I met Chris while I was a broker. As everyone knows, brokers are salesmen who happen to deal in the stock market. It is better to know nothing about the stock market and be a good salesperson than to have twenty years’ experience in the stock market and have no sales experience.

The first thing the brokerage firm tells you when you are hired is to call up all your friends and get them to invest with you. Once you have gone through your list of friends, then you call your friends’ friends, and then you call the friends of your friends’ friends. When you run out of leads, start cold calling.

Chris was actually the friend of a friend. Chris loved the stock market, followed it every day, and knew the ups and downs of individual stocks—the perfect candidate. My friend arranged for us to get together so we could see if I could interest him in allowing me to manager part of his portfolio.

The meeting was planned at a restaurant in two weeks. Knowing Chris was a mover and a shaker, I decided to suggest some tech stocks to him, something that could move fast, make him some money, and get him to come back for more. This was back in the early 1990s when tech stocks were just beginning to hit their stride before the internet bubble blew apart all concepts of a fair return.

I did my research and found three stocks I thought were going to do well over the next few years: Microsoft, Cisco Systems, and Intel. All were ones with high growth potential and all would do well as the use of personal computers grew.

You never know how a potential client is going to take your recommendations. They might reject a proposal because a stock was too risky, or reject the same stock because it was too safe. I remember I had pitched Cisco to a client, described how it had risen in price for several years, how its earnings were consistently growing, how their product was the backbone of the internet and how the company would grow as the internet expanded. In other words, the stock couldn’t lose, which turned out to be true. The customer was really excited about it and was ready to invest. She asked me how much it was and when I told her it was currently trading at $75, she asked me, “Don’t you have anything cheaper?” I tried to explain to her that the price didn’t matter. It was better to buy 10 shares of a stock that was going up than a 100 shares of a stock that was going down, even if the stock had a higher price, but to no avail.

I had a similar problem with Chris. A couple weeks after meeting him, my friend called me back and let me know that Chris wasn’t interested in investing with me. Were my recommendations too risky? I asked. No, it wasn’t that, he replied. If anything, my recommendations were too conservative. The main issue was that my firm charged commissions that were more than he was willing to pay. I could have suggested the perfect stock to him and because of my commissions, he wouldn’t have invested with me. Now he tells me, I thought.

This was the early 1990s when investing without a broker was just starting to catch on. The stock market hadn’t reached the point where people could trade on line yet; that was still a few years away, but it was close. Even brokers couldn’t trade on line yet. We still had a vacuum tube system in the office. We filled out an order to buy or sell stocks, stuck the order in a cylindrical tube (similar to the ones you put money in at the drive-through at the bank — as if any of you remember that), sent it to the operations manager who would type in the order and send it to New York. We were amazed when we got the response back through the vacuum tube system only a few minutes later.

Not only was there no on-line trading, but CNBC had yet to create a near-monopoly on stock market coverage. There was no CNBC, but there was a local channel in Los Angeles that provided financial news during the morning. The channel paid for itself not only by selling commercial time, but by allowing different stock promoters to have fifteen minute programs on while the market was open and after the market had closed. Since we were in California, the market closed at 1pm, and the hour after the market close was the prime time for stock promoters. It was two hours of pump and dump before the channel turned to Spanish-language programming for the rest of the day.

Most of the programs were 15 minutes long, which was about all the promoters could afford, but the one right after the close, Profits through Penny Stocks, was a 30-minute pump-and-dump show par excellence.

Penny stocks appeal to gamblers, to the people who think they can outwit the market, but inevitably get outwitted themselves. A penny stock is any stock that trades for under one dollar. The stock usually has hundreds of millions of shares outstanding, but the company is worth less than a lemonade stand.

Penny stocks appeal to gamblers for two reasons. First, the stocks are cheap so anyone can afford them. No one is going to ask if you have something cheaper. Since the stocks trade for ten cents or five cents, the buyer reasons, if only the stock goes up five or ten cents, I will double my money.

The punters are willing to believe this because the stock used to be at five cents only a few months before, and now it is at twenty-five cents. Since the stock has already moved up five-fold, there is no reason it couldn’t move up to one dollar, or more. By following the recommendations on TV, the investor could easily make thousands of dollars, but rarely did.

