The most important component of a screening tool is what powers it – complete data as only provided by Global Financial Data. It’s About Time.

The Finaeon Screen-In-Time is the first screening functionality to search a complete universe of London and United States equities beginning with the first stock ever traded in 1601. Building upon the underlying Fama-French Factors is only the beginning of our Screen-In-Time, but we didn’t stop there.

Fineon has No Exchange Bias, No Survivorship Bias and is Microversal, meaning that it examines thousands of foreign equities that listed on the LSE hundreds of years prior to the existence of the NYSE, This provides hundreds of years of analysis, screening and back-testing opportunities using the 5 factors that have markets buzzing.

Size of an Individual Company by Market Capitalization

Value of a Company as measured by the PE Ratio

Risk as determined by the Beta.

Momentum

Investment

Standard screening tools provide the S&P 500 benchmark as the measure of market performance. Finaeon allows you the choice of the GFD US-100 or any other major benchmark with the entire history not limited to 1925 or what is convenient. Your screening universe is complete producing you the most accurate result possible. When you choose to compare your portfolio of stocks (your Custom Index) against the benchmark of your choice you will have the confidence of knowing your Custom Index would have stood the test of time, in history.

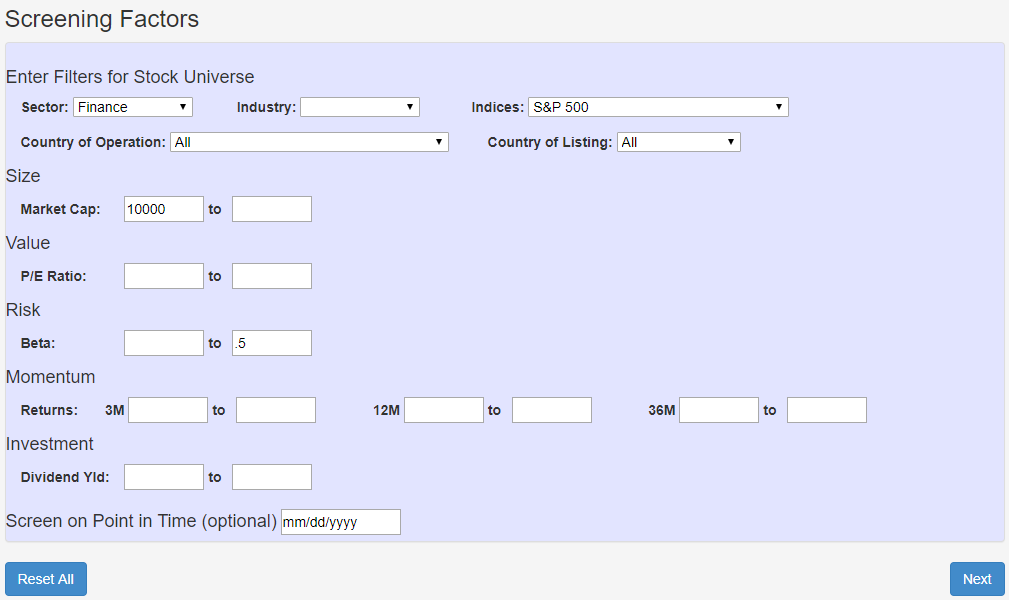

Screening Factors (Fama-French)

In this example, the Finance Sector of the S&P 500 is used as a stock universe filter. Factors used are Market Cap with a minimum of 10000, and Risk using a maximum of .5 Beta. When the Next button is clicked, a screen will be performed.

