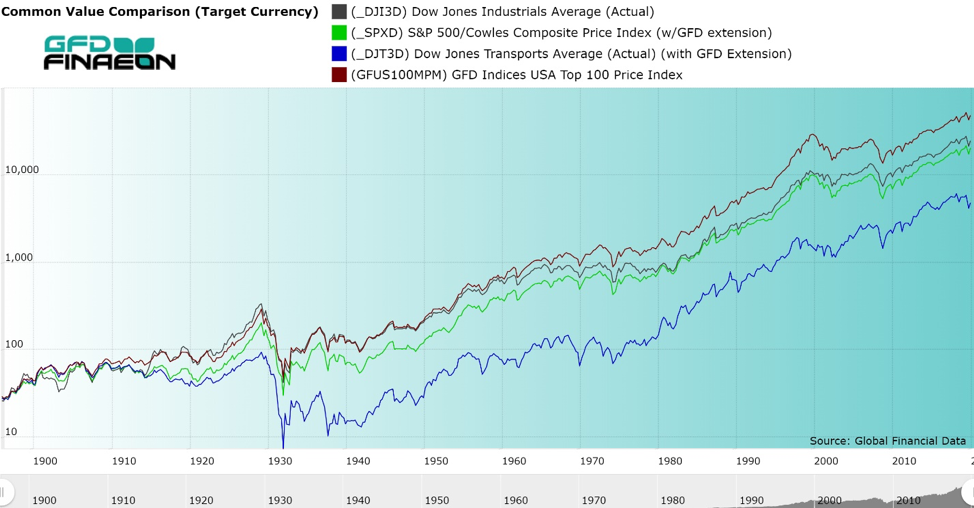

The Dow Jones Industrial Average (DJIA) is one of the three key indices that are used to follow the United States Stock Market. Although it includes only 30 stocks and is an average of stock prices rather than a cap-weighted index of stock prices, it has been around since 1896 and along with the Dow Jones Transport Average, has more daily history than any other stock average in the world. Price data is available for the four main indices with data back to 1896, the Dow Jones Industrial Average, the Dow Jones Transport Average, the S&P Composite and the GFD-100. If we measure the annual returns for these indices from May 1896 when the DJIA began and May 2020, we find that the DJIA returned 5.59% per annum, the DJTA 4.21%, the S&P Composite 5.42% and the GFD-100 returned 6.19% Although the DJIA price index is referred to on a daily basis and includes daily data going back to 1896, the total return version of the index only began on September 30, 1987, when the DJIA was at 2596.28, Dow Jones decided to start calculating the Industrial, Transport, Utilities and Composite Averages on a total return basis using the value of the price index on September 20, 1987 as the base for the DJIA Total Return Index. While the price index closed at 25383.11 on May 29, 2020, the return index closed at 58013.46, more than double the value of the price index. Is it possible to create a total return index that precedes 1987? Of course it is.  Figure 1. DJIA, DJTA, S&P Composite and GFD-100 Price Indices, 1896 to 2020 To do this, we would need two things: historical data for the DJIA price index and dividends that were paid on the stocks that were included in the DJIA. Historical data on the DJIA is readily available, as are the historic components of the DJIA. Next, we found old copies of the Dow Jones Investor’s Handbook which included data on historical quarterly dividends that had been paid on the Dow Jones Industrial Average. Unfortunately, Dow Jones only calculated quarterly dividends for the DJIA back to 1938. That meant that if we were to calculate a total return index back to 1896, we would have to collect historical data on the dividends that each stock that had been in the DJIA paid. Since Global Financial Data has collected all of this information, it was just a matter of putting the information together and making the calculations. How did the DJIA compare on a total return basis to the other three indices with data back to 1896? We will soon find out. A History of the Dow Jones Industrial Average Dow Jones has calculated several stock averages since it introduced its 14 Stock Average in 1885. The first index included 12 railroad stocks and two industrials and was calculated from February 16, 1885 until December 31, 1885. On January 2, 1886, Charles Dow introduced a new index which included 10 railroad stocks and 2 industrial stocks. On September 23, 1889, a second index was introduced which included 20 stocks and which eventually became the Dow Jones Transport Average. The Dow Jones Industrial Average was introduced on May 26, 1896 and has been calculated daily since then. Of course, in 1896, there were no computers which could calculate the Average in real time as occurs today. At the end of each day, Charles Dow simply added up the price of each of the stocks in the Average and divided the total by 12. That gave him the average value of the stocks that were included in the DJIA. It should be remembered that until October 13, 1915, stocks that were listed on the NYSE were quoted as a percentage of par, so if each stock had been at par, whether the par value for the stock was $10, $50 or $100, the average price would have equaled 100. As stocks deviated from their par value, the index would change to reflect the new prices. Dividends were also quoted as a percentage of par, so as long as