Second, the investor could own a lot of shares. This reinforces the illusion that the investor can make a lot of money. While it takes thousands of dollars to own just one share of Berkshire Hathaway stock, with a penny stock, the investor could buy 100,000 shares of a stock trading at five cents for only $5,000. Never mind that there are probably a hundred million shares outstanding, and the company can always issue more shares, and probably will. The whole process is psychological and has very little to do with reality.

Unfortunately for the investor, the stock rarely goes up in price, it usually goes down as the promoter unloads his shares on the adoring public. When the stock price hits $0.001 or less, the company does a 1000 to one reverse split and 100,000 shares become 100 shares which trade at the price the shares originally sold for the year before. These companies don’t create value, they destroy value.

Another trick of the trade is to issue warrants. A warrant allows you to buy shares at a certain price when the regular stock goes up in price. The advantage is that if the common stock goes up five-fold, the warrants can go up fifty-fold. They rarely do, but it is a good pipe dream.

In 1992, Profits Through Pennies was promoting a stock called Spectrum Information Technologies which was developing a “secret” technology that would allow users to fax wirelessly, rather than being tied down to a phone line.

Chris had no concept of diversification. His idea was, if the stock is going to work, then why not put everything you have into it? Why leave your money in some loser stocks when you can put all your money into one winner? The answer is that the one stock you put your money into is rarely the winner, and you risk losing everything as a result.

This fact of life didn’t discourage Chris, nor did the fact that none of his previous sure things had worked out either. All Chris needed was to hit the jackpot once, and all his problems would be solved, or so he thought.

Spectrum had lain dormant for several months, gradually moving up a little at a time. Chris had put his entire portfolio into Spectrum. He took what was left from his previous investments that had gone awry and put them all into Spectrum. He owned the common stock, he owned both the warrants, he owned the units.

Then, by some miracle, rumors started to spread that the new technology might actually work. The stock started to go up. Chris was actually making a profit. Profits Through Pennies, which was probably more amazed than Chris at the unexpected activity in Spectrum, assured its viewers that this was the big one. Viewers needed to call up their brokerage firm and put even more money into the stock. Because Chris had lost a good portion of his initial investment in several other stocks, he had to raise capital to double up on his profits.

In this, Chris left no stone unturned. He realized he could borrow cash against his credit card, and he did. He realized he could get additional credit cards to borrow against, and he did. He realized he could take out a second mortgage on his house, and he did. He wasn’t able to sell his mother into the white slave trade, but he did borrow money from her. And, of course, he bragged about his profits to his friends and got as many of them as possible to invest with him.

As Spectrum started to rise in price, others began to notice. Not only did the stock start to move up rapidly, but it also fluctuated dramatically. One day it would be up twenty percent, the next day down fifteen percent. It would move up for four days, then fall for three. For the average investor, this is the worst type of stock to be in. You know it is moving on pure speculation. You know it could double or triple in price from here, or today could be the day it starts moving down for good. As a friend of mine put it, “you worry when it goes up and you worry when it goes down.” A stock like this would turn a heavy sleeper into an insomniac.

Then the stock started to go nuts. The stock had been at 25 cents when I first spoke to Chris. Now it was at $1, then it moved up to $2 in one day. The warrants had gone from 5 cents to $1 and were soon in the money. The stock started trading wildly, swinging up and down on a daily basis. Then the most incredible thing happened. In one wild day in which 75 million shares traded, a record on Nasdaq, Spectrum hit $10. My friend was now a millionaire. His investment had paid off.

