GFD has calculated a global index of stocks that begins in 1602 and continues until the present. With this index, we can track the changes in global stock markets over the past 400 years, determine when bear markets occurred and study the causes of those bear markets.

We have already shown that you can divide up the history of equity markets into four eras: the period of Mercantilism (1600-1799) during which a few international trade companies dominated stock exchanges, Free Trade (1800-1914) during which railroads, finance and other industries grew in size, Regulation (1914-1981) during which government regulation and nationalizations restricted the growth of global stock markets, and Globalization (1981-) during which markets once again became a source of capital for global corporations.

GFD defines a bear market as a 20% decline in the price of stocks following a bull market in which prices increase by at least 50%. GFD’s World Index measures the behavior of global stocks in British Pounds up until 1914 and U.S. Dollars since then. There were six bear markets in the 1600s, five bear markets in the 1700s, only one real bear market in the 1800s, nine bear markets in the 1900s and so far, two bear markets in the 2000s. This gives us a total of 23 global bear markets over the past 417 years.

Although people are familiar with the bear markets of the 1900s and 2000s, there is almost no research on bear markets in the 1700s and 1800s, primarily because no data has existed to measure these global bear markets. Another blog, “A Century of War: Bear Markets in the 1700s” explored the bear markets that occurred in the 1700s showing how European wars drove the bear markets of that century. The 1800s, on the other hand, were a century of peace. There were no major European wars between the end of the Napoleonic Wars in 1815 and the start of World War I in 1914. This freed up capital to invest in railroad, finance and other companies that dominated financial markets. Between 1815 and 1914, Britain’s government debt declined, but the capitalization of the British stock market grew from $250 million to $15 billion and the capitalization of the United States’ stock markets grew from $50 million to $20 billion.

The question this raises is why were bear markets so rare in the 1800s? Bear markets occur about once a decade. The longest global bear market in history occurred after the collapse of the South Sea Bubble in 1720 and lasted for 42 years. However, the 1800s had two very long bull markets lasting from 1797 until 1845 and from 1848 until 1912. It was the combination of the collapse of the railway mania and the Revolution of 1848 in France that created the only bear market in the 1800s.

Although there were numerous corrections in global stock markets driven by Panics in 1819, 1825, 1837, 1847, 1857, 1866, 1869, 1873, 1882, 1884, 1893 and 1896, global stock markets were not integrated in the same way they were in 1987. Corrections occurred rather than bear markets. A list of the major panics in the 1800s is provided in Table 1.

