week. The reason is that as soon as a dancer got an offer for a dance job in another country, they took it. If you had the opportunity of making $100 a month or less in Cuba or making $700 to $1000 in another country, what would you do? Many of the other young people we talked to were ready to jump at the first opportunity that was offered them, if any. The problem is that all of this creates a brain drain on the Cuban economy. There is an average of 1.2 births per Cuban woman, so the country is not replacing itself. If you then subtract out the young people who leave Cuba, there are even fewer people available to work in the economy. Then if you consider the fact that many of the people in Cuba with skills have abandoned their professional government jobs to join the more profitable tourist economy, one wonders how much longer the Cuban economy can survive being half-pregnant with socialism and capitalism. A second alternative is to have a relative in either the United States or Cuba who will help you out financially. There is currently no limit on the amount of money Cubans in Florida can send to their family members who are still in Cuba. The Cuban Revolution could not have “succeeded” without the help it gets from other countries. For decades, Cuba relied upon the subsidies from the Soviet Union. When the USSR stopped sending money, Cuba opened up and encouraged Cubans in the United States to send money to their relatives in Cuba. When Chavez came to power in Venezuela, he provided Cuba with billions of dollars in oil subsidies. Cuba continues to send doctors to countries throughout Latin America, basically renting them out for foreign exchange. But all is not well. With Venezuela collapsing, Cuba will have to avoid a second Special Period by relying upon tourism and other money for foreigners to keep the economy going. Now you know why Cuba is doing everything it can to encourage Americans to visit Cuba now that they can no longer rely on Venezuela subsidizing their failed national experiment in Cubanomics. Cubans who don’t get money from relatives in the United States can sometimes rely upon family members who work in the private sector to help them out, but the best solution to not relying on a government salary and rations is to actually work in the small, but growing, private sector. Cubans can either supplement their government salary with money earned in the private sector, or they can quit their job and work exclusively in the private sector.Earning in One Hour in the Private Sector What Can Be Earned in a Month in the Public Sector

Before the special period of the 1990s, Cuba was like other countries where doctors, engineers, teachers and other professionals who had valuable skills earned more than those who lacked skills, but today, that is no longer the case. Thousands of doctors, teachers, engineers and other Cuban professionals have quit their jobs in the government sector to drive a taxi (often an old American car from the1950s), open a restaurant (paladar), a bed and breakfast (casa particular) or work in the tourist sector. In one day, some Cubans can make in the private sector what they would make in one month at a government job. Let me give you a few examples. Despite the opening up under Obama, Americans, unlike people from Canada and other countries, are still not allowed to visit Cuba on their own. Instead, they have to visit under the auspices of their visit being an educational trip, a “person-to-person” visit, or one of twelve other permitted categories to visit. To qualify for this exemption, our tour group was provided with a number of educational lectures on our trip. Several of the lecturers came from the University of Havana. Although these speakers might only make $40 per month as a teacher, they could make $200 or more for a one-hour lecture to our tour group. In other words, they made as much in one hour with our tour group as they would have made teaching for five months at the University. Of course, without their position at the University, they would not have gotten the opportunity to lecture us and earn this large supplement to their meagre government salary. Similarly, our tour guide who made about $40 a month from Havanatur, received a tip of $2000 for the week she spent with us, the equivalent of four years’ salary at Havanatur. I think you are beginning to understand the insanity of Cubanomics. You also have to realize that none of these Cubans were “paid” by our tour group. They were either provided with a donation if they were a group of people, or they were provided with a tip if they were an individual. US government law makes it illegal to hire Cubans, but you can always tip or donate money and not violate US government laws. Governments create regulations so people can find a way around them.Cuban Capitalism