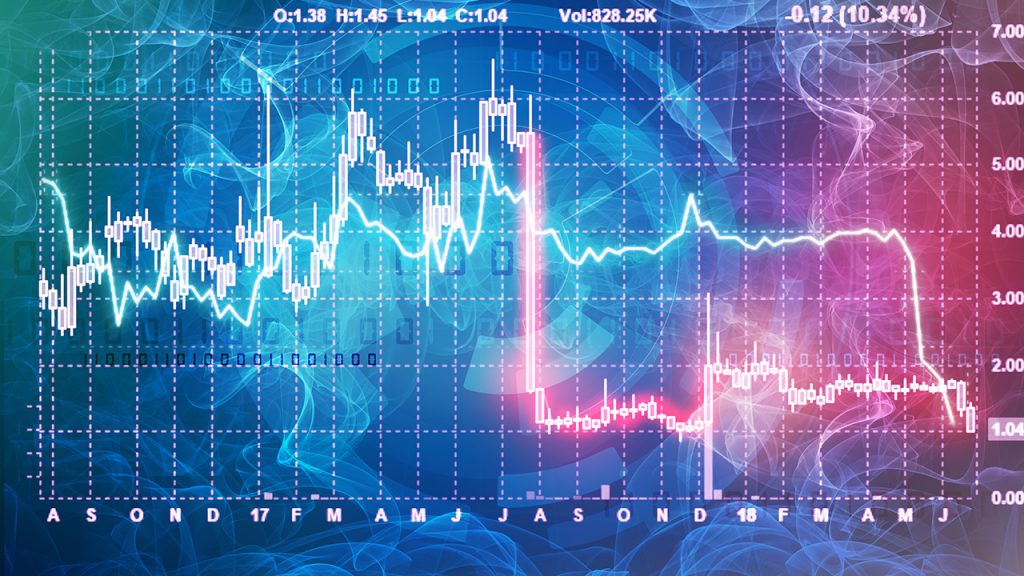

Spectrum Information Technologies Stock Price, 1991-1998

Being the novice broker that I was, I was impressed. I called Chris up to congratulate him and see if he had sold his shares yet. As it turned out, his portfolio was now worth $1.5 million. Had he sold out? No. Why not? The stock was headed to $20 and at that point he would have $3 million. He would be set for life. What if it didn’t hit $20? It would, he promised.

But it didn’t.

As luck would have it, the day I spoke to Chris was the day the stock hit its peak. In two days it lost half of its value, and in a week it was back down to $2. In one week, he had made and lost over $1 million. At that point, you know the stock isn’t going to go back to its high, but you know at some point it will get a dead-cat bounce. The problem is everyone else knows this, and everyone is waiting to sell their stock to a sucker who thinks the stock will go higher than they will. The technical term for this is the “greater fool theory.” You may have been a fool to buy the stock at $2, but you hope you can find an even greater fool who will buy the stock at $3. The problem is, sometimes you’re the greater fool.

The other problem with owning a large block of shares is that you have to get rid of them. It may be easy to accumulate hundreds of thousands of shares over time, but selling hundreds of thousands of shares, all at once, will only depress the price.

A few weeks later new rumors started to spread that the ex-CEO of a rival technology firm was going to be hired to bring the technology into fruition. Activity picked up in the stock again, the stock rose in price, and Chris sold into the rally. Despite having lost a million dollars in paper profits, he ended up making $100,000 on his rollercoaster ride.

But that isn’t why we called him Crazy Chris.

Like any addiction, it is the thrill that keeps the person in the game. It simply isn’t possible to make a large profit and walk away forever. Making a large profit only whets the appetite for more, and now that Chris had restored his capital base through profiting on Spectrum, which a few years later went bankrupt, after a month’s vacation, he was ready for some more action.

The next penny stock to be promoted on Profits through Pennies couldn’t have been more different. Yes, it was a technology stock, but it wasn’t an internet company, but one that had new railroad technology. This company was about to revolutionize an industry in a way that hadn’t occurred in over a century, Profits through Pennies promised. In fact, this stock was such a secret, its story hadn’t even reached the United States yet. The stock traded on the Vancouver Stock Exchange.

Now, the fact that the stock traded on the Vancouver stock Exchange would be enough to worry me. Any respectable Canadian stock traded on the Toronto Stock Exchange. Oil and mining stocks that couldn’t qualify for the Toronto Stock Exchange because they had no history or prospect of profits listed on the Vancouver Stock Exchange. Now that technology stocks were taking the place of oil and mining stocks, Vancouver offered them an opportunity they couldn’t get anywhere else. Vancouver made Las Vegas look safe and conservative.

