Today there are only two stock exchanges in the United States, the New York Stock Exchange (NYSE) and the NASDAQ. The NYSE Amex LLC is owned by the NYSE. This wasn’t the case 225 years ago or 100 years. There have been dozens of exchanges that have existed in the United States over the past 200 years. Unfortunately, very few investors are aware that regional stock exchanges played an important role in financial markets until World War II. Over time, thousands of stocks were listed on the regional exchanges that were not listed on the New York Stock Exchange, NASDAQ or AMEX, these stocks have been overlooked because until now data on those stocks was unavailable. Any stock market analysis that explores the beginning of the US Stock Market in 1786 until the present must include data from the regional exchanges. It wasn’t until the growth of the railroads and the introduction of the telegraph in the 1840s that the NYSE began to dominate national stock markets. Global Financial Data has collected data from all of the major regional exchanges and has put together indices of the regional exchanges so their performance can be analyzed over time.

Beginning of Regionals

Richard E. Sylla, Jack Wilson and Richard E. Wright collected data on U.S. regional exchanges between 1786 and 1862 and made the data available in “The Price Quotations in Early U.S. Securities Markets, 1790 to 1860.” They collected data for stock markets in Alexandria, Baltimore, Boston, Charleston, New Orleans, New York, Norfolk, Philadelphia and Richmond. We have taken this data and incorporated it into the Global Financial Database. However, this leaves the question, what happened in the United States after Sylla, Wilson and Wright’s database ended? Data is available from Sylla, Wilson and Wright for Philadelphia through 1850, New York through 1853, Boston through 1859 and Baltimore through 1862.

There are other sources for data that allow us to extend these data sources after 1850. The Commercial and Financial Chronicle began publishing in July 1865 so it can be used to provide data from 1865 until 1972. For stocks that traded between 1850 and 1865, we collected data from local newspapers to fill in the gap between 1850 and 1865.

We took the data in the Sylla database in order to determine the number of stocks in different sectors and how this evolved over time. The four primary stock markets were in Boston, New York, Philadelphia and Baltimore. The stock markets in Alexandria, Charleston, New Orleans, Norfolk and Richmond were small and traded few stocks.

Originally, each of the four major exchanges served their local markets. In 1800, New York was not yet the primary exchange in the United States. Banks, insurance companies, manufacturing companies, canals and turnpikes listed on a local exchange. Only federal government securities, such as the U.S. 6% or 3% bonds and shares in the Bank of the United States listed on multiple exchanges. Shares in both the First Bank of the United States and the Second Bank of the United States listed on the Baltimore, Boston, London, New York, Norfolk, and Philadelphia stock exchanges. Similarly, U.S. Federal Government 3% bonds listed in Baltimore, Boston, Charleston, London, New York, Philadelphia and Richmond. Government bonds and shares in the Banks of the United States were the most active securities on each of the regional exchanges and only in that way was there a national securities market.

The Philadelphia Stock Exchange

In the 1700s and early 1800s, Philadelphia was the commercial capital of the United States. The Philadelphia Stock Exchange was founded in 1790 while the Buttonwood Agreement, which laid down the rules for trading stocks in New York, was signed in 1792. Both the First and the Second Banks of the United States were located in Philadelphia.

Philadelphia was the capital of the United States between 1790 and 1800, the First Bank of the United States was in Philadelphia as was the United States Mint. When Alexander Hamilton reorganized the United States’ finances in 1792, shares in the 3% and 6% stock began trading in Philadelphia and elsewhere.

During the 1820s, New York City became the primary port for the United States, in part because the Erie Canal was opened in 1825, linking the Great Lakes to Albany and via the Hudson to New York City. When Andrew Jackson withdrew his support for the Second Bank of the United States, Philadelphia’s claim to being the financial center of the United States evaporated. Had Philadelphia maintained its control over financial markets in the United States, we would be talking about Chestnut Street, not Wall Street. In the 1830s, railroads began springing up around the country. Unlike banks, insurance companies, canals or turnpikes, railroads crossed state borders and spread through the United States. Railroads listed where capital markets were deepest, and by the 1840s that was clearly in New York.