prices and dividends were quoted as a percent of par, calculating the average was simple. During the 1800s, preferred stocks were often traded as much if not more than the common stocks of some companies and were often included in the DJIA. United States Steel, which had issued $500 million of common and $500 million of preferred when it issued shares in 1901 had both its common and its preferred included in the Dow Jones Industrial Average. Before World War I, most companies issued both common and preferred stocks, and if the preferred was commonly traded, it was included in the DJIA or Dow Jones Rail Average. Moreover, not all stocks paid dividends on a quarterly basis. Before World War I, many stocks only paid a dividend only twice a year. Dollars, Percents and Splits Unfortunately, things didn’t stay that way. On October 13, 1915, the NYSE changed their rules and decided to quote all stocks at their nominal dollar value, not as a percent of par. This meant that Pennsylvania Railroad, Philadelphia & Reading and Lehigh Valley stock, which had a $50 par, would be quoted at half of its former price. Utah Copper, which had a $10 par would be quoted at one-tenth of its par price. This meant that in order to calculate the Average, you had to assume that two shares of Pennsylvania Railroad stock were included in the Rail Average to maintain its weight in the Rail Average, but that could be easily done. General Motors was added to the DJIA on March 16, 1915. Its stock shot up in price and the company decided to split its stock five-to-one on December 15, 1916. How would you handle that? Dow had an easy solution, remove it from the average. General Electric had been removed from the DJIA on September 15, 1898 when it did a reverse split. On October 4, 1916, a new list of 20 industrial stocks was introduced to replace the old 12-stock Industrial Average. General Motors was kicked out of the DJIA and stayed out until August 31, 1925. To provide some history, the 20-share Average was calculated back to December 12, 1914 when the NYSE had opened up following its closure on July 31, 1914 when World War I began. Surprisingly, the DJIA did not decline while the NYSE was closed between July and December. We calculated the DJIA during the closure using bid-ask prices that were quoted for stocks by brokers on the curb. Although the DJIA did decline into October, by December, stocks had fully recovered in anticipation of the strong performance of “war babies” selling goods to the European powers trying to kill each other. After the War, Texaco split its stock, laying the foundation for numerous stock splits that would plague the DJIA in the Roaring Twenties. Of course, stocks also paid stock dividends, but these were generally ignored by the DJIA. If a stock paid a 10% dividend or even a 25% dividend, it did impact the price of the stock, driving the price down by the amount of the stock dividend, but until stock splits occurred, these were ignored by Dow. Of course, you have to understand the difference between a stock split and a stock dividend. A stock dividend provided you more of the same stock. So if a company had 1,000,000 shares of $100 par stock outstanding and issued a 20% stock dividend, you would have 120 shares of $100 par stock rather than 100 shares. The price of the stock would decline by 20%, but no more. What this does is to create a downward bias in the DJIA. If a company increases the number of shares by 20%, the stock price will decline by 20% reducing the value of the average, but since there is no adjustment in the stock index, the stock index will appear to have fallen. The same would be true of a rights distribution or a stock distribution that reduced the price of the stock. General Electric provided rights distributions in 1905, 1906, 1918 and 1920, a 30% stock dividend in 1913 (and the DJIA fell 4%), and stock