The fact that Kelly Technologies (Keltech as they referred to it) actually traded on the Vancouver Stock Exchange was promoted as one of its selling points. Profits through Pennies promised that once people in the US discovered the stock, it would go nuts! The stock had hit twenty several years ago, but now was under $1. So why couldn’t it go up to $20 once again and surpass that? They always can return to their old highs, but they rarely do.

Chris was sold on this chance of a lifetime, and he started to pour his money into Keltech. Not only did Chris take all his money from Spectrum and put it into Keltech, but he borrowed against what little equity was left in his house.

Now you have to understand that since Chris owned over 100,000 shares in the company and consequently was a substantial shareholder, he felt he had the right to get information directly from the company’s president. Keltech only had a hundred or so people working for the company, and only one person in shareholder relations, so she got to know Chris pretty well.

When a report was due on the new technology, Chris called her up to see how the tests had gone. A couple times, he even got to speak to the President of the company, and once he had done this, he expected to be able to talk to the President whenever he called up. Unfortunately, the tests did not go as planned and the stock started to sink in price. The stock was headed for twenty cents, not twenty dollars.

As with Spectrum, Chris had researched the technology and knew all the competitors and as much information about the technology as he could understand. At first, Chris called up once a week, then as the tests failed to produce the promised results, he began to call up several times a week, pestering the shareholder representative to let him talk to the President. After all, Chris owned several hundred thousand shares, and by his reckoning, he was one of the larger shareholders in the company.

During each conversation, Chris would make suggestions on how to improve the technology, how to conduct the tests, how to make “his” company more profitable. The President soon became fed up with the constant haranguing, and one day, out of exasperation, he told Chris, “Well, if you know how to do things so well, why don’t you come up here to Canada and show us how to run things?”, thinking this would put Chris in his place. Unfortunately, it did the opposite. “You probably do need my help,” Chris replied. “That isn’t a bad idea.”

The President of the company was even more flabbergasted when the next month, Chris called up and gave him his travel itinerary and told him he had rented an apartment only one mile from the company’s headquarters. What the President of the company didn’t know was that Chris had sacrificed everything in his life to become rich off of this one stock. Chris had borrowed tens of thousands through his credit cards, for which he barely met the minimum payment. His house had been foreclosed upon because he had failed to make timely payments on the house’s three mortgages. His job performance was poor because he spent more time thinking about Keltech than the company he worked for, and he had lost his job. His girlfriend had left him, and now he was practically broke. Chris had lost everything except the shares he owned in Keltech.

At first Chris worked for free, inspecting the technology, making suggestions, and helping where he could. To the President’s surprise, Chris actually had some good ideas, and after two weeks, the President of the company decided to hire Chris. Nevertheless, the stock continued to sink, falling not only to twenty cents, but down to ten cents. At the end of the year, the President of the company left and Chris became the new CEO of Keltech.

In a little over a year, Chris had gone from not knowing about Keltech, to investing his life savings in the company, to losing everything he had, to moving to Canada, and eventually becoming President of the company in which he had unwittingly sunk his life savings. That is why we called him Crazy Chris.

Chris stuck with the company for another year, but eventually left the company because the technology tests always showed new problems, and the solution always seemed one more test away. By the time he left Keltech, not only had Chris lost interest in the company, but what was even more amazing, he had lost interest in the stock market. Chris moved back to California, and got a job with a manufacturing firm.

Although this was when the internet bubble was going full speed, Chris didn’t invest in anything. It was torture avoiding investing as the NASDAQ moved up to 5000, but when it crashed from there, he felt relieved. Crazy Chris wasn’t crazy anymore.

Global Financial Data has expanded its unprecedented coverage of U.S. Stocks with the addition of data on over 4,000 banks unavailable from any other source. No other data provider can compete with the robust nature of GFD’s emerging US Stocks Database. Through the efforts of our economists and research department, Global Financial Data has assembled 200 years of stock history covering every bull and bear market. GFD has eliminated both the survivorship bias and the exchange bias by including every US exchange as well as stocks that traded over-the-counter.