Table 1 shows the growth in the number of stocks that traded in Baltimore, Boston, New York and Philadelphia by decade between 1790 and 1850 using data from Sylla, et al. Although Boston had the largest number of stocks, most of these were local companies. By capitalization, New York was clearly the largest stock exchange.

|

Year |

Baltimore |

Boston |

New York |

Philadelphia |

Total |

|

1790 |

1 |

1 |

|||

|

1800 |

2 |

5 |

6 |

8 |

|

|

1810 |

23 |

6 |

16 |

19 |

48 |

|

1820 |

24 |

8 |

23 |

25 |

57 |

|

1830 |

36 |

33 |

40 |

34 |

105 |

|

1840 |

40 |

83 |

58 |

66 |

193 |

|

1850 |

26 |

132 |

54 |

52 |

214 |

Table 1. Stocks Trading on Regional Exchanges, 1790 to 1850

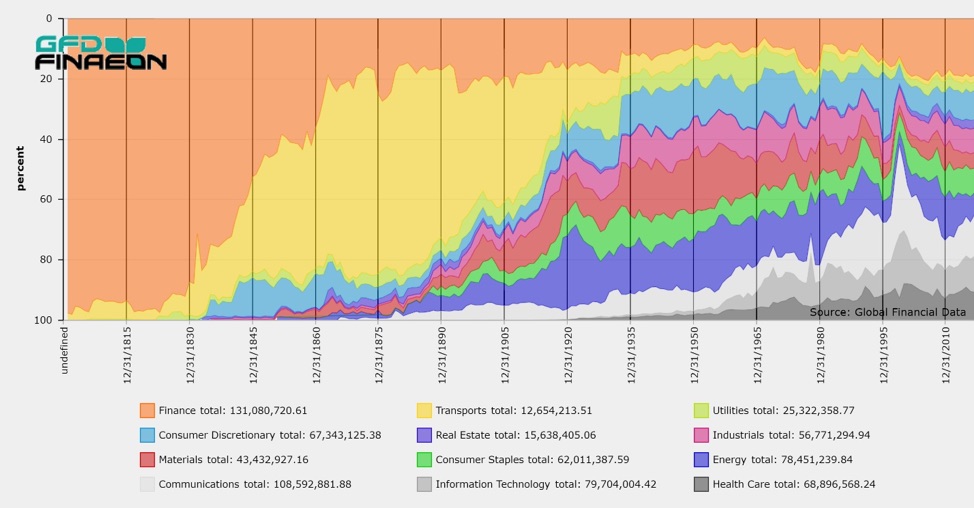

As Figure 1 shows, railroads became the dominant sector in the United States in the 1830s. The growth of railroads favored deep capital markets such as New York over local capital markets such as Boston, Philadelphia or Baltimore. The introduction of the telegraph in the 1840s enabled capital markets to centralize even more since investors no longer had to be in Boston, New York or Philadelphia to buy and sell stocks. Investors could wire their orders to brokers in New York and receive a wire back. In 1866, the transatlantic cable was laid and London was connected to New York by cable for the first time. It no longer took a week to send information from London to New York, but minutes.

Figure 1. Sectoral Allocation in the United States, 1800 to 2018

Although the New York Stock Exchange was the largest exchange by market cap, the Boston Stock Exchange, founded in 1834, had more companies listed on its exchange. In addition to the bank and insurance stocks that were listed in Boston, there were a large number of railroads, Michigan mining stocks, and local manufacturing stocks that operated in Massachusetts; however, none of these companies had a national reach.

Before the Civil War, there were two Panics in 1837 and 1857 that drove the American economy into a depression. Each of the regional stock markets was affected by these Panics, but to different degrees because financial markets were not as integrated before the war. When Panics hit in 1869, 1873, 1884, 1893, 1901 and 1907, they were all centered in New York City which had become the financial center of the United- States.

New York City and the Civil War

By the start of the Civil War, Wall Street was clearly the financial center of the United States. Exchanges in Boston, Philadelphia and Baltimore might provide markets for local companies, but any corporation that was of sufficient size to operate across state lines listed on Wall Street. Competition with the New York Stock Exchange would no longer come from regional exchanges in Boston, Philadelphia or Baltimore, but from new exchanges located in New York City that competed directly with the NYSE.