Most things in Cuba are inexpensive. A night at a casa particular is about $30-$40 and a meal in a restaurant is around $10-$20. Seven of the people in our tour group went out for dinner and had a full meal, appetizers, drinks, all for $120, about what you might spend for two people in the United States. Standard fare is fish (including lobster and shrimp), pork and chicken, and the alcohol is really cheap. You can always top it off with a Cuban cigar (no limits on bringing them back for your own consumption now). Of course, don’t drink the tap water, unless you want to suffer what I call “Castro’s revenge.” We were told that a waiter at restaurant might receive $200 a month or more in salary, but could make $600 or more in tips and earn $1000 a month at a successful paladar. A chef could make $2000 a month or more. Consequently, jobs in the tourist industry are in high demand and the owner of a paladar can call the shots. Private sector workers in Cuba don’t have the same rights as private sector workers in capitalist countries. If a worker does a poor job, they are immediately fired, no questions asked. There is no labor board to appeal to, no unemployment insurance to collect, no pension or six-months firing bonus to smooth over the transition to another job, just the opportunity to look for new employment. Despite all this, I still heard complaints that it was sometimes difficult finding reliable workers. If you open your own business in Cuba, you can’t franchise your business and reinvest your profits to grow your business. Cubans are allowed to open one restaurant, no more. Your wife can open up a restaurant, but you can’t open up two restaurants. Legally, you can only have 50 seats in a restaurant, but you can call half your paladar a restaurant and half of it a cafeteria and have 100 seats, but you can’t have 200 seats. There is a limit to the number of non-family employees you can hire, but you would be amazed at how many cousins pop out of the woodwork when the inspectors come by. In theory, a restaurant or a bed and breakfast is in a home, and owners simply provide food to customers in their kitchen or rent out one of their bedrooms, but in practice whole houses accommodate a restaurant and every room in a casa particular is turned into a room for rent. To run your business efficiently, you have to have connections, not only to deal with government officials, but to make sure you get supplies of lobster and alcohol and spices and other scarce resources unavailable in regular Cuban stores. One paladar we ate at had salt and pepper from “Kirkland” which had been picked up at Costco on a recent trip to the United States. And of course, Cuban businesses have to deal with Cuban tax collectors who probably have little respect for entrepreneurial Cubans because they are running their own business and making money while the officials are earning a minimal salary as a government employee. Although education is free, many young people wonder why they should spend years in college to get a professional job for which the government pays them only $30 a month when they can join the private sector and make many times that as a waiter or taxi driver immediately, or find a job in another country that pays more than they could ever make in Cuba. At the university, there are no business classes that can lead to the Cuban equivalent of an MBA, which is what Cubans really need. All the entrepreneurial spirit is self-taught. There are even fewer opportunities in small towns. Cubans still use horses and buggies for transportation in rural areas, and there are few if any employment opportunities available, so most young people head for a larger city to find rewarding employment. Since most Cuban youth make little money, they spend their free time doing things that cost little or nothing, meeting up with others, walking along the Malecon in Havana, playing dominos or other games, and so forth. Once in a while, young people celebrate by going to a club, but only if they can afford it. When you finally step outside of the airport building, you see the 1950s American cars that Cuba is well-known for, but of course, these cars provide even more lessons about Cubanomics. Interestingly enough, American cars in Cuba are considered to be part of the Cuban national heritage and cannot be sold to foreigners. A good car in top condition can sell for $75,000. Think of it as a capital investment in a new business. Cars in average condition can be sold for $25,000. Top condition cars are for foreign tourists and command fares in Convertible Pesos. Cars in average condition are used for locals and earn less money for their owners. It is ironic that capitalist cars are a keystone to the Cuban economy today.But things are changing.

The millennials in Cuba grew up with hip-hop and rap just as millennials in the United States did. Cubans have been able to have cell phones and computers since 2006 and there are over 1 million cell phones in Cuba now, most of them brought in from the United States. Although Cubans don’t have telephone plans that provide internet access, they can go to a hot spot, and get a password to access the internet for around $1 per hour. Then like teenagers anywhere, young people can use the Cuban version of FaceTime, text their friends, make phone calls, go onto the internet or do everything else that teenagers in the United States consider a birthright. Cuba does block some internet websites, mainly ones relating to pornography, foreign news, or employment abroad, but there is access. Cubans can get internet connections in their house, but it is horribly expensive, even by American standards. And just think, we learned all this without even having left the Havana airport!The Blockade: a $125 Billion Scapegoat