Global Financial Data has expanded its unprecedented coverage of U.S. Stocks with the addition of data on over 4,000 banks unavailable from any other source. No other data provider can compete with the robust nature of GFD’s emerging US Stocks Database. Through the efforts of our economists and research department, Global Financial Data has assembled 200 years of stock history covering every bull and bear market. GFD has eliminated both the survivorship bias and the exchange bias by including every US exchange as well as stocks that traded over-the-counter.

I met Chris while I was a broker. As everyone knows, brokers are salesmen who happen to deal in the stock market. It is better to know nothing about the stock market and be a good salesperson than to have twenty years’ experience in the stock market and have no sales experience.

The first thing the brokerage firm tells you when you are hired is to call up all your friends and get them to invest with you. Once you have gone through your list of friends, then you call your friends’ friends, and then you call the friends of your friends’ friends. When you run out of leads, start cold calling.

Chris was actually the friend of a friend. Chris loved the stock market, followed it every day, and knew the ups and downs of individual stocks—the perfect candidate. My friend arranged for us to get together so we could see if I could interest him in allowing me to manager part of his portfolio.

The meeting was planned at a restaurant in two weeks. Knowing Chris was a mover and a shaker, I decided to suggest some tech stocks to him, something that could move fast, make him some money, and get him to come back for more. This was back in the early 1990s when tech stocks were just beginning to hit their stride before the internet bubble blew apart all concepts of a fair return.

I did my research and found three stocks I thought were going to do well over the next few years: Microsoft, Cisco Systems, and Intel. All were ones with high growth potential and all would do well as the use of personal computers grew.

You never know how a potential client is going to take your recommendations. They might reject a proposal because a stock was too risky, or reject the same stock because it was too safe. I remember I had pitched Cisco to a client, described how it had risen in price for several years, how its earnings were consistently growing, how their product was the backbone of the internet and how the company would grow as the internet expanded. In other words, the stock couldn’t lose, which turned out to be true. The customer was really excited about it and was ready to invest. She asked me how much it was and when I told her it was currently trading at $75, she asked me, “Don’t you have anything cheaper?” I tried to explain to her that the price didn’t matter. It was better to buy 10 shares of a stock that was going up than a 100 shares of a stock that was going down, even if the stock had a higher price, but to no avail.

I had a similar problem with Chris. A couple weeks after meeting him, my friend called me back and let me know that Chris wasn’t interested in investing with me. Were my recommendations too risky? I asked. No, it wasn’t that, he replied. If anything, my recommendations were too conservative. The main issue was that my firm charged commissions that were more than he was willing to pay. I could have suggested the perfect stock to him and because of my commissions, he wouldn’t have invested with me. Now he tells me, I thought.

This was the early 1990s when investing without a broker was just starting to catch on. The stock market hadn’t reached the point where people could trade on line yet; that was still a few years away, but it was close. Even brokers couldn’t trade on line yet. We still had a vacuum tube system in the office. We filled out an order to buy or sell stocks, stuck the order in a cylindrical tube (similar to the ones you put money in at the drive-through at the bank — as if any of you remember that), sent it to the operations manager who would type in the order and send it to New York. We were amazed when we got the response back through the vacuum tube system only a few minutes later.

Not only was there no on-line trading, but CNBC had yet to create a near-monopoly on stock market coverage. There was no CNBC, but there was a local channel in Los Angeles that provided financial news during the morning. The channel paid for itself not only by selling commercial time, but by allowing different stock promoters to have fifteen minute programs on while the market was open and after the market had closed. Since we were in California, the market closed at 1pm, and the hour after the market close was the prime time for stock promoters. It was two hours of pump and dump before the channel turned to Spanish-language programming for the rest of the day.

Most of the programs were 15 minutes long, which was about all the promoters could afford, but the one right after the close, Profits through Penny Stocks, was a 30-minute pump-and-dump show par excellence.

Penny stocks appeal to gamblers, to the people who think they can outwit the market, but inevitably get outwitted themselves. A penny stock is any stock that trades for under one dollar. The stock usually has hundreds of millions of shares outstanding, but the company is worth less than a lemonade stand.

Penny stocks appeal to gamblers for two reasons. First, the stocks are cheap so anyone can afford them. No one is going to ask if you have something cheaper. Since the stocks trade for ten cents or five cents, the buyer reasons, if only the stock goes up five or ten cents, I will double my money.