| Panic | Country | Cause |

| 1819 | United States | Speculative Land Deals |

| 1825 | Great Britain | Collapse of Banks and South American Stocks |

| 1837 | United States | Bank of the United States Battle |

| 1847 | Great Britain | Railway Mania and French Revolution |

| 1857 | United States | Failure of Ohio Life Insurance and Trust |

| 1866 | Great Britain | Collapse of Overend, Gurney and Co. |

| 1869 | United States | Black Friday Collapse of Gold Market |

| 1873 | USA, Austria | Collapse of Jay Cooke & Co., Vienna Stock Market Crash |

| 1882 | France | Collapse of l’Union Generale |

| 1884 | United States | Collapse of Grant and Ward and Marine National Bank |

| 1893 | USA, Britain | Collapse of Baring Brothers, Bank Failures |

| 1896 | United States | Gold Standard Problems |

Table 1. Major Panics in the 1800s

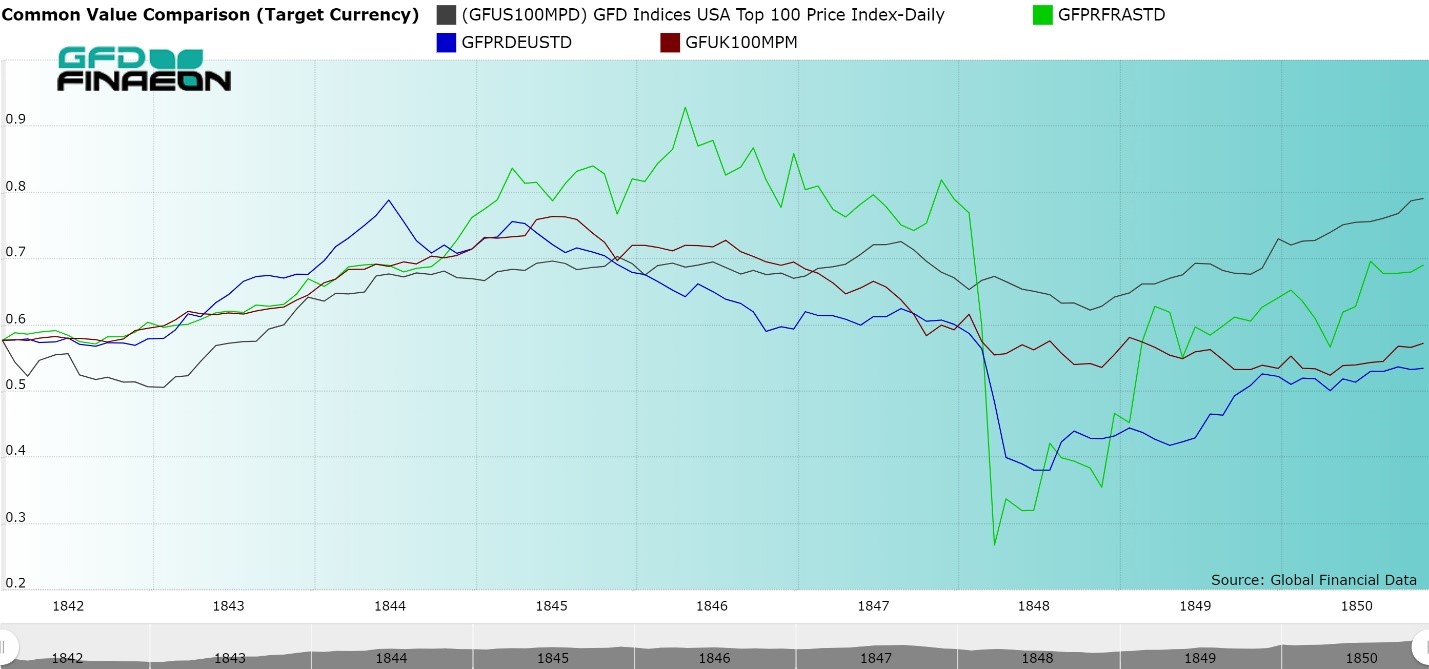

The 1845 to 1848 bear market is illustrated in Figure 1 which shows the performance of stock indices for the United States (black), France (green), Germany (blue) and the United Kingdom (brown). The largest decline came from stocks in France, but the majority of the capitalization for the index came from stocks in the United Kingdom.

Figure 1. Stock Indices for the United States, France, Germany and the United Kingdom, 1841-1850

Bear Markets in Individual Countries

In 1800, there were only four stock markets in the world, located in London, Amsterdam, Paris and the United States. During the 1800s, stock markets were founded in every major country in the world, and by the end of the 1800s, data from over a dozen countries was available for the world stock index. Although there was only one global bear market in the 1800s, individual countries endured more than one bear market between 1800 and 1900.

Britain had bear markets between April 1802 and August 1803 (down 31.5%), between November 1809 and November 1812 (down 20.6%), and between January 1825 and October 1848 (down 37.2%). The London Stock Exchange then had a 51-year bull market run between 1848 and May 1899 whence the market declined by 37% to October 1915. Hence, there were only three bear markets in London during the 1800s.

France suffered several more bear markets than the United Kingdom in the 1800s. There was really only one stock that traded in France until the 1830s, and that was the Banque de France. The stock suffered 20% or greater declines in 1803, from 1807 to 1814, in 1815 after the defeat of Napoleon and between 1825 and 1831. After railroads began dominating the French stock market in the 1830s, there were bear markets between July 1840 and March 1848 (down 58%), between May 1856 and March 1871 (down 33.6%) and between December 1881 and May 1887 (down 20%).

If you look at Germany, you find six bear markets between June 1844 and June 1848 (down 51.1%), between May 1853 and April 1854 (down 25.3%), between May 1856 and June 1859 (down 27%), between November 1872 and June 1877 (down 64%), between December 1889 and November 1891 (down 31.5%), and between May 1899 and October 1901 (down 26.4%).

The data for the United States is quite interesting because the United States suffered its longest bear market in the early 1800s. Between January 1792 and January 1843, the US-100 index declined by 66.8%. Finance companies dominated the stock exchanges, and because of state-imposed restrictions, banks and insurance companies had few opportunities for growth. Although stocks on average declined in price by 1% per annum between 1792 and 1843, stocks provided a dividend yield of 5% generating a positive total return of 4% per annum. The Panic of 1857 sent the U.S. stock market into a tailspin between August 1853 and October 1857 (down 33.7%). The decline between July 1864 and October 1873 was largely a result of the deflation following the Civil war when the stock market declined by 34.4%. A final bear market occurred between May 1881 and January 1885 when the stock market fell by 34.6%.

What is important to notice here is the lack of coordination between the bear markets in London, Paris, Berlin and the United States. Today, as soon as a decline occurs in one market, it is transmitted to other markets throughout the world in hours. This simply wasn’t the case in the 1800s before the telegraph could transmit information around the world. Markets moved independently of one another and although there was some coordination, it was limited.

In addition to this, London represented a majority of the world’s market capitalization in the 1800s, so changes in London drove changes in the global stock market. London didn’t have a bear market between 1848 and 1899 so neither did the World Stock Index.