distributions each year between 1922 and 1926 and in 1932. All of these actions reduced the price of General Electric stock without being taken into consideration in the value of the DJIA. On the other hand, if there were a stock split, you would receive new shares to replace the old. In the case of Texaco (then known as the Texas Co.), the first DJIA stock to split, shareholders received 4 new $25 par shares in exchange for 1 old $100 par share. So how do you deal with that? Simply take the new price of the stock, multiply by 4 and assume the Average included four shares of Texaco instead of one. But Texaco wasn’t the only stock to split. It was followed by American Car & Foundry, General Electric, Studebaker, American Locomotive, American Can, American Tobacco and Sears. Each time a stock split, you had to multiply the number of shares in the DJIA by the size of the split, so by 1928 the DJIA included 4 Texaco shares, 2 American Car & Foundry, 4 General Electric, 2.5 Studebaker, 2 American Locomotive, 6 American Can, 2 American Tobacco and 4 Sears. Obviously, calculating the DJIA was getting very complicated. Dow came up with a solution to this problem in 1928. It introduced the concept of a divisor. On October 1, 1928, the number of stocks in the DJIA was increased from 20 to 30 and a divisor was introduced to calculate the average. Now you added up the price of all the stocks and instead of dividing by the number of stocks in the Average, you divided by the divisor. If a new stock were added or a stock split, you simply changed the value of the divisor. The divisor was set at 16.67 on October 1, 1928 to reflect the impact of the stock splits that had occurred before then. Since then, the divisor has steadily declined, and today the divisor for the DJIA stand at about 0.1458. So if you want to calculate the value of the DJIA on your own, sum up the price of the 30 members, divide the sum by 0.1458 and you will get the value of the Dow Jones Industrial Average. Although very few of the stocks that are included in the Averages today provide small stock dividends to its shareholders, historically, some of the stocks did provide stock distributions and rights distributions that were not included in the divisor. For example, on December 15, 1932, GE distributed 1/6 share of Radio Corp. of America to shareholders, but this did not affect the DJIA divisor. So as you can see, what first looks like a very simple process of adding up the values of the stocks and the dividends and adjusting the prices of the stocks for those dividends is in reality a very complicated action. Nevertheless, it is doable. Collecting the Data We were able to collect quarterly dividend data from the Dow Jones Handbooks back to 1938. This meant that we would have to collect dividend data on the stocks that were included in the Dow Jones Industrial Average before 1938. Our goal was to create a quarterly “dividend” that would be paid out to the Dow Jones Industrial Average just as if it were a stock. We collected data for each of the components of each index going back to 1885, the 14-stock Average in 1885, the 12-stock Average between 1886 and 1896, the 12 Industrial stocks between 1896 and September 1916, the 20-stock Average between August 1914 and September 1928 and the 30-stock Average beginning in October 1928. We adjusted the value of the dividends when the par was different from $100 or when there was a split. So after Texaco stock split in 1920, we simply multiplied all subsequent dividends by four as if you were holding 4 shares of $25 par stock instead of 1 share of $100 par stock. We were able to obtain information on the DJIA divisor beginning in October 1928 and used this value to divide the sum of the dividends by the DJIA divisor so we could get an accurate calculation of the dividend that would have been paid to shareholders each quarter.