The punters are willing to believe this because the stock used to be at five cents only a few months before, and now it is at twenty-five cents. Since the stock has already moved up five-fold, there is no reason it couldn’t move up to one dollar, or more. By following the recommendations on TV, the investor could easily make thousands of dollars, but rarely did.

Second, the investor could own a lot of shares. This reinforces the illusion that the investor can make a lot of money. While it takes thousands of dollars to own just one share of Berkshire Hathaway stock, with a penny stock, the investor could buy 100,000 shares of a stock trading at five cents for only $5,000. Never mind that there are probably a hundred million shares outstanding, and the company can always issue more shares, and probably will. The whole process is psychological and has very little to do with reality.

Unfortunately for the investor, the stock rarely goes up in price, it usually goes down as the promoter unloads his shares on the adoring public. When the stock price hits $0.001 or less, the company does a 1000 to one reverse split and 100,000 shares become 100 shares which trade at the price the shares originally sold for the year before. These companies don’t create value, they destroy value.

Another trick of the trade is to issue warrants. A warrant allows you to buy shares at a certain price when the regular stock goes up in price. The advantage is that if the common stock goes up five-fold, the warrants can go up fifty-fold. They rarely do, but it is a good pipe dream.

In 1992, Profits Through Pennies was promoting a stock called Spectrum Information Technologies which was developing a “secret” technology that would allow users to fax wirelessly, rather than being tied down to a phone line.

Chris had no concept of diversification. His idea was, if the stock is going to work, then why not put everything you have into it? Why leave your money in some loser stocks when you can put all your money into one winner? The answer is that the one stock you put your money into is rarely the winner, and you risk losing everything as a result.

This fact of life didn’t discourage Chris, nor did the fact that none of his previous sure things had worked out either. All Chris needed was to hit the jackpot once, and all his problems would be solved, or so he thought.

Spectrum had lain dormant for several months, gradually moving up a little at a time. Chris had put his entire portfolio into Spectrum. He took what was left from his previous investments that had gone awry and put them all into Spectrum. He owned the common stock, he owned both the warrants, he owned the units.

Then, by some miracle, rumors started to spread that the new technology might actually work. The stock started to go up. Chris was actually making a profit. Profits Through Pennies, which was probably more amazed than Chris at the unexpected activity in Spectrum, assured its viewers that this was the big one. Viewers needed to call up their brokerage firm and put even more money into the stock. Because Chris had lost a good portion of his initial investment in several other stocks, he had to raise capital to double up on his profits.

In this, Chris left no stone unturned. He realized he could borrow cash against his credit card, and he did. He realized he could get additional credit cards to borrow against, and he did. He realized he could take out a second mortgage on his house, and he did. He wasn’t able to sell his mother into the white slave trade, but he did borrow money from her. And, of course, he bragged about his profits to his friends and got as many of them as possible to invest with him.

As Spectrum started to rise in price, others began to notice. Not only did the stock start to move up rapidly, but it also fluctuated dramatically. One day it would be up twenty percent, the next day down fifteen percent. It would move up for four days, then fall for three. For the average investor, this is the worst type of stock to be in. You know it is moving on pure speculation. You know it could double or triple in price from here, or today could be the day it starts moving down for good. As a friend of mine put it, “you worry when it goes up and you worry when it goes down.” A stock like this would turn a heavy sleeper into an insomniac.

Then the stock started to go nuts. The stock had been at 25 cents when I first spoke to Chris. Now it was at $1, then it moved up to $2 in one day. The warrants had gone from 5 cents to $1 and were soon in the money. The stock started trading wildly, swinging up and down on a daily basis. Then the most incredible thing happened. In one wild day in which 75 million shares traded, a record on Nasdaq, Spectrum hit $10. My friend was now a millionaire. His investment had paid off.

I met Chris while I was a broker. As everyone knows, brokers are salesmen who happen to deal in the stock market. It is better to know nothing about the stock market and be a good salesperson than to have twenty years’ experience in the stock market and have no sales experience.