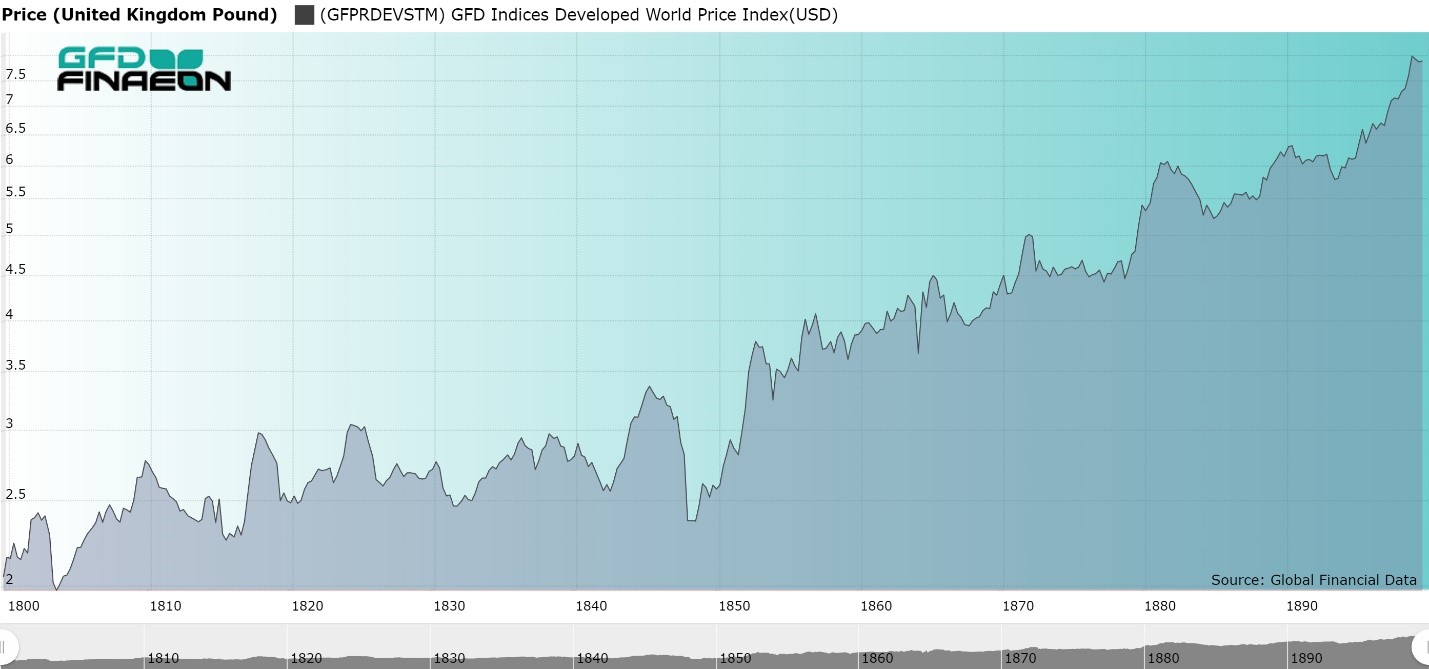

The World Index, measured in British Pounds, is illustrated in Figure 2. As can be seen, the only bear market during the 1800s occurred between July 1845 and November 1848 when the index declined by 31%. There were a number of corrections in the index of 10% or more at different points in time, but no bear markets with a decline of 20% or more.

Figure 2. GFD World Index in GBP, 1800 to 1900

Of course, in July 1914, World War I began. During the 1900s, the world suffered bear markets between August 1912 and July 1921 (down 39.9%), August 1929 and June 1932 (down 75.4%), February 1937 and May 1940 (down 39.9%), May 1946 and September 1949 (down 26.3%), November 1968 and June 1970 (down 25.5%), March 1973 and September 1974 (down 43.4%), April and August 1982 (down 26.5%) August and November 1987 (down 23.7%) and between January and September 1990 (down 25.9%). Bear markets shortened in time but became more frequent during the 1900s.

It should also be noted that the coordination of financial markets improved over the course of the twentieth century. A decline in stocks in the United States usually led to a decline in stocks in other countries. It no longer took days or weeks for a decline in London or New York to influence other stock markets, but hours. The declines in the first half of the 1900s were driven by World War I and World War II. By the end of the 1900s, financial panics and recessions became the main drivers of global bear markets.

War, Peace and Financial Markets

Stock markets have gone through many fundamental changes over the past 400 years. During the 1700s, there was a handful of international trading companies that dominated stock markets in Amsterdam, London and Paris. Investors primarily bought stocks for their dividends and prices largely remained unchanged, except when a war came along imposing losses on investors. While the 1700s were a century of war in which government debt grew dramatically, but stock market capitalization grew slowly, the 1800s were the opposite. There were no major wars in Europe between 1815 and 1914 and stock markets grew rapidly. Government debt declined during those 100 years, but stock market capitalization increased in size. There was only one major bear market in the entire century. When war returned to the continent in 1914, government debt soared, market capitalization shrank as a share of GDP, and bear markets returned.

One wonders what would have happened if the 1700s had been a century of peace or the 1800s had been a century of war. Would stock markets have expanded in the 1700s as they did in the 1800s? Would the industrialization of the economy have been delayed if wars had plagued the European continent in the 1800s? And what about the world in the 1900s? What if World Wars I and II had never occurred? How different would our world have been today? China, India and Russia would have industrialized faster and been an integral part of the global economy in a way they weren’t when socialism dominated their economies.

And what about the twenty-first century? Will it be a century of war? A century of peace? Will emerging markets become developed markets? Will financial panics or wars drive the bear markets of the next 100 years? Only time will tell.