Once you do leave the airport, you are subjected to Cuban government propaganda. Corporations are not allowed to erect billboards advertising their product in Cuba, but the government is allowed to advertise their own product. Outside of the airport is a billboard paying tribute to Hugo Chavez (the least the country can do for someone who gave Cuba billions of dollars), protestations against the United States embargo (my favorite billboard shows a noose against black with the message: “Bloque: El Genocidio Mas Largo de la Historia” (Embargo: The Longest Genocide in History), and the usual ones praising Che Guevara, Castro and the Cuban Revolution. It is only upon leaving the airport that you realize what the airport didn’t have: a newsstand. Speaking of the blockade, at one of our lectures we were informed that the United States owes Cuba $125 billion for the economic costs the blockade has imposed upon Cuba. I wish the Cuban government luck in getting that amount of money out of Donald Trump. Many people wonder how an economic system and political system that has failed its people has survived for so long, but in some ways, the answer is not that difficult. On the one hand, the Cuban Revolution was homegrown and unlike in Eastern Europe didn’t collapse when the Soviet government collapsed. Castro has consistently allowed his political and economic opponents to leave the country rather than stay in Cuba. That means that anyone who has stayed in Cuba since the Revolution is not going to try and overthrow the political system. Those who are strongly opposed to Castro or who have an entrepreneurial bent went to Florida. Political opponents of the regime are still subject to arrest. On the other hand, letting the country’s critics out of Cuba and sending them to the United States has created the strong opposition to the Cuban government that exists in Florida. The former Cubans in Florida are the ones who have backed the Embargo, the special treatment of Cubans who make it to the United States, financial sanctions against Cuba, and so forth. Since Cuban Americans can’t democratically oppose Castro in Cuba, they democratically oppose Castro in the United States, and since they are lucky enough to live in a swing state, they have influence over US foreign policy. By getting rid of his opponents in Cuba, Castro created even stronger critics in Florida. When we got our lecture on US-Cuban relations, our tour group received a long list of what the United States had to do to accommodate Cuba, mainly remove the embargo, leave Guantanamo, end the special treatment of Cubans arriving in the United States, and so forth. But there was little about what the Cuban government planned to do to give Cubans more economic opportunities and to open up their political system. Probably the only country with more nationalistic propaganda than Cuba is North Korea. Billboards praising Che Guevara, Fidel Castro and Raul Castro, condemning the United States and promoting the revolution with phrases like “Hasta la victoria, siempre” (Onward to victory, forever) are omnipresent, though I think a more accurate phrase today would be “Hasta el turismo, siempre.” The propaganda is also on television (after a list of the wrongs the United States has done against Cuba, the TV ad encourages the United States to end these impositions with an English “Yes we can”. Like any propaganda, the government’s goal is to make its message so pervasive that Cubans don’t even question the contrary. Although Cuba rails against the Embargo, I wonder what the Cuban government would do if they no longer had the United States as a scapegoat to blame their problems on. After all, there are over one hundred other countries in the world that can invest in Cuba, send tourists, freely import and export goods and help the Cuban economy to grow. To blame the United States for all that is wrong with Cuba simply avoids the question of what Cuba has done wrong, and what changes Cuba needs to make for its citizens to improve their standard of living in the absence of any change from the United States. With China and Eastern Europe successfully shaking off the shackles of socialism and enriching their own people, there is no reason why Cuba couldn’t do the same.There is No Such Thing as “One” Starbucks