The first thing the brokerage firm tells you when you are hired is to call up all your friends and get them to invest with you. Once you have gone through your list of friends, then you call your friends’ friends, and then you call the friends of your friends’ friends. When you run out of leads, start cold calling.

Chris was actually the friend of a friend. Chris loved the stock market, followed it every day, and knew the ups and downs of individual stocks—the perfect candidate. My friend arranged for us to get together so we could see if I could interest him in allowing me to manager part of his portfolio.

The meeting was planned at a restaurant in two weeks. Knowing Chris was a mover and a shaker, I decided to suggest some tech stocks to him, something that could move fast, make him some money, and get him to come back for more. This was back in the early 1990s when tech stocks were just beginning to hit their stride before the internet bubble blew apart all concepts of a fair return.

I did my research and found three stocks I thought were going to do well over the next few years: Microsoft, Cisco Systems, and Intel. All were ones with high growth potential and all would do well as the use of personal computers grew.

You never know how a potential client is going to take your recommendations. They might reject a proposal because a stock was too risky, or reject the same stock because it was too safe. I remember I had pitched Cisco to a client, described how it had risen in price for several years, how its earnings were consistently growing, how their product was the backbone of the internet and how the company would grow as the internet expanded. In other words, the stock couldn’t lose, which turned out to be true. The customer was really excited about it and was ready to invest. She asked me how much it was and when I told her it was currently trading at $75, she asked me, “Don’t you have anything cheaper?” I tried to explain to her that the price didn’t matter. It was better to buy 10 shares of a stock that was going up than a 100 shares of a stock that was going down, even if the stock had a higher price, but to no avail.

I had a similar problem with Chris. A couple weeks after meeting him, my friend called me back and let me know that Chris wasn’t interested in investing with me. Were my recommendations too risky? I asked. No, it wasn’t that, he replied. If anything, my recommendations were too conservative. The main issue was that my firm charged commissions that were more than he was willing to pay. I could have suggested the perfect stock to him and because of my commissions, he wouldn’t have invested with me. Now he tells me, I thought.

This was the early 1990s when investing without a broker was just starting to catch on. The stock market hadn’t reached the point where people could trade on line yet; that was still a few years away, but it was close. Even brokers couldn’t trade on line yet. We still had a vacuum tube system in the office. We filled out an order to buy or sell stocks, stuck the order in a cylindrical tube (similar to the ones you put money in at the drive-through at the bank — as if any of you remember that), sent it to the operations manager who would type in the order and send it to New York. We were amazed when we got the response back through the vacuum tube system only a few minutes later.

Not only was there no on-line trading, but CNBC had yet to create a near-monopoly on stock market coverage. There was no CNBC, but there was a local channel in Los Angeles that provided financial news during the morning. The channel paid for itself not only by selling commercial time, but by allowing different stock promoters to have fifteen minute programs on while the market was open and after the market had closed. Since we were in California, the market closed at 1pm, and the hour after the market close was the prime time for stock promoters. It was two hours of pump and dump before the channel turned to Spanish-language programming for the rest of the day.

Most of the programs were 15 minutes long, which was about all the promoters could afford, but the one right after the close, Profits through Penny Stocks, was a 30-minute pump-and-dump show par excellence.

Penny stocks appeal to gamblers, to the people who think they can outwit the market, but inevitably get outwitted themselves. A penny stock is any stock that trades for under one dollar. The stock usually has hundreds of millions of shares outstanding, but the company is worth less than a lemonade stand.

Penny stocks appeal to gamblers for two reasons. First, the stocks are cheap so anyone can afford them. No one is going to ask if you have something cheaper. Since the stocks trade for ten cents or five cents, the buyer reasons, if only the stock goes up five or ten cents, I will double my money.

The punters are willing to believe this because the stock used to be at five cents only a few months before, and now it is at twenty-five cents. Since the stock has already moved up five-fold, there is no reason it couldn’t move up to one dollar, or more. By following the recommendations on TV, the investor could easily make thousands of dollars, but rarely did.

Second, the investor could own a lot of shares. This reinforces the illusion that the investor can make a lot of money. While it takes thousands of dollars to own just one share of Berkshire Hathaway stock, with a penny stock, the investor could buy 100,000 shares of a stock trading at five cents for only $5,000. Never mind that there are probably a hundred million shares outstanding, and the company can always issue more shares, and probably will. The whole process is psychological and has very little to do with reality.