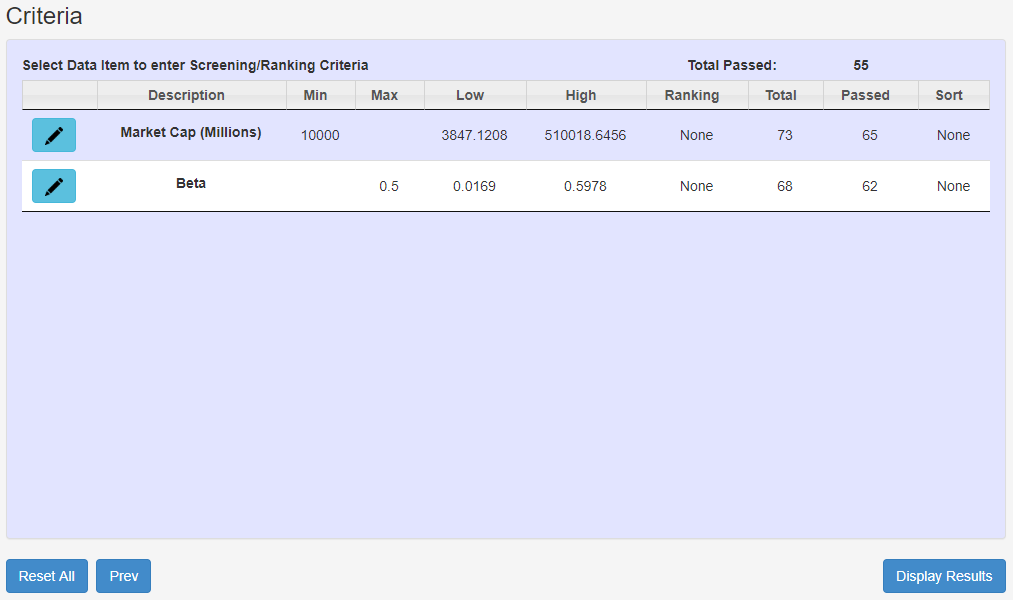

Factors Criteria

After the screen, the results are shown for Low/High for the Filtered Universe, total number of stocks passed for each criteria within the filtered universe, and total passed for all criteria. In this example, 55 stocks have passed all criteria within the Filtered Universe.

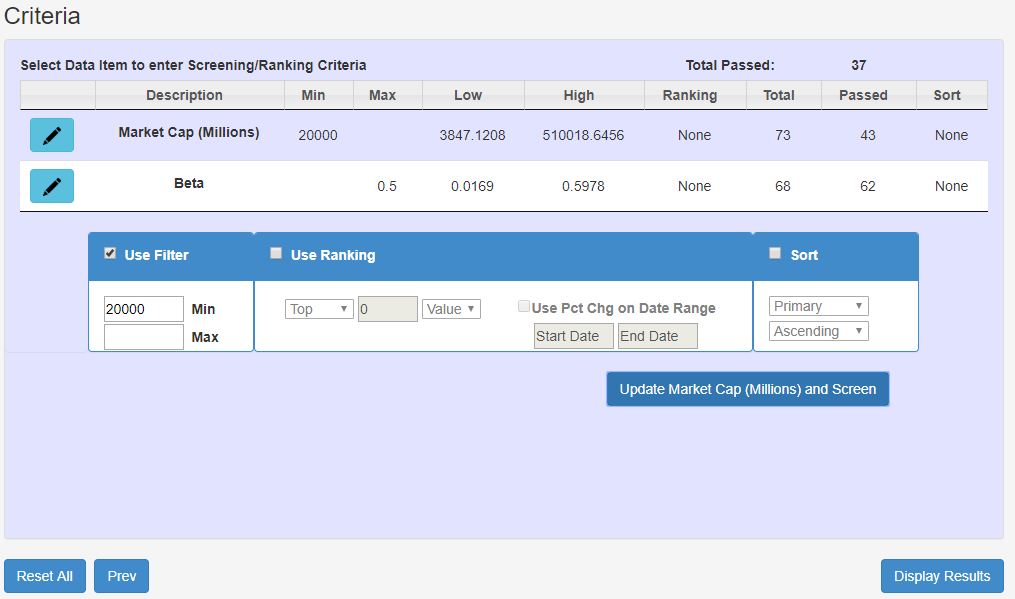

If the user wants to alter the Criteria or add Ranking/Sorting capabilities to each Factor, the Edit button is used. This will produce the box shown below. In this example, the Market Cap was increased to 20000 and the Update button pressed. This lowered the passing results to 37. edit