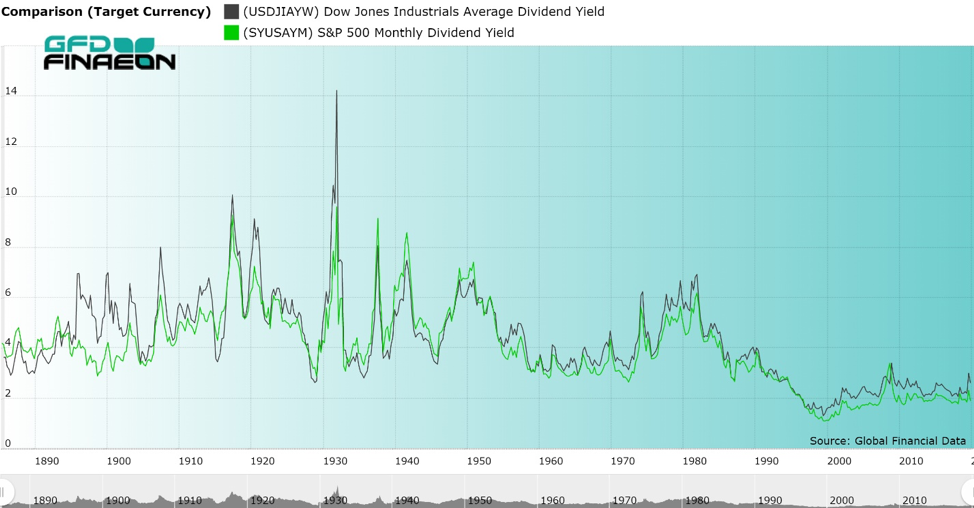

Figure 1. DJIA, DJTA, S&P Composite and GFD-100 Price Indices, 1896 to 2020 To do this, we would need two things: historical data for the DJIA price index and dividends that were paid on the stocks that were included in the DJIA. Historical data on the DJIA is readily available, as are the historic components of the DJIA. Next, we found old copies of the Dow Jones Investor’s Handbook which included data on historical quarterly dividends that had been paid on the Dow Jones Industrial Average. Unfortunately, Dow Jones only calculated quarterly dividends for the DJIA back to 1938. That meant that if we were to calculate a total return index back to 1896, we would have to collect historical data on the dividends that each stock that had been in the DJIA paid. Since Global Financial Data has collected all of this information, it was just a matter of putting the information together and making the calculations. How did the DJIA compare on a total return basis to the other three indices with data back to 1896? We will soon find out. A History of the Dow Jones Industrial Average Dow Jones has calculated several stock averages since it introduced its 14 Stock Average in 1885. The first index included 12 railroad stocks and two industrials and was calculated from February 16, 1885 until December 31, 1885. On January 2, 1886, Charles Dow introduced a new index which included 10 railroad stocks and 2 industrial stocks. On September 23, 1889, a second index was introduced which included 20 stocks and which eventually became the Dow Jones Transport Average. The Dow Jones Industrial Average was introduced on May 26, 1896 and has been calculated daily since then. Of course, in 1896, there were no computers which could calculate the Average in real time as occurs today. At the end of each day, Charles Dow simply added up the price of each of the stocks in the Average and divided the total by 12. That gave him the average value of the stocks that were included in the DJIA. It should be remembered that until October 13, 1915, stocks that were listed on the NYSE were quoted as a percentage of par, so if each stock had been at par, whether the par value for the stock was $10, $50 or $100, the average price would have equaled 100. As stocks deviated from their par value, the index would change to reflect the new prices. Dividends were also quoted as a percentage of par, so as long as prices and dividends were quoted as a percent of par, calculating the average was simple. During the 1800s, preferred stocks were often traded as much if not more than the common stocks of some companies and were often included in the DJIA. United States Steel, which had issued $500 million of common and $500 million of preferred when it issued shares in 1901 had both its common and its preferred included in the Dow Jones Industrial Average. Before World War I, most companies issued both common and preferred stocks, and if the preferred was commonly traded, it was included in the DJIA or Dow Jones Rail Average. Moreover, not all stocks paid dividends on a quarterly basis. Before World War I, many stocks only paid a dividend only twice a year. Dollars, Percents and Splits Unfortunately, things didn’t stay that way. On October 13, 1915, the NYSE changed their rules and decided to quote all stocks at their nominal dollar value, not as a percent of par. This meant that Pennsylvania Railroad, Philadelphia & Reading and Lehigh Valley stock, which had a $50 par, would be quoted at half of its former price. Utah Copper, which had a $10 par would be quoted at one-tenth of its par price. This meant that in order to calculate the Average, you had to assume that two shares of Pennsylvania Railroad stock were included in the Rail Average to maintain its weight in the Rail Average, but that could be easily done. General Motors was added to the DJIA on March 16, 1915. Its stock shot up in price and the company decided to split its stock five-to-one on December 15, 1916. How would you handle that? Dow had an easy solution, remove it from the average. General Electric had been removed from the DJIA on September 15, 1898 when it did a reverse split. On October 4, 