The Open Board began operating in 1863 and offered access to anyone who paid the membership fee. Instead of relying upon twice-daily auctions as the NYSE did, it provided continuous trading. The NYSE carried out two auctions each day, so providing trading throughout the day was an innovation that gave the Open Board an advantage over the NYSE. In addition to the Open Board, the Gold Exchange allowed investors to speculate on the price of gold relative to the paper money the Union was using to fund the Civil War. In 1869 both the Open Board and the Gold Exchange merged with the New York Stock Exchange to form a single exchange. If you can’t beat them, absorb them.

During the 1870s, several new stock exchanges were established in New York. The New York Mining Stock Exchange was founded in 1875. It consolidated with the National Petroleum Exchange in 1883 and with the New York Petroleum Exchange and Stock Board in 1885 to form the Consolidated Stock Exchange. In addition to mining stocks, the Consolidated traded odd lots of NYSE listed stocks. Trading on the NYSE was only in round lots of 100 shares. Trading in NYSE-listed stocks brought down the wrath of the NYSE on the Consolidated Stock Exchange which eventually drove the Consolidated Exchange out of business, though not until the 1920s.

Any stock that was not listed on the NYSE was traded “on the curb” outside of the New York Stock Exchange. Curbstone brokers made sure that they did not trade any stock that listed on the NYSE to keep the NYSE from trying to shut them down. If a stock was traded on the curb and it began trading on the NYSE, the curb brokers would drop the stock from their list. The NYSE tolerated the curbside brokers as long as (1) they didn’t trade any stock listed on the NYSE and (2) they traded stocks outside the NYSE and didn’t move indoors to trade stocks as the Consolidated Stock Exchange had done.

The growing importance of the curb became obvious in 1907 when the two primary stocks that drove the “Rich Man’s Panic” of 1907, United Copper and Knickerbocker Trust were both traded on the curb, not on the NYSE. Wall Street, and in particular, the “money trust” was blamed for the Panic of 1907. Critics alleged that J.P. Morgan and the banks ran the financial markets for their own benefit, not that of the public. The House Committee on Banking and Currency, also known as the Pujo Committee, investigated the causes of the Panic of 1907. The curbstone brokers used the threat of the NYSE’s monopoly control over the financial markets to organize and establish the New York Curb in 1921.

Meanwhile, new regional stock exchanges were being founded throughout the country. Whenever there was a gold strike, a local exchange would be founded to raise capital for mines and to trade mining stocks. The exchange would close after the gold rush was over with, but over time new exchanges were established in the larger cities of the United States. Regional stock exchanges were opened in Pittsburgh (1864), New Orleans (1880), Chicago, (1882), San Francisco (1882), Washington (1884), Cincinnati (1885), Cleveland (1899), Los Angeles (1899), St. Louis (1899) and Detroit (1907). Of these exchanges, the Chicago Stock Exchange became the largest. Table 2 illustrates the rise and fall of the regional exchanges between 1880 and 1940.

|

Boston |

Philadelphia |

Baltimore |

Chicago |

NYSE |

|

|

1880 |

17 |

15 |

3 |

153 |

|

|

1890 |

71 |

42 |

16 |

12 |

267 |

|

1900 |

230 |

136 |

52 |

34 |

330 |

|

1910 |

182 |

89 |

48 |

58 |

344 |

|

1920 |

181 |

75 |

64 |

111 |

698 |

|

1930 |

150 |

72 |

58 |

454 |

1441 |

|

1940 |

78 |

34 |

31 |

287 |

1014 |

Table 2. Stocks Listed on Different Exchanges, 1880 to 1940

In addition to listing local stocks, regional exchanges also listed stocks that were traded on either the NYSE or the Curb. Although hundreds of stocks might trade on a regional exchange, if a regional corporation grew in size, it would move to the NYSE or the Curb to take advantage of the capital that was available through those two exchanges. In addition to local banks, utilities and trams, the stocks that listed on a regional exchange reflected the industry that grew up near the city. Detroit listed automobile stocks, Los Angeles listed oil stocks, San Francisco listed mining stocks, and so forth.