Yet, many Cubans still don’t understand what capitalism is all about. One of our lecturers told us they were in favoring of allowing in foreign firms as long as they allowed Cubans to maintain 51% ownership. We asked about having Starbucks in Cuba and our lecturer said he thought Cuba should allow “one” Starbucks in Havana. Obviously, the professor just didn’t understand that there is no such thing as “one “ Starbucks. All the Cubans we met were free and happy to answer any questions we had. Everyone in Cuba seems to know someone in the United States or Mexico or another country, so they know what life is like outside of Cuba. But how the government can continue to do a balancing act between Cubans who earn virtually nothing when working for the government and those in the private sector who earn many times what their fellow government employees make is a dialectical tension that can’t go on forever. I had a great time in Cuba and had an economics lesson that I could never have received anywhere else. Although many people go to Cuba to see the old cars from the 1950s, treat your visit to Cuba as a unique lesson in Economics. As one of our fellow travelers told me, “I never appreciated Capitalism until I visited Cuba.” Even Castro is said to have admitted to a foreigner that “the Cuban model doesn’t even work for us anymore.” But if socialism failed in Venezuela which had no embargo and billions of dollars in oil, in China with a billion people and extensive resources, or in the Soviet Union which established a Marxist legacy for the world, why would socialism succeed in a Cuba? The truth is that without the billions in foreign subsidies from the Soviet Union or Venezuela or Florida emigres, the Cuban economy would have collapsed decades ago. Now that Fidel Castro has died, we will see whether the Cuban Revolution was more about Castro than about Communism. Global Financial Data includes information on thousands of businesses that entrepreneurs have created during the past two centuries, and two of these were run by Donald Trump. There are so many different aspects of Donald Trump’s life that we could talk about, but the focus here is on Trump’s two publicly traded companies, Trump Hotels & Casino Resorts Inc. and Trump Entertainment Resorts, Inc.

Global Financial Data includes information on thousands of businesses that entrepreneurs have created during the past two centuries, and two of these were run by Donald Trump. There are so many different aspects of Donald Trump’s life that we could talk about, but the focus here is on Trump’s two publicly traded companies, Trump Hotels & Casino Resorts Inc. and Trump Entertainment Resorts, Inc.

Making Atlantic City Great Again

Although the company earned a gross profit each year, it had about $1.8 billion in outstanding debt, generating around $220 million in interest expenses. After losing money for ten years in a row, the only solution was a restructuring of the company.

The 88 Cent Solution

Morgan Stanley was chosen as the lead arranger to provide the company with additional $500 million in financing under the restructuring in which Trump reduced his interest in the company from 56% to 27%. Under the bankruptcy agreement, shareholders in Trump Hotels & Casino Resorts received 0.001 share in the new company, Trump Entertainment Resorts, Inc., 0.1106736 Class A Common Stock Purchase Warrant and 88 cents in cold cash. Virtually every shareholder lost money.The Third Times a Charm

Although Donald Trump never declared personal bankruptcy, his businesses filed for Chapter 11 bankruptcy protection seven times between 1991 and 2014. The bankruptcies included four of his hotels, the Trump Taj Mahal (1991), Trump Plaza Hotel and Casino (1992), Plaza Hotel (1992), Trump Castle Hotel and Casino (2004) as well as both of his publicly traded companies, Trump Hotels and Casino Resorts, which filed for bankruptcy in 2004 with $1.8 billion in debt and Trump Entertainment Resorts which filed for bankruptcy in 2009 with $500 million in debt. GFD has added data on over 220 companies and over 600 securities listed on the St. Petersburg Stock Exchange between 1865 and 1917 when the Russian Revolution forced the stock exchange to close until the fall of the Soviet Union.

Contrary to popular belief, both Imperial Russia and the St. Petersburg stock exchange were booming before the Russian Revolution occurred. The St. Petersburg Stock Exchange Index outperformed shares on the New York Stock Exchange between the end of the American Civil War in 1865 and the onset of World War I in 1914. Although Russia had one of the largest economies in the world before World War I, it was also a developing country where there were plenty of opportunities for investment in banks, railroads, oil, and other booming sectors.