1916, a new list of 20 industrial stocks was introduced to replace the old 12-stock Industrial Average. General Motors was kicked out of the DJIA and stayed out until August 31, 1925. To provide some history, the 20-share Average was calculated back to December 12, 1914 when the NYSE had opened up following its closure on July 31, 1914 when World War I began. Surprisingly, the DJIA did not decline while the NYSE was closed between July and December. We calculated the DJIA during the closure using bid-ask prices that were quoted for stocks by brokers on the curb. Although the DJIA did decline into October, by December, stocks had fully recovered in anticipation of the strong performance of “war babies” selling goods to the European powers trying to kill each other. After the War, Texaco split its stock, laying the foundation for numerous stock splits that would plague the DJIA in the Roaring Twenties. Of course, stocks also paid stock dividends, but these were generally ignored by the DJIA. If a stock paid a 10% dividend or even a 25% dividend, it did impact the price of the stock, driving the price down by the amount of the stock dividend, but until stock splits occurred, these were ignored by Dow. Of course, you have to understand the difference between a stock split and a stock dividend. A stock dividend provided you more of the same stock. So if a company had 1,000,000 shares of $100 par stock outstanding and issued a 20% stock dividend, you would have 120 shares of $100 par stock rather than 100 shares. The price of the stock would decline by 20%, but no more. What this does is to create a downward bias in the DJIA. If a company increases the number of shares by 20%, the stock price will decline by 20% reducing the value of the average, but since there is no adjustment in the stock index, the stock index will appear to have fallen. The same would be true of a rights distribution or a stock distribution that reduced the price of the stock. General Electric provided rights distributions in 1905, 1906, 1918 and 1920, a 30% stock dividend in 1913 (and the DJIA fell 4%), and stock distributions each year between 1922 and 1926 and in 1932. All of these actions reduced the price of General Electric stock without being taken into consideration in the value of the DJIA. On the other hand, if there were a stock split, you would receive new shares to replace the old. In the case of Texaco (then known as the Texas Co.), the first DJIA stock to split, shareholders received 4 new $25 par shares in exchange for 1 old $100 par share. So how do you deal with that? Simply take the new price of the stock, multiply by 4 and assume the Average included four shares of Texaco instead of one. But Texaco wasn’t the only stock to split. It was followed by American Car & Foundry, General Electric, Studebaker, American Locomotive, American Can, American Tobacco and Sears. Each time a stock split, you had to multiply the number of shares in the DJIA by the size of the split, so by 1928 the DJIA included 4 Texaco shares, 2 American Car & Foundry, 4 General Electric, 2.5 Studebaker, 2 American Locomotive, 6 American Can, 2 American Tobacco and 4 Sears. Obviously, calculating the DJIA was getting very complicated. Dow came up with a solution to this problem in 1928. It introduced the concept of a divisor. On October 1, 1928, the number of stocks in the DJIA was increased from 20 to 30 and a divisor was introduced to calculate the average. Now you added up the price of all the stocks and instead of dividing by the number of stocks in the Average, you divided by the divisor. If a new stock were added or a stock split, you simply changed the value of the divisor. The divisor was set at 16.67 on October 1, 1928 to reflect the impact of the stock splits that had occurred before then. Since then, the divisor has steadily declined, and today the divisor for the DJIA stand at about 0.1458. So if you want to calculate the value of the DJIA on your own, sum up the price of the 30 members, divide the sum by 0.1458 and you will get the value of the Dow Jones Industrial Average. Although very few of the stocks that are included in the Averages today provide small stock dividends to its