Table 3 provides a list of the stocks that were listed on regional exchanges through 1972. As the table shows, the exchanges with the largest number of stocks over time were the Boston and Philadelphia exchanges, followed by Chicago and San Francisco. Between 1790 and 1972, there were 3944 common stocks listed on the regionals, 4078 common stocks listed on the Curb/AMEX and 7056 stocks listed on the NYSE. Although there were more stocks listed on the Regionals and the AMEX together than on the NYSE, the market capitalization of the NYSE was substantially greater than the AMEX and the regional stocks.

|

Exchange |

Total |

Common |

Percent |

|

Baltimore |

466 |

286 |

8.65 |

|

Boston |

1074 |

746 |

22.55 |

|

Charleston |

36 |

29 |

0.88 |

|

Chicago |

587 |

268 |

8.10 |

|

Cincinnati |

236 |

99 |

2.99 |

|

Cleveland |

278 |

153 |

4.63 |

|

Detroit |

205 |

142 |

4.29 |

|

Los Angeles |

221 |

164 |

4.96 |

|

Midwest |

41 |

33 |

1.00 |

|

New Orleans |

107 |

83 |

2.51 |

|

NY Consolidated |

375 |

310 |

9.37 |

|

Pacific |

54 |

35 |

1.06 |

|

Philadelphia |

594 |

336 |

10.16 |

|

Pittsburgh |

203 |

141 |

4.26 |

|

Richmond |

28 |

20 |

0.60 |

|

San Francisco |

452 |

279 |

8.43 |

|

St. Louis |

194 |

114 |

3.45 |

|

Washington |

119 |

70 |

2.12 |

Table 3. GFD US Stocks Companies by Exchange, 1790 to 1972

In the 1920s, you could divide the market for stocks in the United States into four categories: the New York Stock Exchange, the Curb, regional exchanges and over-the-counter stocks. Stocks were mutually exclusive between the NYSE and the Curb. Once a stock listed on the NYSE, it no longer traded on the Curb. Stocks could dually list on the regional exchanges and either the NYSE or Curb. Stocks that did not list on either the NYSE, the Curb or a regional exchange, such as banks and insurance companies, as well as small industrial companies, listed over-the-counter.

In 1934, the SEC began to regulate the stock market at a federal level. Before 1934, it was relatively easy to list a company on a regional exchange and there were few limits to listing on the AMEX. There were more “unlisted” stocks on the AMEX than “listed” stocks. While the NYSE had required that companies file financial statements beginning in 1896, most of the regional exchanges did not have these requirements and those who did had less stringent requirements than the NYSE did. The new SEC rules discouraged smaller companies from listing on regional exchanges and encouraged regional companies to either move to the AMEX or remain over-the-counter rather than list on a regional exchange. Consequently, the number of companies that listed on regional exchanges began to decline.

After World War II, the regional exchanges began to merge. In 1949, the Philadelphia and Baltimore exchanges merged and the Chicago, Cleveland and St. Louis exchanges merged to form the Midwest Stock Exchange. In 1953, the San Francisco and Los Angeles Stock Exchanges merged to form the Pacific Stock Exchange. By the time the NASDAQ was formed in 1971, providing a nationwide computer network for buying and selling stocks, regional exchanges had become obsolete. The few that remained merged into other exchanges. NASDAQ also sounded the death knell of the AMEX. Companies that once listed on the AMEX until they were able to meet the listing requirements of the NYSE now listed on the NASDAQ. Some NASDAQ stocks never moved to the NYSE and in 2006, NASDAQ registered as a national securities exchange. In 2008, the AMEX was acquired by the NYSE. Today, the NYSE and NASDAQ are the two largest stock exchanges in the world.

Studying the Past to Understand the Future

Amex was bought out by the NYSE and now there are only two stock exchanges left in the United States. Nevertheless, anyone who wants to understand the history of the United States’ financial markets must have a complete picture, not only of the New York Stock Exchange, but of all of the stocks that have been traded in the United States on the AMEX, the regional exchanges and over-the-counter. No one else has put together a complete picture of stocks traded in the United States. Sylla, Wilson and Wright collected data on American exchanges up to the civil war, but not beyond that. CRSP has data on the NYSE back to 1926, but on the AMEX only back to 1962 and on NASDAQ only back to 1972. Only GFD has collected complete data histories for all the American exchanges back to 1792.