Unfortunately for the investor, the stock rarely goes up in price, it usually goes down as the promoter unloads his shares on the adoring public. When the stock price hits $0.001 or less, the company does a 1000 to one reverse split and 100,000 shares become 100 shares which trade at the price the shares originally sold for the year before. These companies don’t create value, they destroy value.

Another trick of the trade is to issue warrants. A warrant allows you to buy shares at a certain price when the regular stock goes up in price. The advantage is that if the common stock goes up five-fold, the warrants can go up fifty-fold. They rarely do, but it is a good pipe dream.

In 1992, Profits Through Pennies was promoting a stock called Spectrum Information Technologies which was developing a “secret” technology that would allow users to fax wirelessly, rather than being tied down to a phone line.

Chris had no concept of diversification. His idea was, if the stock is going to work, then why not put everything you have into it? Why leave your money in some loser stocks when you can put all your money into one winner? The answer is that the one stock you put your money into is rarely the winner, and you risk losing everything as a result.

This fact of life didn’t discourage Chris, nor did the fact that none of his previous sure things had worked out either. All Chris needed was to hit the jackpot once, and all his problems would be solved, or so he thought.

Spectrum had lain dormant for several months, gradually moving up a little at a time. Chris had put his entire portfolio into Spectrum. He took what was left from his previous investments that had gone awry and put them all into Spectrum. He owned the common stock, he owned both the warrants, he owned the units.

Then, by some miracle, rumors started to spread that the new technology might actually work. The stock started to go up. Chris was actually making a profit. Profits Through Pennies, which was probably more amazed than Chris at the unexpected activity in Spectrum, assured its viewers that this was the big one. Viewers needed to call up their brokerage firm and put even more money into the stock. Because Chris had lost a good portion of his initial investment in several other stocks, he had to raise capital to double up on his profits.

In this, Chris left no stone unturned. He realized he could borrow cash against his credit card, and he did. He realized he could get additional credit cards to borrow against, and he did. He realized he could take out a second mortgage on his house, and he did. He wasn’t able to sell his mother into the white slave trade, but he did borrow money from her. And, of course, he bragged about his profits to his friends and got as many of them as possible to invest with him.

As Spectrum started to rise in price, others began to notice. Not only did the stock start to move up rapidly, but it also fluctuated dramatically. One day it would be up twenty percent, the next day down fifteen percent. It would move up for four days, then fall for three. For the average investor, this is the worst type of stock to be in. You know it is moving on pure speculation. You know it could double or triple in price from here, or today could be the day it starts moving down for good. As a friend of mine put it, “you worry when it goes up and you worry when it goes down.” A stock like this would turn a heavy sleeper into an insomniac.

Then the stock started to go nuts. The stock had been at 25 cents when I first spoke to Chris. Now it was at $1, then it moved up to $2 in one day. The warrants had gone from 5 cents to $1 and were soon in the money. The stock started trading wildly, swinging up and down on a daily basis. Then the most incredible thing happened. In one wild day in which 75 million shares traded, a record on Nasdaq, Spectrum hit $10. My friend was now a millionaire. His investment had paid off.

Until 1934 when the Securities and Exchange Commission outlawed rigging the market, Wall Street was occasionally treated to a battle between shorts and long that ended in a corner on the market. A stock is cornered when shorts have sold more shares in a company than are in the outstanding float, and one shareholder owns the floating stock. Since the shorts must cover their positions by buying back the shares they have borrowed, if one person owns all the shares, he can set the price and the shorts have no choice but to pay the price the owner demands.

Until 1934 when the Securities and Exchange Commission outlawed rigging the market, Wall Street was occasionally treated to a battle between shorts and long that ended in a corner on the market. A stock is cornered when shorts have sold more shares in a company than are in the outstanding float, and one shareholder owns the floating stock. Since the shorts must cover their positions by buying back the shares they have borrowed, if one person owns all the shares, he can set the price and the shorts have no choice but to pay the price the owner demands.