shareholders, historically, some of the stocks did provide stock distributions and rights distributions that were not included in the divisor. For example, on December 15, 1932, GE distributed 1/6 share of Radio Corp. of America to shareholders, but this did not affect the DJIA divisor. So as you can see, what first looks like a very simple process of adding up the values of the stocks and the dividends and adjusting the prices of the stocks for those dividends is in reality a very complicated action. Nevertheless, it is doable. Collecting the Data We were able to collect quarterly dividend data from the Dow Jones Handbooks back to 1938. This meant that we would have to collect dividend data on the stocks that were included in the Dow Jones Industrial Average before 1938. Our goal was to create a quarterly “dividend” that would be paid out to the Dow Jones Industrial Average just as if it were a stock. We collected data for each of the components of each index going back to 1885, the 14-stock Average in 1885, the 12-stock Average between 1886 and 1896, the 12 Industrial stocks between 1896 and September 1916, the 20-stock Average between August 1914 and September 1928 and the 30-stock Average beginning in October 1928. We adjusted the value of the dividends when the par was different from $100 or when there was a split. So after Texaco stock split in 1920, we simply multiplied all subsequent dividends by four as if you were holding 4 shares of $25 par stock instead of 1 share of $100 par stock. We were able to obtain information on the DJIA divisor beginning in October 1928 and used this value to divide the sum of the dividends by the DJIA divisor so we could get an accurate calculation of the dividend that would have been paid to shareholders each quarter.  Figure 2. Dow Jones Industrial Average & S&P Composite Dividend Yield, 1886 to 2020 The yield on the DJIA and the S&P Composite from 1886 until 2020 is illustrated in Figure 2. From 1890 until 1990, the yield averaged between 4 and 5 percent. During periodic market crashes, the yield would rise, increasing to 14% in June 1932 at the height of the Great Depression. The 1980s and 1990s saw a collapse in the yield as it declined from 6.99% in 1980 to 1.3% in 2000. Since then, it has moved back up, hitting 3% in April 2020. All of this data is available to subscribers to the Global Financial Database. The quarterly dividends can be found in the file USDJIADQ and the annual sum of the quarterly dividends in USDJIADM. The dividend yield for the DJIA is available in USDJIAYW and the Total Return for the DJIA is available in _DJITRD. We have calculated the index back to 1886 when the 12-stock index that included both railroad and industrials began. We have used the 12-stock average up to July 1914 and the 20-stock Average beginning in August 1914. The 30-stock Average begins on October 1, 1928. Results So what did we find out from all of this work? We found that the Dow Jones Industrial Average outperformed the S&P 500 and the Dow Jones Transports but underperformed the GFD-100 Index. This is illustrated in Figure 3. On average, including dividends, the Dow Jones Industrial Average returned 10.26% per annum between May 1896 and May 2020. You can contrast this with returns of 8.40% to the Dow Jones Rail/Transport Average, 9.70% to the S&P Composite and 10.36% to the GFD-100 Index which includes the top 100 stocks in the United States each year regardless of its sector. The DJIA clearly beat the S&P Composite on a total return basis. The differences between the two indices is not significant, but it is interesting that over a 124-year period, the differences in the return between the 30 stocks in the DJIA and the 500 stocks in the S&P Composite would be so small, especially given the fact that one is an average of stock prices and the other is a cap-weighted index of stocks. On the other hand, if you compare the DJIA and the Dow Jones Rails/Transports Average since 1889, as illustrated in Figure 4, you can see that the differences in the returns are significantly different. While the DJIA returned 10.26% per annum, the DJTA returned only 8.43% per annum. Obviously, the sector you choose makes a difference.