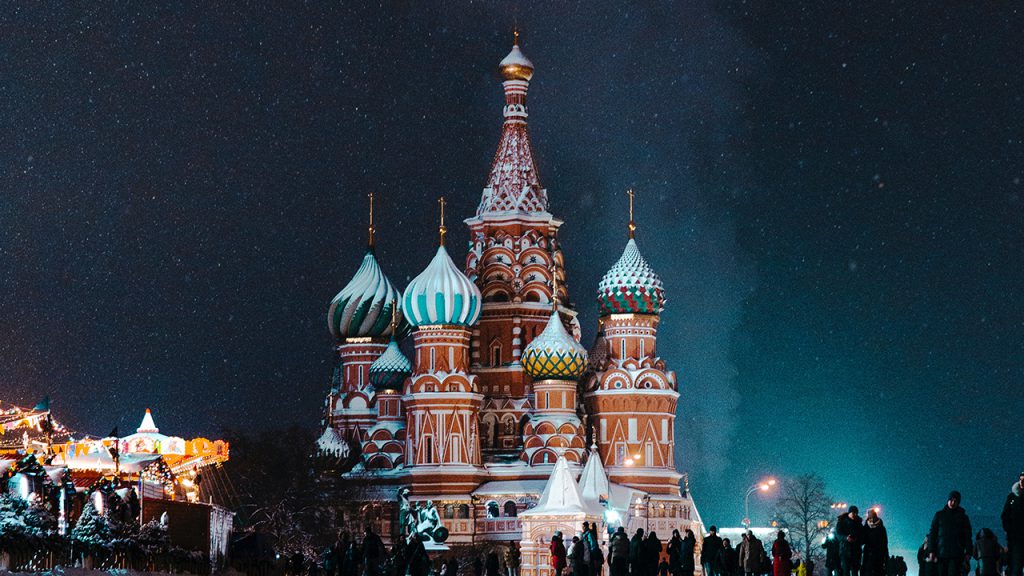

GFD has added data on over 220 companies and over 600 securities listed on the St. Petersburg Stock Exchange between 1865 and 1917 when the Russian Revolution forced the stock exchange to close until the fall of the Soviet Union.

Contrary to popular belief, both Imperial Russia and the St. Petersburg stock exchange were booming before the Russian Revolution occurred. The St. Petersburg Stock Exchange Index outperformed shares on the New York Stock Exchange between the end of the American Civil War in 1865 and the onset of World War I in 1914. Although Russia had one of the largest economies in the world before World War I, it was also a developing country where there were plenty of opportunities for investment in banks, railroads, oil, and other booming sectors.

The stock data are monthly, and are priced in Russian Rubles. The equity data were obtained from the International Center for Finance at Yale. GFD provides both the original names of the companies in Russian and the names of the companies translated into English (Russian External Trade Bank (Русский банк вн ешней торговли) or Keller Vodka Company (Водочный завод “Келлер и К”)). Shares have been classified by sector and industry to aid analysis of the data.

One interesting aspect of the St. Petersburg stock exchange is that individual securities traded on the exchange rather than company shares. Railroads raised money by issuing new issues of common stock which traded simultaneously with other shares. A railroad or bank might have a dozen issues from the same corporation trading simultaneously, all with equal rights and similar prices. Data on these separate issues is included.

Global Financial Data has added monthly data on 88 companies listed on the Copenhagen Stock Exchange between 1893 and 1937. Using the data for these companies, GFD has also calculated 50 proprietary indices for Danish stocks during this period of time.

The data on the individual companies includes both monthly price data and dividends on the top 50 companies listed on the Copenhagen Stock Exchange between 1893 and 1937. Users can download price data for each company as well as a total returns showing the effect of reinvesting dividends. Shares have been classified by sector and industry to aid analysis. Data can be converted into other currencies and adjusted for inflation.

Global Financial Data has added monthly data on 88 companies listed on the Copenhagen Stock Exchange between 1893 and 1937. Using the data for these companies, GFD has also calculated 50 proprietary indices for Danish stocks during this period of time.

The data on the individual companies includes both monthly price data and dividends on the top 50 companies listed on the Copenhagen Stock Exchange between 1893 and 1937. Users can download price data for each company as well as a total returns showing the effect of reinvesting dividends. Shares have been classified by sector and industry to aid analysis. Data can be converted into other currencies and adjusted for inflation.