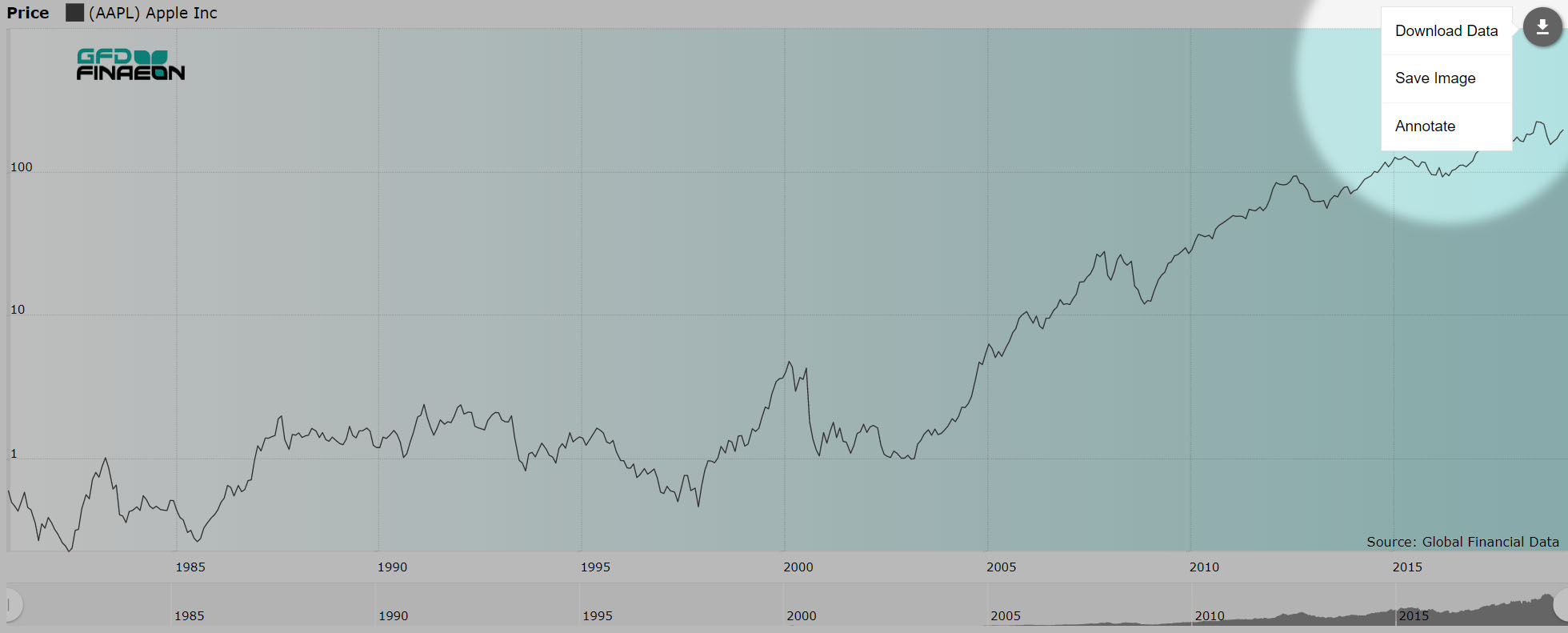

Exporting data is quick and easy using GFD Finaeon.

Update thousands of files daily or choose a few for a special project, GFD offers you the flexibility of choice.

On-Demand Downloading

If you need quick and easy access to a handful of files, you can download directly from our website. You can use our search engine to find the files you need, get a description of the data, generate graphs, or export. Workbooks may also be created.

Application Programming Interface (API)

GFD’s API is recommended for analysts who require large amounts of data for broad research needs. It enables researchers to study the interaction between different data series, sectors, and genres of data. You can choose economic data, fixed income, equities, exchange rates and commodities to enhance your analysis of different asset classes. Simply plug your list of files into the API and download. You can make special requests for formatting the data, adjusting for corporate actions, inflation, currency or other variables to fit your needs. Our API supports R and Python so you can download your data directly to your application.