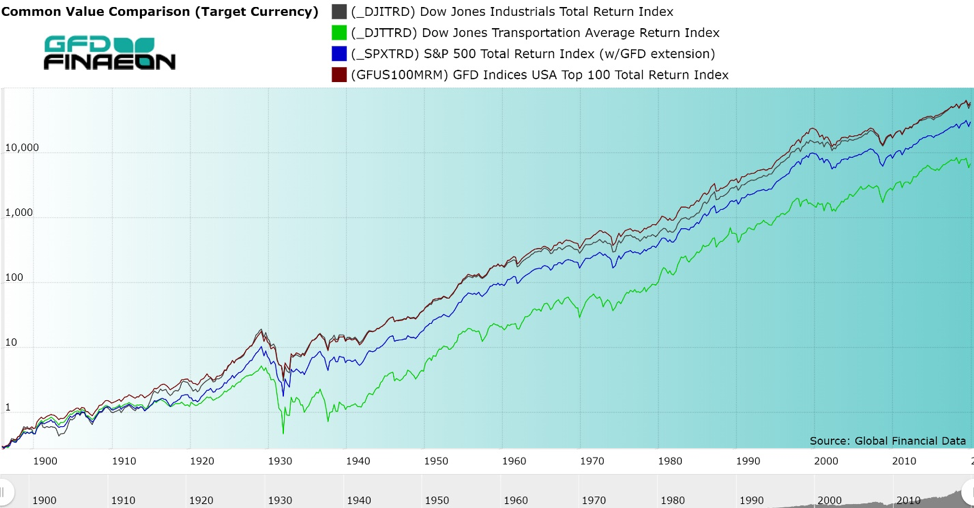

Figure 2. Dow Jones Industrial Average & S&P Composite Dividend Yield, 1886 to 2020 The yield on the DJIA and the S&P Composite from 1886 until 2020 is illustrated in Figure 2. From 1890 until 1990, the yield averaged between 4 and 5 percent. During periodic market crashes, the yield would rise, increasing to 14% in June 1932 at the height of the Great Depression. The 1980s and 1990s saw a collapse in the yield as it declined from 6.99% in 1980 to 1.3% in 2000. Since then, it has moved back up, hitting 3% in April 2020. All of this data is available to subscribers to the Global Financial Database. The quarterly dividends can be found in the file USDJIADQ and the annual sum of the quarterly dividends in USDJIADM. The dividend yield for the DJIA is available in USDJIAYW and the Total Return for the DJIA is available in _DJITRD. We have calculated the index back to 1886 when the 12-stock index that included both railroad and industrials began. We have used the 12-stock average up to July 1914 and the 20-stock Average beginning in August 1914. The 30-stock Average begins on October 1, 1928. Results So what did we find out from all of this work? We found that the Dow Jones Industrial Average outperformed the S&P 500 and the Dow Jones Transports but underperformed the GFD-100 Index. This is illustrated in Figure 3. On average, including dividends, the Dow Jones Industrial Average returned 10.26% per annum between May 1896 and May 2020. You can contrast this with returns of 8.40% to the Dow Jones Rail/Transport Average, 9.70% to the S&P Composite and 10.36% to the GFD-100 Index which includes the top 100 stocks in the United States each year regardless of its sector. The DJIA clearly beat the S&P Composite on a total return basis. The differences between the two indices is not significant, but it is interesting that over a 124-year period, the differences in the return between the 30 stocks in the DJIA and the 500 stocks in the S&P Composite would be so small, especially given the fact that one is an average of stock prices and the other is a cap-weighted index of stocks. On the other hand, if you compare the DJIA and the Dow Jones Rails/Transports Average since 1889, as illustrated in Figure 4, you can see that the differences in the returns are significantly different. While the DJIA returned 10.26% per annum, the DJTA returned only 8.43% per annum. Obviously, the sector you choose makes a difference.  Figure 3. DJIA, DJTA, S&P Composite and GFD-100 Total Return Indices, 1896 to 2020 One of the most interesting discoveries of this research is how dividends have changed over the past 130 years. This is illustrated in Figure 4. Up until World War II, dividends were extremely volatile, collapsing during the downturns that occurred in 1895, 1903, 1915 and the 1930s. However, since 1945, dividends have followed a steady path upward, consistently rising almost every year. The steady increase in dividends to companies in the DJIA has sustained the steady returns that investors have enjoyed.