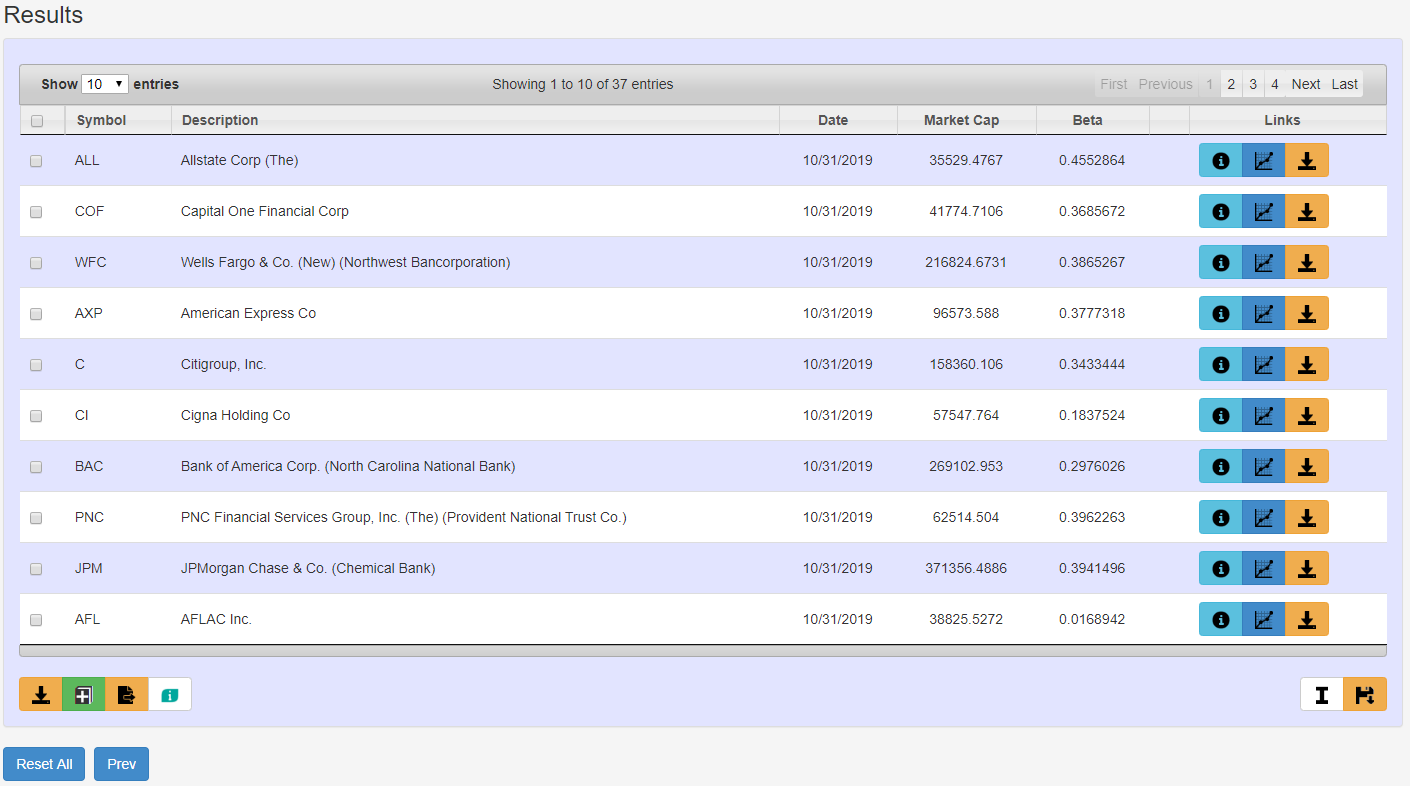

Results

When the user is satisfied with the numbers, they can view the resulting passed stocks by clicking on the Display Results button.