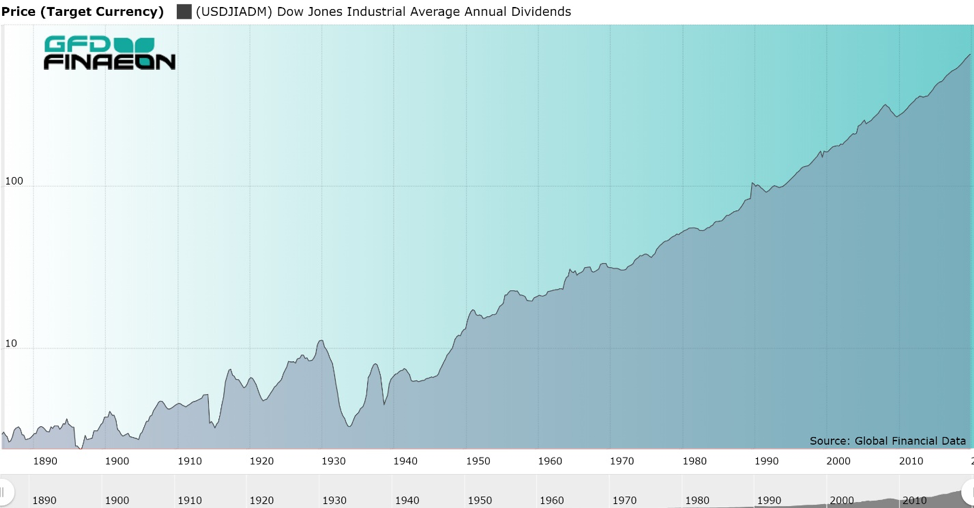

Figure 3. DJIA, DJTA, S&P Composite and GFD-100 Total Return Indices, 1896 to 2020 One of the most interesting discoveries of this research is how dividends have changed over the past 130 years. This is illustrated in Figure 4. Up until World War II, dividends were extremely volatile, collapsing during the downturns that occurred in 1895, 1903, 1915 and the 1930s. However, since 1945, dividends have followed a steady path upward, consistently rising almost every year. The steady increase in dividends to companies in the DJIA has sustained the steady returns that investors have enjoyed.  Figure 4. Dow Jones Industrial Average Annual Dividend, 1886 to 2020 Conclusion Until now, no one has calculated the Dow Jones Industrial Average on a total return basis back to 1896. Although data for the price index has been around for 125 years, data on the total returns have only existed since 1987 when Dow Jones first started calculating a daily total return index for the Dow Jones Industrials, Transports, Utilities and Composite Averages. Although the Averages began as relatively simple indices to calculate, simply adding up the prices of the components and then dividing by the number of stocks that were included in the Averages, the impact of changes in the components, stocks splits, different pars, stock distributions and other corporate actions has made a relatively simple task quite complex. Today, the impact of all of these actions are included in the divisor which changes whenever there is a stock split or a change in the components of the Average. If you compare the returns to the DJIA, the S&P Composite and the GFD-100, they are remarkably similar, even though you are looking at returns over a period of almost 125 years. On the other hand, if you compare the returns to the Dow Jones Rails/Transports Average with the Dow Jones Industrials Average, the returns are significantly different. The lesson to be learned here is that sector is more important than size. US stocks have provided solid returns over the past 125 years and there is no reason to believe that this won’t continue to be true.

Figure 4. Dow Jones Industrial Average Annual Dividend, 1886 to 2020 Conclusion Until now, no one has calculated the Dow Jones Industrial Average on a total return basis back to 1896. Although data for the price index has been around for 125 years, data on the total returns have only existed since 1987 when Dow Jones first started calculating a daily total return index for the Dow Jones Industrials, Transports, Utilities and Composite Averages. Although the Averages began as relatively simple indices to calculate, simply adding up the prices of the components and then dividing by the number of stocks that were included in the Averages, the impact of changes in the components, stocks splits, different pars, stock distributions and other corporate actions has made a relatively simple task quite complex. Today, the impact of all of these actions are included in the divisor which changes whenever there is a stock split or a change in the components of the Average. If you compare the returns to the DJIA, the S&P Composite and the GFD-100, they are remarkably similar, even though you are looking at returns over a period of almost 125 years. On the other hand, if you compare the returns to the Dow Jones Rails/Transports Average with the Dow Jones Industrials Average, the returns are significantly different. The lesson to be learned here is that sector is more important than size. US stocks have provided solid returns over the past 125 years and there is no reason to believe that this won’t continue to be true.

REQUEST A DEMO with a GFDFinaeon Specialist